Weekly Fintech Newsletter | 2021 #32

Hi, there! Welcome back to another Fintech Weekly Newsletter. In this newsletter, I cover all the major weekly news related to the fintech industry. The newsletter begins with recommended articles, reports, and Fintech maps. Thank you for subscribing!

If you are a fintech startup and have over 100 questions send me an email, maybe I can answer a few.

PODCAST

The podcast recommendation of the week belongs to News & Views, The Fintech Times Podcast. In this week's episode, the team goes back to a previous topic of discussion on buy now pay later, and takes a deeper delve into its benefits, as well as potential flaws.

INTERVIEW

dLocal made history when it raised $200 million from U.S. private equity firm General Atlantic at a $1.2 billion valuation, becoming the first unicorn to hail from Uruguay. Then in June, the fintech debuted on the NASDAQ, becoming the first Uruguayan company to go public in the U.S.

The CEO of dLocal, Sebastián Kanovich, is now worth an estimated $960 million.

“I don’t spend one minute thinking about that,” he claims. “I'm proud of what we've achieved, but we're also very hungry. The opportunity ahead is massive.”

NEWSLETTER

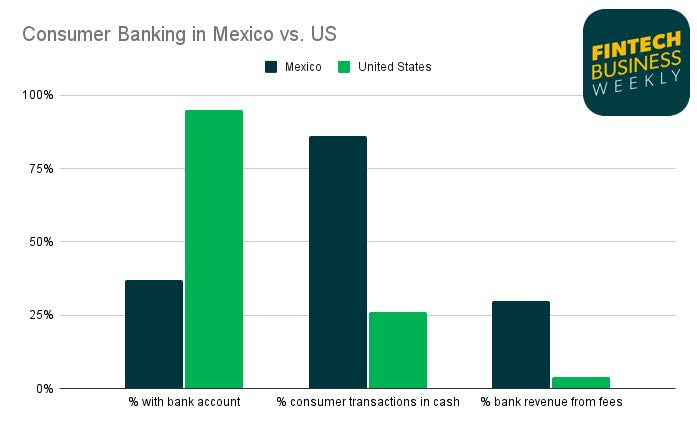

I highly recommend Jason Mikula's latest Blog Post / Newsletter on why credit card rates can hit 151% in Mexico.

"While in Oaxaca, I found myself in a Coppel department store, and I immediately noticed that every single item in the store, even an MXN $150 (USD $7.5) SIM card, could be financed in bi-weekly installments... Even if the UX and name have evolved, buy now pay later isn’t new. Retail financing has long been a tool deployed by merchants, formally or informally, to boost sales by enabling consumers to defer or spread payments over time.”

With low bank account penetration (37%), low credit usage, few bank branches (13.7 per 100,000 population vs. 30.46 per 100,000 in the US), and high smartphone usage (73%), Mexico is well-positioned to benefit from fintech.

