Weekly Fintech Newsletter | 2021 #37

BLOG

PODCAST

The podcast recommendation of the week belongs to Nethone’s latest episode from their Crypto Talks series. In this episode they are joined by Lukas Enzersdorfer-Konrad, Chief Product Officer at Bitpanda.

In this session they discuss:

How is Bitpanda dealing with the recent surge of new users?

How to provide both: security and a great user experience for clients?

How does Bitpanda respond to feedback from its users?

What are your plans for the further development of crypto exchange?

What is the growth strategy?

Fintech Meetup: NO CONTENT, ONLY MEETINGS!

Unlike other events, we focus on what you really need--meetings and connections with new partners and customers.

Meet hundreds of fintechs, including Alloy, Alviere, Argyle, Autobooks, MANTL, PPRO, Ripple, Sila, Socure & Synctera (and many, many more!), banks including Bank of America, Citi, JP Morgan & Wells Fargo, neobanks including Dave & Revolut, tech cos including Facebook plus networks, credit unions and more.

Online, March 22-24, startup rate available for qualifying cos.

MVO CARD COLLECTION

Mastercard extends its commitment to inclusivity by introducing a new accessible card standard for blind and partially sighted people, called the Touch Card.

REPORT

The Paypers 2021 Open Banking report highlights how the proliferation of API-led possibilities has led to a tremendous potential in shaping up the new Open Banking business models in the banking industry.

The Paypers provides the definition of embedded finance and how it can deliver radically better customer experiences. As Open Banking continues to expand and evolve, The Paypers also takes a closer look at Embedded Finance and Banking-as-a-Service and the opportunities they bring. Link here.

FINTECH MAPS

NOW, ON TO THE SUMMARY OF LAST WEEK'S FINTECH SPACE

NEWS HIGHLIGHTS

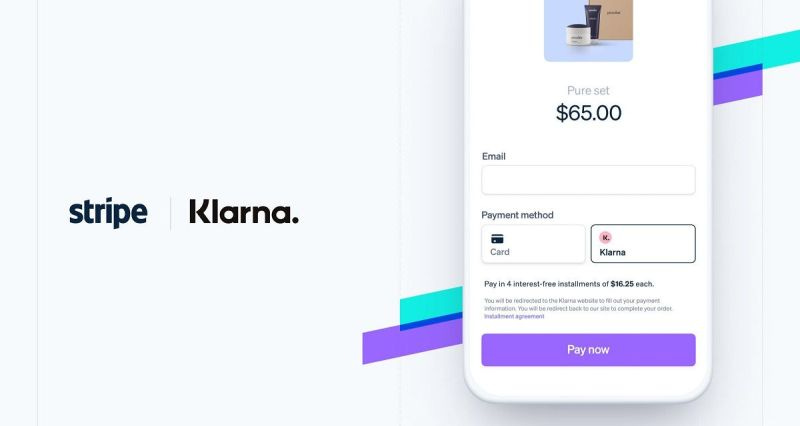

Stripe and Klarna, two of the world’s biggest private FinTech companies, are teaming up.

Stripe said Tuesday it has agreed on a strategic partnership with Klarna to offer the Swedish firm’s buy now, pay later payment method to its merchants.

“Together with Stripe, we will be a true growth partner for our retailers of all sizes, allowing them to maximize their entrepreneurial success through our joint services,” said Koen Köppen, Klarna’s chief technology officer.

Stripe, which helps businesses accept payments online, said the tie-up would make it easier for retailers to add Klarna as a payment option on their website.

Klarna typically partners with stores directly to embed its checkout button. The move could give Klarna a much wider reach of customers.

FINTECH HIGHLIGHTS

🇺🇸PayPal is NOT pursuing an acquisition of 🇺🇸Pinterest at this time, the digital payments company said on Monday, after several media last week reported on its talks to buy the digital pinboard site for as much as $45 billion. Link here.

Yesterday at Money20/20, 🇺🇸Mastercard and 🇺🇸Bakkt announced a multifaceted partnership to make it easier for merchants, banks and fintechs in the U.S. to embrace and offer a broad set of cryptocurrency solutions and services. Link here.

🇺🇸 Chime is in talks to go public at a valuation of $35 to $45 billion, according to a person familiar with the matter, and it’s targeting March of 2022 for the IPO. Link here.

🇺🇸 Plaid, a top open banking platform, and Currencycloud, a multi-currency transfers Fintech, have agreed to a strategic partnership, according to a release. Link here.

