Weekly Fintech Newsletter | 2021 #33

BLOG

Marqueta’s blog “Cards as the Crypto Gaterway”argues how crypto cards can provide consumers with a familiar method of using crypto.

Crypto can be uncomfortably complex. Understanding it requires a new vocabulary and hours of learning. Intimidating terms like “cryptographic hash functions,” “block confirmations,” and “consensus algorithms” appear frequently in articles on the subject. There’s no doubt that it can all be overwhelming to comprehend. But cryptocurrency doesn’t have to be daunting.

INTERVIEW

Check out this week's episode of The Diary of a CEO by Steven Bartlett, with Sebastian Siemiatkowski, entitled; 'Klarna Founder - From $0 to $46 Billion'. A great talk and a very inspiring story. I highly recommend checking out the full episode!

NEWSLETTER

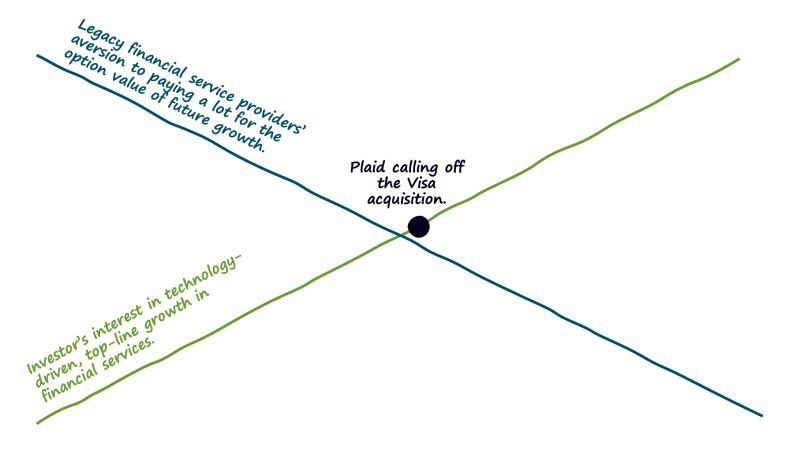

Alex Johnson’s analysis of the Visa-Plaid acquisition asks all the right questions and provides deep insights to the fintech acquisition boom of 2021.

So the question for banks and other legacy financial services providers is how quickly can they square the circle between their natural discomfort with tech-priced acquisitions and the rapidly spiraling valuations of fintech companies?

FINTECH MAPS

NOW, ON TO THE SUMMARY OF LAST WEEK'S FINTECH SPACE

FINTECH HIGHLIGHTS

The People's Bank of China (PBOC) banned all cryptocurrency transactions and said it’s illegal for overseas crypto exchanges to provide services to Chinese consumers, per The Wall Street Journal. Link here.

France is now among the top three destinations in Europe for fintech investors, new data shows, having narrowly overtaking Sweden for the first time. Link here.

BNPL

🇺🇸 Mastercard Inc. plans to wade into the world of buy-now pay-later with a new offering that will let merchants accept installment payments without doing extra technical integration. Link here.

🇸🇪 Klarna has launched its latest OOH UK campaign, Old Credit Is History. Link here.

Also, 🇸🇪 Klarna will likely wait for volatility in the stock market to settle before solidifying plans for an initial public offering, CEO Sebastian Siemiatkowski has told CNBC. Link here.

Financial coaching app 🇬🇧 Claro Money has taken to London's streets with a billboard campaign urging Brits to "Say bye now to Buy Now, Pay Later". Link here.

American buy now, pay later giant 🇺🇸 Affirm has developed technology that gives customers a range of personalized payment options at the checkout. Link here.

CRYPTO

🇺🇸 BitPay and 🇺🇸 Verifone announce the extension of BitPay’s blockchain payment technology to enable consumer cryptocurrency payments on Verifone’s in-store and eCommerce Cloud Services platforms in the United States. Link here.