FINTECH MAPS

NOW, ON TO THE SUMMARY OF LAST WEEK'S FINTECH SPACE

FINTECH SPOTLIGHT

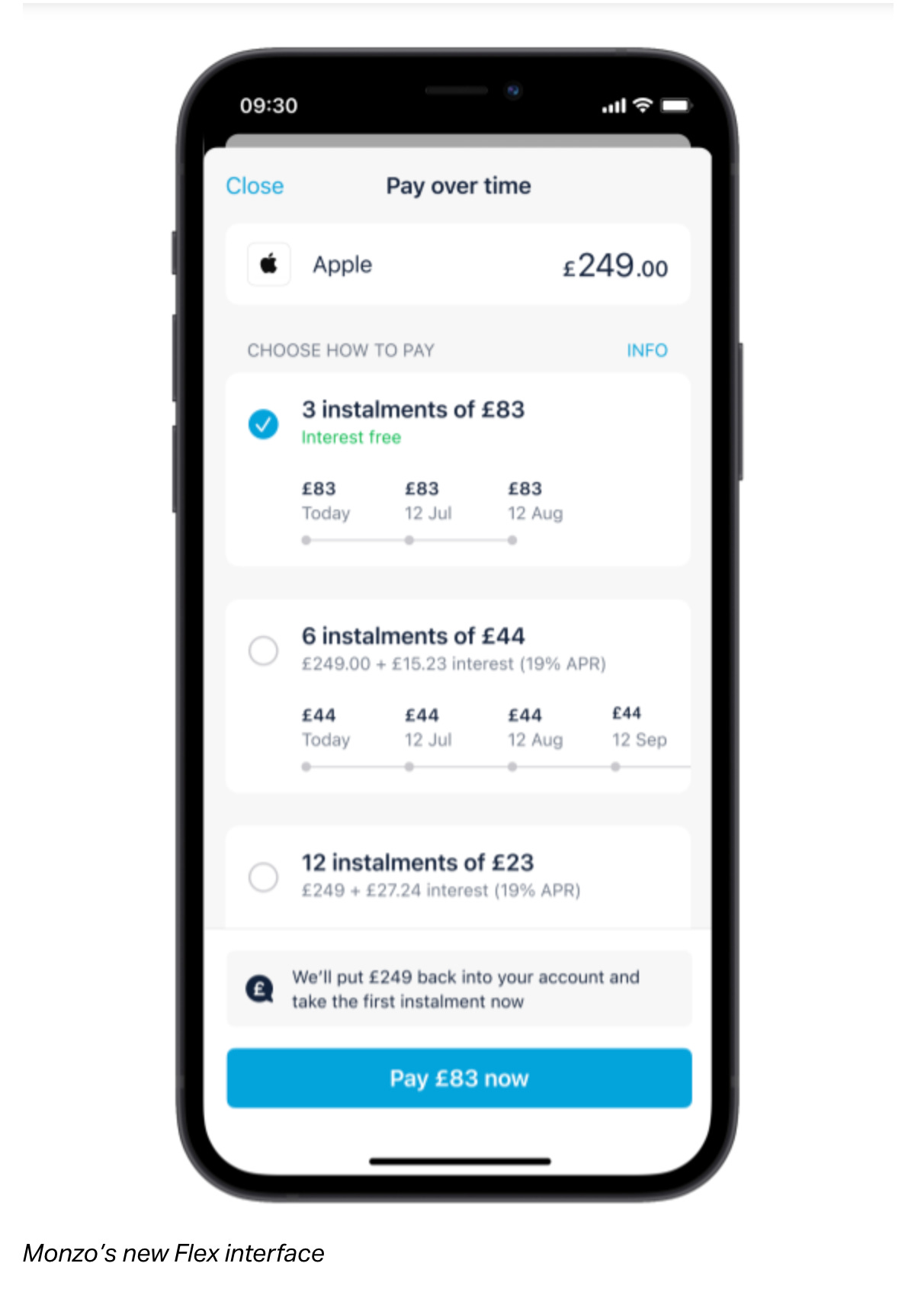

Isabel Woodford’s insightful article on BNPL inquires about the possible advantages the feature has for neobanks.

“The ‘Klarnas’ have the luxury of shovelling the cost onto the merchant. They own the checkout rails, so it’s pure profit for them. Monzo doesn’t,” explains Gwera Kiwana, a consultant at 11FS. “Monzo is not quite doing BNPL here as it’s not handling the checkout. It’s basically a line of [free] credit with emojis.”

When viewed as an acquisition tool, BNPL could offer strong unit economics.

FINTECH HIGHLIGHTS

Latin American FinTechs with an estimated valuation of over $100M. The overview Includes active Fintech companies founded in 2012 or after, with headquarters in Latin America. Link here.

The FinTech opportunity in Vietnam is real and many companies in the country are getting in on it. Link here.

Beijing wants to break up 🇨🇳 Alipay, the 1bn plus-user superapp owned by Jack Ma’s Ant Group, and create a separate app for the company’s highly profitable loans business, in the most visible restructuring yet of the FinTech giant. Link here.

Coinbase has abandoned its planned interest-earning product two weeks after the cryptocurrency exchange revealed that the SEC was threatening to sue over the issue. Link here.

