Weekly Fintech Newsletter | 2021 #24

Hi, there! Welcome back to another Fintech Weekly Newsletter. In this newsletter, I cover all the major weekly news related to the fintech industry. The newsletter begins with recommended articles, reports, and Fintech maps. Thank you for subscribing!

INTERVIEW

How does a 3 person team manage two funds, four unicorns, and $54B of value created?

🇬🇧 Outward’s conversation with Hussein Kanji, the founding partner at 🇬🇧 Hoxton Ventures, is an insightful must-read.

“In this bull market, raising capital is easy. Building great teams is hard. Here in the UK, what is astoundingly difficult is finding good sales people.” - Hussein Kanji.

👉 Read more here.

REPORT

Having managed to raise $800 million in a funding round led by 🇺🇸 SoftBank Group Corp.'s Vision Fund and 🇺🇸 Tiger Global Management, UK-based FinTech company 🇬🇧 Revolut is now valued at $33 billion, making it the biggest 'unicorn' in the country as well as the highest-valued FinTech company.

Second on the list of the UK's most valuable unicorns, as compiled by CB Insights, is another FinTech company - checkout.com - which reached its $15 billion valuation after raising $450 million at the beginning of the year, again led by Tiger Global Management.

👉 Read more here.

FINTECH MAPS

NOW, ON TO THE SUMMARY OF LAST WEEK'S FINTECH SPACE

FINTECH SPOTLIGHT

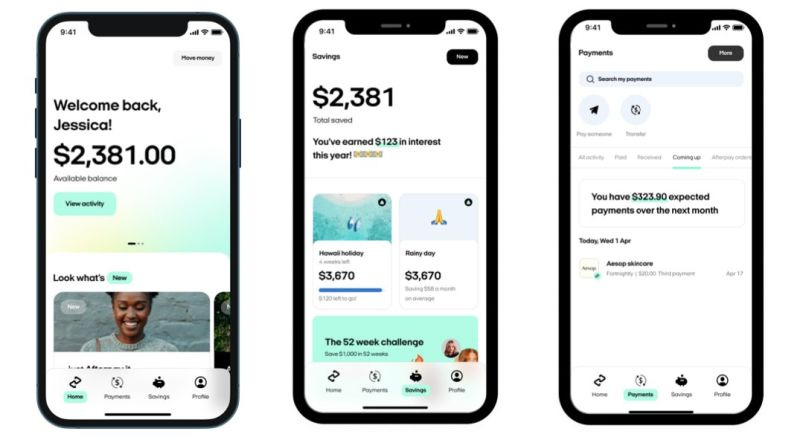

🇦🇺 Afterpay is gearing up to launch its first banking products. ‘Money by Afterpay’ will be a standalone finance app, separate from its current shopping experience, with customers to be issued a “basic” deposit account and debit card. A 1% interest rate will be paid on savings, comparable to market-leading rates, and Afterpay says the accounts won’t charge any fees.

👉 Read more here.

FINTECH HIGHLIGHTS

Argentina’s booming fintech industry boasts over 300 companies that employ nearly 15,000 people. This year, the sector is expected to create more than 5,600 positions, reflecting on the industry’s massive growth and traction. Link here.

Data compiled for the UK’s Department of Digital, Culture, Media, and Sport shows investment into UK tech from the middle east and Asia region is booming. Link here.

🇸🇪 Klarna announced the first group to receive grants from the recently-launched Klarna Small Business Impact Initiative to help SMBs recover from a loss of business due to the pandemic. Link here.

INVESTMENTS

🇸🇬 Tradesocio’s presence across EMEA and India is set to grow 🇸🇬 Bambu B2B Robo Advisor’s reach in a rapidly expanding and evolving global digital wealth market. Link here.

CRYPTO

🇺🇸 Square is creating a new standalone business that will act as a platform for developers to build decentralized finance projects based on bitcoin. Mike Brock who has worked on Square's successful push into cryptocurrencies, will lead the business. Link here.