🇧🇷 Nubank is “the largest digital bank in the world, the major FinTech in Latin America, and the first Brazilian startup to reach the $10 billion mark.” Link here.

Financial consultancy 🇬🇧 11:FS Foundry has teamed up with Google Cloud to create a new platform for its clients. Link here.

The sixth 🇦🇺 EY FinTech Australia Census finds the sector a standout hero preparing for even greater international expansion. Link here.

As Q3 has drawn to a close, 🇳🇱 Dealroom.co has taken a look at one of tech’s most lucrative sectors, and how things have fared so far in 2021. Link here.

PAYMENTS

🇺🇸 Early Warning® Services, LLC, the network operator behind 🇺🇸 Zelle®, and 🇺🇸 Fiserv, Inc., empower minority and underserved communities to access real-time payments through Zelle. Link here.

🇨🇦 Payfare Inc. and 🇬🇧 Wise announced plans to bring fast, low-fee, and secure international money transfer capabilities to Payfare’s digital banking app in 2022. Link here.

🇺🇸 Square has announced two new tools in the UK to help businesses grow their sales and engage customers with just a few clicks. The two tools, Square Marketing and Square Loyalty, are now available as separate subscriptions for UK businesses of all types and sizes. Link here.

🇺🇸 Mastercard is to embed working capital into its Track Business Payments package through a partnership with supply chain finance specialist DEMICA. Link here.

In a country-first for Malawi, mobile money service provider 🇲🇼 TNM Mpamba launched a 🇺🇸 Mastercard debit card, enabling its customers – even those without bank accounts – to make safe and seamless in-person and online digital payments on the 🇺🇸 Mastercard network. Link here.

🇺🇸 Mastercard is to embed working capital into its Track Business Payments package through a partnership with supply chain finance specialist DEMICA. Link here.

🇺🇸 Plaid is planning to unveil a new payments program on Thursday that will facilitate digital payments funded by users’ bank accounts. Link here.

🇿🇦 MFS Africa, the largest pan-African digital payments hub, announced that it had signed an agreement to acquire Baxi, one of Nigeria's leading super-agent networks. Link here.

Kiwi-owned company launches instant payment app 🇳🇿 DOSH New Zealand, which allows New Zealanders to pay each other instantly using a smartphone app. Link here.

Leading integrated payments platform, 🇬🇧 Paysafe Group, announced that it has extended its partnership with payments provider 🇵🇱 ZEN.COM. Link here.

BNPL

As buy now, pay later valuations continue to soar, Berlin’s B2B pay later leader 🇩🇪 Billie has also seen its price tag skyrocket. Link here.

The Paypers has launched the Who’s Who in Buy Now, Pay Later industry mapping, a global overview of key players, and business models. Link here.

Pitch deck reveals how 🇸🇪 Klarna plans to grab ad dollars, despite tight competition from other buy now, pay later firms. Link here. Also, the company can now add “travel agent” to that list. Link here. Finally, Klarna announced a strategic partnership with 🇮🇱 Wix.com, a leading global SaaS platform to create, manage and grow an online presence. Link here.

CRYPTO

🇺🇸 BlockFi has partnered with 🇺🇸 Neuberger Berman to develop and issue a series of digital asset management products and strategies, the companies announced on Monday. Link here.

🇸🇬 Nium launched in the US and extended its range of Banking-as-a-Service products to include cryptocurrency buying. Link here.

🇺🇸 EQIFI, the decentralized finance (DeFi) platform for lending, borrowing, and investing for ETH, stablecoins, and select fiat currencies, has announced the launch of its global, secure, crypto Mastercard. Link here.

🇺🇸 Facebook is launching a small pilot for its Novi Financial digital app. However, it does not involve the Diem stablecoin, instead utilising the USDP (Pax Dollar) through partnerships with Paxos and Coinbase. Link here.

The first US 🇺🇸 Bitcoin futures exchange-traded fund (ETF) launched yesterday. Link here.

INVESTMENTS

A new investment app has launched in the US promising to better serve retail traders and provide social investing. 🇺🇸 AleFi argues that a “growing number of uneducated retail investors” are losing money in the stock market by “gambling instead of investing”. Link here.

OPEN BANKING

🇬🇧 Konsentus announced the launch of the Konsentus Transparency Directory, a single source of standardized data for the open banking ecosystem. Link here.

Latin American countries are already beginning to incorporate regulatory frameworks for Open Banking. However, the implementation pace of Open Banking is not the same across the region. Link here.