INVESTMENTS

🇦🇺 TEN13, the early-stage technology investment syndicate co-founded in 2019 by Steve Baxter, says it’s on track to deploy more than $100 million in its first three years of operation. Link here.

Money transfer giant 🇬🇧 Wise is gearing up to launch its long-awaited investment product, a year after the group secured a green light from the FCA. Link here

OPEN BANKING

Sydney-based FinTech 🇦🇺 Cape, which is currently beta-testing its corporate credit cards, has partnered with Australian open banking provider Basiq. The tie-up is part of Basiq’s Startup Launchpad, which gives early-stage startups access to its technology and the ability to use real-time financial data. Link here.

🇺🇸 Stripe is opening a fintech development office in London that will focus on open banking, embedded finance, and bank partner integrations. The move represents another investment in the European market for the San Francisco-headquartered payments giant, coming just a week after it outlined plans to recruit hundreds of more engineers in Dublin over the next three years. Link here.

Paytech start-up 🇬🇧 Juno, regulated by the Financial Conduct Authority and backed by £1.6 million of seed investment from angel and venture capital investors, has launched the first digital payments platform in the UK to fully leverage Open Banking technology. Link here.

CRYPTO

The banking and investing app 🇺🇸 MoneyLion is adding crypto trading to its all-in-one financial services app. The 8-year-old FinTech company will introduce buying and selling capabilities for bitcoin and ether at its Investor Conference on Monday morning. Link here.

🇬🇧 Gemini has joined the Take Five Charter in the UK alongside other leading financial institutions, banks, and fintechs. Link here.

Weeks after 🇺🇸 PayPal announced the first international expansion of its cryptocurrency offering outside of the United States to the UK for its customers to buy, hold and sell digital currencies, the company has now completed the launch for all eligible PayPal account holders. Link here.

PAYMENTS

Sellers on 🇺🇸 Square can now accept payments through Cash App Pay. Cash App Pay is free for consumers, and will soon be available to all U.S. Square sellers. Link here.

🇺🇸 Stripe, the digital payments company last valued at nearly $100 billion, is in early discussions with investment banks about going public as soon as next year, according to people with knowledge of the matter. Link here.

🇺🇾 dLocal announced the launch of dLocal’s Direct Issuing, a service enabling merchants to issue their own branded prepaid cards for online and in-store shopping in local currencies. Link here.

🇬🇧 Payhawk brings its customers Apple Pay, a safer, more secure, and private way to pay that helps customers avoid handing their payment card to someone else, touching physical buttons, or exchanging cash — and uses the power of iPhone to protect every transaction. Link here.

🇩🇪 Deutsche Bank has acquired Berlin-based payment service provider 🇩🇪 Better Payment to expand its market share in the fast-growing market for online payment processing and acceptance. Link here.

Mastercard is to open a 'Sustainability Innovation Lab' in Stockholm, which will act as a research and development space for the creation of climate-conscious products. Link here.

The e-commerce giant 🇦🇷 Mercado Libre and the VC firm Kaszek Ventures, announced that their SPAC (special purpose acquisition company), named Mercado Libre Kaszek Pioneer Corp., has filed to go public. Link here.

BNPL

Demand for the BNPL is booming. The expectation that it could disrupt the credit card business, one of the most lucrative and competitive financial services markets in the world, looks more and more likely. Link here.

Consumers are flocking towards BNPL with over half (54 percent) saying that BNPL will replace their use of credit cards, according to research from 🇺🇸 Marqeta, Inc, which also found more than one in three (35 percent) saying they had tried BNPL for the first time during the pandemic. Link here.

FUNDING, FOUNDERS, MOVERS & SHAKERS

This ends my weekly digital fintech newsletter. Thank you for reading to the end! If you liked it, I invite you to like, share and/or leave a comment below. You may find more information regarding my newsletter here.

If there is anything else you think I’m missing, please don’t hesitate to reach out by email at bonjour@marcelvanoost.nl.

Let me know if there are any questions or news/insights worth mentioning in next week's newsletter. Until the next!

Regards,

Marcel van Oost

Follow me on Twitter, Linkedin, and Telegram.

Discover other newsletters by MVO.