Weekly Fintech Newsletter | 2021 #31

Hi, there! Welcome back to another Fintech Weekly Newsletter. In this newsletter, I cover all the major weekly news related to the fintech industry. The newsletter begins with recommended articles, reports, and Fintech maps. Thank you for subscribing!

PODCAST

The podcast recommendation of the week belongs to Nethone’s Crypto Talks. In this initial episode, they talk about #cryptotokens. Find out all about tokenization, how crypto tokens work, and how they can be used with benefits to creators and investors.

REPORT

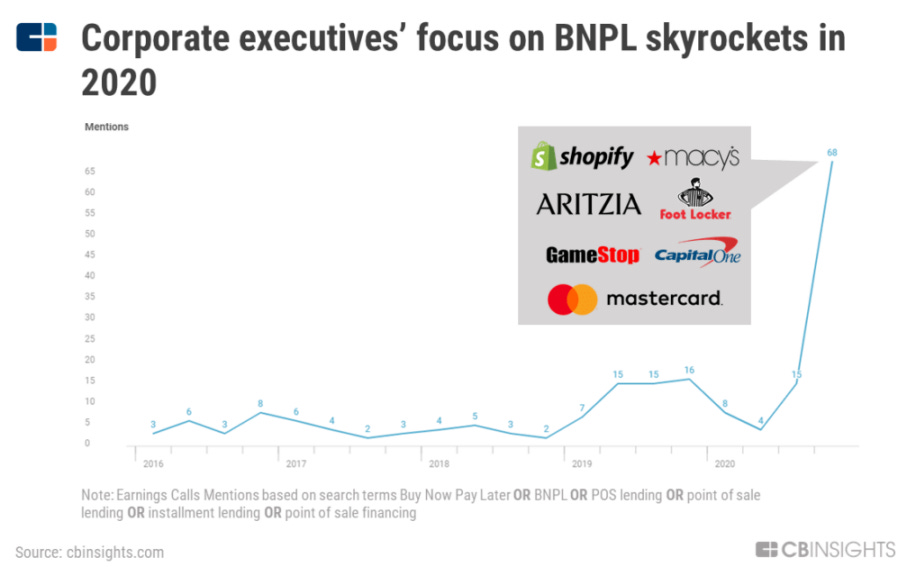

According to the latest report by CB Insights, BNPL may be poised to disrupt the $8T US payment card industry, as a consequence of the pandemic-fueled e-commerce boom.

With e-commerce volumes jumping forward an estimated 4-6 years due to worldwide lockdowns, consumers and merchants have increasingly looked to buy now, pay later solutions to alleviate financial pressure and to meet online shopping demand, respectively.

By 2025, the global BNPL industry is expected to grow 10-15x its current volume, topping $1T in annual gross merchandise volume by some estimates.

FINTECH MAPS

NOW, ON TO THE SUMMARY OF LAST WEEK'S FINTECH SPACE

FINTECH SPOTLIGHT

Debt is no longer a dirty word in European tech.

European startups have raised €8.3bn of it so far in 2021 — topping the previous record of 2017. That also compares to just €1.6bn raised in 2015, a growth rate almost double that of the US.

Debt financing is a type of loan that comes from a specialist lender or a debt fund, and it’s quickly shaking off its reputation as a second-class alternative to venture capital for startups.

👉Read more here.

FINTECH HIGHLIGHTS

Digital bank Monzo Bank is reportedly set to join the massive number of FinTechs racing to offer their customers buy-now-pay-later (BNPL) services. Link here.

Podcast: African nations with a thriving startup scene beyond Nigeria and South Africa. Link here.

Islamic fintechs are set to drive the next major disruption in the financial sector in the Middle East and other regions, as globally mobile millennial and Gen-Z Muslims are increasingly turning to the new age ventures for their financial transactions. Link here.

Solarisbank, Europe’s leading Banking-as-a-Service platform, officially launched its new tech hub in Kyiv, Ukraine. Link here.

INVESTMENTS

A new investment platform, 🇬🇧 Tulipshare, is trying to give the explosion of stock market interest a purpose by offering fractional share investing coupled with activist shareholder campaigns. Link here.

OPEN BANKING

Open Banking payments are gaining traction as many businesses see the benefit of collecting funds from customers via account-to-account payments, which settle directly from the user’s bank account to their 🇬🇧 Zumo wallet. Link here.