Cryptocurrency exchange 🇺🇸 Coinbase is going deeper into traditional financial services, allowing users to deposit paychecks directly into their online accounts. Coinbase said Monday that its U.S. customers will be able to use the direct deposit service for any percentage of their paycheck. Link here.

🇬🇧 Revolut, a FinTech company with a $33 billion valuation that offers cryptocurrency buying as part of its services, is looking to launch its own cryptographic token, according to two people with knowledge of the plans. Link here.

🇺🇸 Twitter is rolling out its tipping feature to all users and letting some people tip their favorite tweeters using bitcoin. Link here.

🇬🇧 eToro, the global multi-asset investment platform, has launched a DeFi portfolio, offering investors long-term exposure to key projects in the DeFi ecosystem, enabling them to become part of one of the most innovative developments in finance. Link here.

🇬🇧 Monne, has enlisted cryptocurrency exchange Coinbase, in a move that will enable payment of invoices in a range of cryptocurrencies. Link here.

Coinbase has abandoned its planned interest-earning product two weeks after the cryptocurrency exchange revealed that the SEC was threatening to sue over the issue. Link here.

🇫🇷 Sorare, a blockchain-based fantasy football game, has raised a $680m Series B round led by SoftBank, which values the three-year-old French company at $4.3bn. Link here.

INVESTMENTS

British fintech giant 🇬🇧 Wise has entered the retail investing space with its new feature “Assets”, which allows UK account holders to invest in stocks across 54 currencies. Link here.

OPEN BANKING

🇬🇧 Truelayer launched its global open banking platform in Australia following its accreditation as an unrestricted Accredited Data Recipient under the Consumer Data Right (CDR). Link here.

🇩🇪 Serrala and Europe’s leading open banking platform 🇸🇪 Tink, have entered into a channel partnership for open banking technology. Link here.

🇬🇧 Woodhurst, a digital transformation consultancy, is excited to announce the launch of their new Open Finance Community, SHIFT. Link here.

UK-based personal finance management platform 🇬🇧 FINEO partnered with European open banking company 🇱🇻 Nordigen to leverage open banking technology. Link here.

PAYMENTS

🇮🇳 Paytm has become the first payments platform in India to accept international remittances directly into a digital wallet in India, after it announced a tie-up with Ria Money Transfer, which is a cross-border money transfer firm and a part of Euronet Worldwide. Link here.

🇮🇱 Kenbi offers an “advanced AI platform” which it says can enable real-time, cross-country matches between issuers and merchants. It claims this process means both sides can approve transactions that would otherwise be declined. Link here.

Approved 🇲🇴 Alipay (Macao) users can use the e-wallet to pay with Macao patacas at any Hong Kong merchants that display the logos of “Alipay+” or “Alipay (Macao)” while enjoying preferential exchange rates with no extra handling fees. Link here.

While Delila Kidanu grew up in Nairobi, Kenya, mobile money platform 🇰🇪 M-Pesa was the go-to FinTech platform for her and most Kenyans. Link here.

🇺🇸 Mbanq announced that it is partnering with 🇺🇸 Galileo Financial Technologies, the global leader in card issuing and payments processing, to streamline and speed up card issuing for Mbanq’s clients. Link here.

🇬🇧 PPRO, the leading local payments infrastructure provider, has announced a strategic partnership and minority investment in 🇳🇱 Sentinels, Europe’s leading transaction monitoring startup based out of the Netherlands. Link here.

🇿🇦 Chipper Cash is using Stitch to enable its customers in South Africa to fund their Chipper wallet. Link here.

🇺🇸 Spreedly, the provider of the leading Payments Orchestration platform, and MODO, the “wallet of banks” app, announced that Spreedly’s Payments Orchestration platform was selected to support MODO’s over 35 connections to banks across Argentina. Link here.

🇮🇹 Switcho, a Milan-based fintech startup that helps users save money on household utilities, has closed its equity crowdfunding campaign on Mamacrowd, which started at the beginning of August, raising just under $2.35 million (€2 million). Link here.