🇦🇺 SelfWealth, an Australian Securities Exchange-listed (ASX) company and one of the country’s largest non-bank online brokers with 95,000 investors, is looking to add crypto to its platform. Link here.

A start-up created by two mates from the 🇦🇺University of Technology, Sydney has convinced global card giant 🇺🇸 Visa to approve the issuance of a physical debit card that will allow users of the 🇦🇺 CryptoSpend app to spend their bitcoin trading profits in shops and bars by tapping on existing payment terminals. Link here.

A member of the Paraguayan congress has announced they will present a bill regulating crypto in the next few days. Link here.

Bans against Bitcoin (BTC) mining in China and the exodus of digital miners could open up business opportunities in Latin America. Link here.

Mexican politicians confirmed their plan to put a Bitcoin law proposal in the TalentLand digital conference by next week. Link here.

PAYMENTS

Mastercard has launched a cloud-native, real-time payment gateway designed to ease access for institutions connecting to the UK's Faster Payments network. Link here.

By teaming up with the Toronto-based 🇨🇦 Payfare Inc., which operates as the payments engine behind companies like DoorDash, Uber, and Lyft, Marqeta aims to combine its card-issuing platform with Payfare's full-service digital banking apps and modern user interface. Link here.

🇺🇸 Visa, the global leader in digital payments, announced the launch of a new portfolio of services for Bangladeshi customers in line with Islamic Banking principles on Thursday. Link here.

Digital payments firm 🇮🇳 Paytm is targeting a $2.2 billion initial public offering (IPO) in India at a valuation of $25 billion, Reuters reported on Friday (July 16), citing sources. Link here.

🇺🇸 Verizon Business and 🇺🇸 Mastercard announced a strategic partnership expected to drive transformational solutions for the global payments and commerce ecosystem. Link here.

🇳🇱 Adyen the global payments platform of choice for many of the world's leading companies, and 🇮🇳 slice, the innovative tech platform powering America's independent pizzerias, have partnered to enhance Slice's payment processing experience. Link here.

🇮🇪 Nomu Pay, a newly established payment solutions provider backed by Finch Capital, said it has completed two transactions to acquire Wirecard Payment Solutions Malaysia and Wirecard Payment Solutions Hong Kong. Link here.

BNPL

🇺🇸 Discover Financial Services is investing $30 million in buy now, pay later startup 🇺🇸 Sezzle as part of an agreement that also sees the card firm launch a BNPL service on its network. Link here.

🇺🇸 PayPal launched its own buy now pay later service ‘Pay in 4’ which has been automatically rolled out to most of its 9.1 million Australian customers. Link here

🇺🇸 Bloomberg reported that 🇺🇸Apple and 🇺🇸 Goldman Sachs are partnering to launch a buy now, pay later (BNPL) service through Apple Pay called Apple Pay Later. According to the article: “Users who want to use the Apple Pay Later service will need to be approved via an application submitted through the iPhone’s Wallet app, where they will also be able to manage their payments." Link here.

🇺🇸 Microsoft Store and buy now pay later (BNPL) industry giant, 🇦🇺 Zip Co, has joined forces, allowing customers to purchase products on interest-free installment payment plans. Link here.

FUNDING

🇨🇴 Rappi raised “over” $500 million at a $5.25 billion valuation in a Series F. Link here.

🇬🇧 IslamicFinanceGuru (IFG) closed an investment round led by Outward VC. Link here.

🇺🇸 Capchase raised an additional $280 million in new debt and equity funding, led by i80 Group, following a $125 million round in June. Link here.

🇸🇬 Syfe closed a SG$40 million Series B funding round. Link here.

🇲🇽 Klar announced its Series B funding round. Link here.

🇺🇸 M1 Finance raised $150 million in a Series E funding round led by SoftBank’s Vision Fund 2. Link here.

🇺🇸 Stripe funds fintech startup Ramp at a $1.6 billion valuation. Link here.