🇳🇱 ING Bank-backed Yolt is shutting down its consumer-facing smart money app in order to focus on its open banking technology platform. Launched in 2017, 🇬🇧 Yolt has since garnered more than 1.5 million registered users who are currently able to see their various bank accounts in one place, enabling them to track their spending, set budgets, and identify where they can make savings. Link here.

CRYPTO

Innovation-driven 🇫🇷 Paris Saint-Germain (PSG) announced a multi-year partnership agreement with the world’s fastest-growing crypto platform, Crypto.com. Crypto.com will become the Official Cryptocurrency Platform Partner of the Parisian club and the partnership will also include the release of exclusive Non-Fungible Tokens (NFTs) on Crypto.com’s native NFT platform: Crypto.com/NFT. Link here.

Ukraine is the fifth country in as many weeks to lay down some ground rules for the cryptocurrency market, a sign that governments around the world are realizing that bitcoin is here to stay. In a nearly unanimous vote, the Ukrainian Parliament adopted a law that legalizes and regulates cryptocurrency. The bill was set in motion in 2020 – and heads to the desk of President Volodymyr Zelenskyy. Link here.

🇺🇸 Mastercard will extend its capabilities deep into the field of digital assets with an agreement to acquire 🇺🇸 CipherTrace, a leading cryptocurrency intelligence company with insight into more than 900 cryptocurrencies. Link here.

PAYMENTS

🇳🇱 ABN Amro is extending its relationship with subscriptions management outfit 🇩🇰 Subaio to provide grieving family members with an overview of a deceased person's recurring payments, including subscriptions, loans, and insurance. Link here.

🇳🇴 Zwipe and 🇦🇪 NymCard are joining forces to launch biometric payment cards in the Middle East and Africa. With the rapidly growing demand for safer and more secure payment solutions from fintechs and modern payment innovators, this collaboration will ensure a faster deployment of biometric payment cards in the region. Link here.

🇺🇸 Paysafe, a leading specialized payments platform, announced the launch of a campaign in the U.S. that will see it waive $1 million of collective processing fees for small and medium businesses (SMBs) that sign up with Paysafe as new customers. Link here.

Flutterwave, Africa’s leading payments technology company, announced a mobile money partnership with 🇿🇦 MTN Group, Africa’s largest telecommunications provider. This partnership will allow businesses integrating Flutterwave in Cameroon, Côte d’Ivoire, Rwanda, Uganda, and Zambia to receive payments via MTN Mobile Money (MoMo). Link here.

🇺🇸 Square, the globally trusted software, payments, and hardware solution for businesses of all sizes, is raising the bar on customer experience with the launch of its Square Register in Canada. Link here.

🇺🇸 Amazon’s Project Santos is working on the point-of-sale (POS) solution to compete with the likes of industry giants. Project Santos is a dedicated (once-secret) task force launched by Amazon last year with the aim of brainstorming innovations to compete against Canadian giant, 🇨🇦 Shopify. Link here.

Gig and independent workers have different needs than salaried employees when it comes to financial products. It’s a challenge that Tilak Joshi, founder of Lean Financial, became acutely aware of during his tenure as head of Mint and years as a product exec at American Express and PayPal. Link here.

Visa and Indian paytech 🇮🇳Innoviti have partnered to explore a proof of concept (POC) for offline payments in India. The POC has been executed by Innoviti — India’s largest provider of payment solutions for offline merchants — in Bengaluru with Yes Bank and Axis Bank. Link here.

BNPL

Shares of 🇺🇸 Affirm AFRM, +34.37%, which enables consumers to split purchases into installments, were up more than 20% in after-hours trading Thursday after the company easily topped revenue and volume expectations for the most recent quarter and gave an upbeat volume forecast for the full year—even without factoring in potential contributions from the Amazon arrangement. Link here.

FUNDING, FOUNDERS, MOVERS & SHAKERS

Sponsored Content: Fintech Meetup gets you meetings with all the right fintechs! We do the hard work so you don’t have to-- you’ll get 3 months worth of meetings in just 3 half days! Online, March 8-10, qualifying banks & credit unions are eligible for FREE tickets.

This ends my weekly digital fintech newsletter. Thank you for reading to the end! If you liked it, I invite you to like, share and/or leave a comment below. You may find more information regarding my newsletter here.

If there is anything else you think I’m missing, please don’t hesitate to reach out by email at bonjour@marcelvanoost.nl.

Let me know if there are any questions or news/insights worth mentioning in next week's newsletter. Until the next!

Regards,

Marcel van Oost

Follow me on Twitter, Linkedin, and Telegram.

Discover other newsletters by MVO.