🇺🇸 Visa has announced its partnership with the first edition of the Arab Fintech Forum – a series of keynotes, panel discussions, and workshops aimed at addressing challenges and opportunities faced by Fintechs amid the current economic landscape. Link here.

FUNDING

UK-based money app 🇬🇧 Ziglu has seen its £1 million crowdfund oversubscribed in just 81 minutes, beating its previous record of three hours, on Seedrs, the leading equity crowdfunding platform. Link here.

🇺🇸 Highnote, a card issuing startup founded by a pair of Braintree veterans, has emerged from stealth mode with $54 million in combined funding from both a Seed and Series A round. Link here.

🇺🇸 Clearpool Group, a decentralized capital markets ecosystem, has received $3 million in funding from a number of prominent crypto investors to further its decentralized finance (DeFi) ambitions of enabling institutions to borrow uncollateralized liquidity. Link here.

Fintech startup 🇬🇧 Coinrule (YC S21) which provides individual and retail cryptocurrency investors an automated crypto trading platform for their assets, has today announced a $2.2m seed funding round. Link here.

🇬🇧 Vyne, the specialist account-to-account payments platform, today announces it has secured $15.5 million in seed funding from leading fintech investors including Hearst Ventures, Entrée Capital, Triple Point, Seedcamp, Venrex, Founder Collective, and Partech alongside angel investment from Alex Chesterman, founder of Zoopla and CEO of Cazoo, Charles Delingpole, CEO, and founder of ComplyAdvantage and Will Neale founder of Grabyo. Link here.

Business payment fintech 🇸🇬 Spenmo has raised $34 million in a Series A investment round. The fundraising was led by New York-based VC firm Insight Partners, which focuses on high-growth technology and software companies. Link here.

Mexican used-car platform 🇲🇽 Kavak.com said it has more than doubled its valuation to $8.7 billion based on its latest funding round, making it the second-most valuable startup in Latin America as it eyes further expansion beyond its home market. Link here.

Software-as-a-Service (SaaS) regtech platform 🇬🇧 PassFort has closed a Series A funding round, raising $16.2 million. Link here.

FOUNDERS & INVESTORS

Read Atlantico's Latin America Digital Transformation Report 2021, which contains 200 slides of data, graphs, and insightful analysis. "While cash is still king, digital payments across the region are growing exponentially and challenging its reign." Read more here.

🇺🇸 Stripe is opening its first Canadian office in Toronto. The San Francisco-based FinTech company also announced the launch of several new products in Canada. The company refused to disclose the number of people it plans to hire in Canada as part of the expansion. Though it did note plans to hire for roles in engineering, product, and sales in Toronto. Link here.

MOVERS AND SHAKERS:

🇩🇪 HAWK:AI, a global leading software platform for banks, FinTechs, and payment companies supporting the fight against financial crime and money laundering, is pleased to announce the appointment of Georg Hauer as Chief Operating Officer (COO) and Chief Financial Officer (CFO). Link here.

After a year of tremendous growth and high-profile listings, 🇬🇧 PrimaryBid has appointed a city heavyweight to chair its board and oversee its next stage of growth. Link here.

U.S. fintech company 🇺🇸 Brex, the all-in-one finance solution for growing businesses, announced Karen Tillman has been appointed Chief Communications Officer, a newly created role. Link here.

🇬🇧 Barclays is expanding its female-focused startup fund to Europe, partnering with venture capital firm Anthemis Group to accompany the effort with a London-headquartered mentorship programme. Link here

🇺🇸 Pipe, a two-year-old startup that aims to be the “Nasdaq for revenue,” announced that it has snagged former Stripe EIC Sid Orlando and HubSpot’s ex-Chief Strategy Officer Brad Coffey to serve on its executive team. Link here.

If you are a fintech startup and have over 100 questions send me an email, maybe I can answer a few.