🇸🇬 CrediLinq.Ai announced that it has secured a SGD 1.35 Million Angel funding round. Link here.

🇬🇧 YuLife has closed one of the biggest funding rounds from a European insurtech, raising a $70m Series B. Link here.

🇵🇱 Nethone, a Poland-based online fraud fighter has raised USD 6,7 million in Series A to fight account takeover. Link here.

🇺🇸 Stytch just raised $30 million in a Series A round of funding as it launches out of beta with its API-first passwordless authentication platform. The round caught our attention for a couple of reasons. Link here.

🇩🇰 HelloFlow closed an approx. €1.3 million seed round led by PreSeed Ventures and Seedcamp. Link here.

🇧🇷 Dinie announced a USD $3.8 million seed round led by Accion and K50 Ventures, with participation from Latitud, Flourish Ventures, DOMO Invest, and Tribe Capital amongst other funds. Link here.

🇬🇧 Railsbank raised $70 million in new equity funding. The London startup plans to use to continue growing internationally and to add more features to its product set. Link here.

🇬🇧 Mouro Capital, a venture capital fund focused on fintechs and adjacent businesses and backed by 🇪🇸 Grupo Santander, has led a €16 million ($19 million) funding round in the tech-driven digital logistics and fulfillment platform 🇦🇹 byrd. Link here.

🇬🇧 Curve announced a new partnership with 🇺🇸 Discover Financial Services. Link here.

🇧🇷 VTEX, a digital commerce platform backed by SoftBank Group Corp., said on Monday it was targeting a valuation of up to $3.2 billion in its U.S. initial public offering (IPO). Link here.

FOUNDERS & INVESTORS

CVC investment in Europe increased to an all-time high of $4.589bn in the first quarter of 2021, lifted by big-ticket rounds such as Visa’s investment into Swedish buy-now-pay-later company 🇸🇪 Klarna and SalesforceVenture’s investment into webinar platform 🇬🇧 Hopin. Link here.

🇺🇸 CB Insights did a wonderful job capturing the transformation that Latin America is going through in terms of Venture Capital. Link here.

Getting financial backing from VCs is an essential aspect of many startups’ growth. And when it comes to catching their attention, learning why they say ‘no’ is as important as why they say ‘yes’. In the latest Sifted Talks, they went straight to the source. Link here.

🇵🇭 Gentree Fund said it has set aside an initial US$40 million to look for investments into early-stage companies across Southeast Asia that plan to tap into the Philippines market. Link here.

Global venture capital funding in the first half of 2021 shattered records as more than $288 billion was invested worldwide, Crunchbase numbers show. Link here.

MOVERS AND SHAKERS:

🇸🇦 geidea, the largest fintech company in Saudi Arabia by market share, has appointed the global financial services and fintech heavyweight Nick Ogden to join its Board of Directors. Link here.

Open Banking platform 🇸🇪 Tink has appointed the former financial services lead for Amazon Web Services (AWS), Rowan Taylor, as chief revenue officer. Link here.

Barry S. is to become the new mortgage lead at 🇦🇺 Pepper Money ANZ. Saoud will join the nonbank after more than a decade at Aussie Home Loans, where he was General Counsel and Head of Product. Link here.

Sponsored Content: Early bird discounted Fintech Meetup tickets are now available! Join the World’s Largest Fintech Meetings Event--4,000 participants, 2,000 organizations, 30,000+ meetings! Online, March 8-10, 2022.

This ends my weekly digital fintech newsletter. Thank you for reading to the end! If you liked it, I invite you to like, share and/or leave a comment below. You may find more information regarding my newsletter here.

If there is anything else you think I’m missing, please don’t hesitate to reach out by email at bonjour@marcelvanoost.nl.

Let me know if there are any questions or news/insights worth mentioning in next week's newsletter. Until the next!

Regards,

Marcel van Oost

Follow me on Twitter, Linkedin, and Telegram.

Discover other newsletters by MVO.