Weekly Fintech Newsletter | 2021 #23

Hi, there! Welcome back to another Fintech Weekly Newsletter. In this newsletter, I cover all the major weekly news related to the fintech industry. The newsletter begins with recommended articles, reports, and Fintech maps. Thank you for subscribing!

ARTICLE

Google is reported to be planning a push into Japan's financial services market. According to Nikkei, Google is in talks to acquire Tokyo-based cashless payment provider pring. This deal could enable Google to offer its own financial services rather than rely on partner banks and credit card companies. Pring is currently owned by Mizuho Bank and many investors, and Google is reportedly set to pay between $180m and $270m for all of the company's shares.

👉 Read more here.

SURVEY

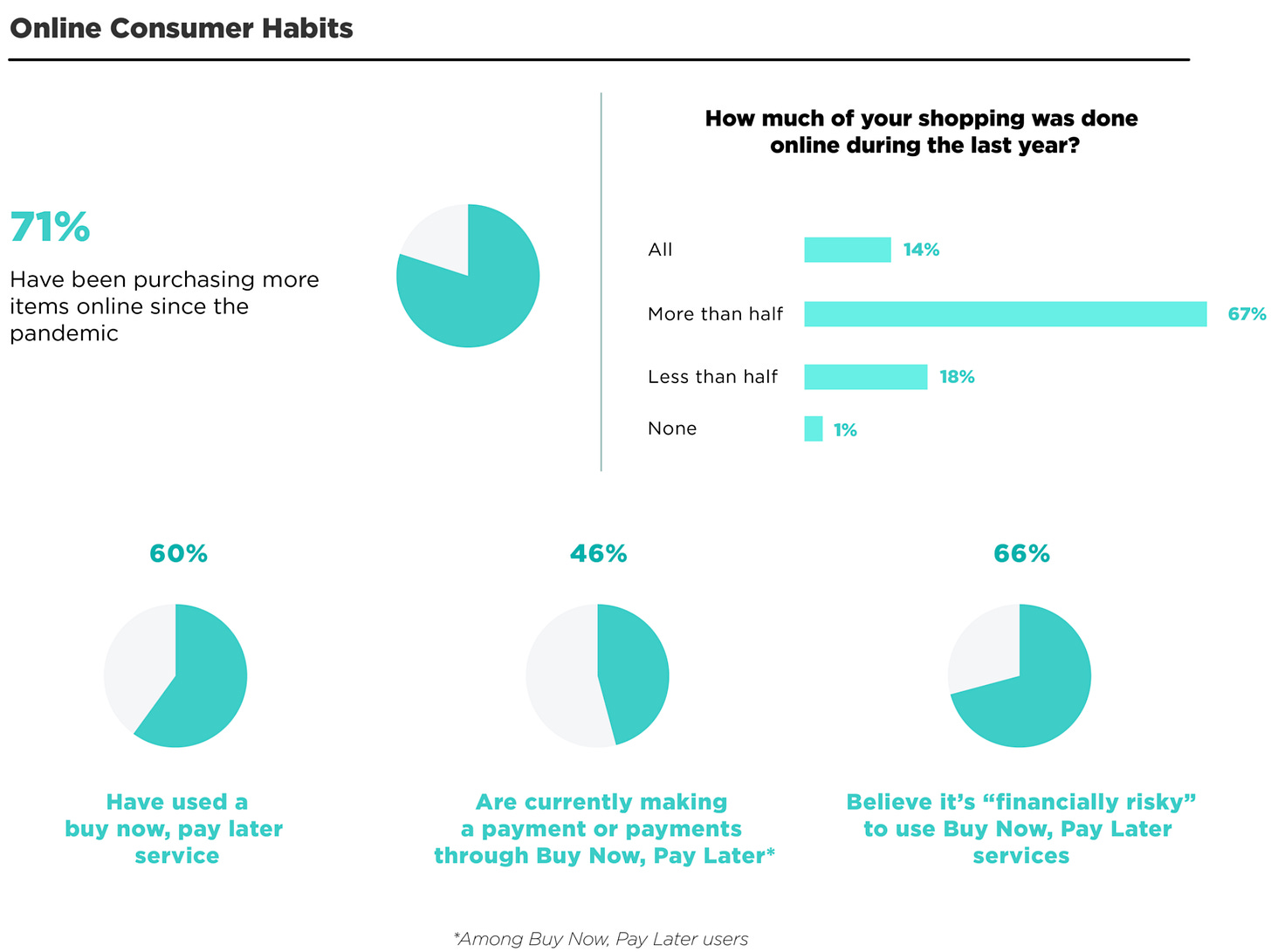

C+R’s research on Buy Now, Pay Later Statistics provides insightful glimpses into user habits and behaviors.

They recently surveyed consumers across the country to get insight into their experiences and the types of purchases they’ve made through these types of services.

71% of consumers say that, during the pandemic, they have been making more online purchases. In fact, roughly two-thirds (67%) say “more than half” of their shopping was done online during the last year.

👉 Read more here.

REPORT

Following the record-setting Q1 2021, Q2 was the most active quarter ever for FinTech deal activity with nearly $37 billion in financing volume, increasing 2021 YTD volume higher than all prior years.

👉 Read more here.

FINTECH MAPS

NOW, ON TO THE SUMMARY OF LAST WEEK'S FINTECH SPACE

FINTECH SPOTLIGHT

Sponsored Content: Registration is Now Live for the World’s Largest Fintech Meetings Event! Join 30,000+ Meetings with 4,000 Participants. Online, March 8-10, 2022.

FINTECH HIGHLIGHTS

🇳🇱 Booking.com announced the creation of a new internal FinTech business unit to facilitate seamless access to the company’s global travel marketplace for both customers and partners. Link here.

Stablecoins are blockchain-based digital currencies that are linked to the value of an underlying asset. Link here.

🇺🇸 Stripe Inc has taken its first major step toward a stock market debut by hiring a law firm to help with preparations. Link here.

According to leaker and mobile developer Alessandro Paluzzi, both 🇺🇸 Instagram and 🇺🇸 Twitter are planning major changes to their current offerings. With 🇺🇸 Twitter considering two new services via 🇺🇸 Chipper Cash and 🇨🇦Wealthsimple; and 🇺🇸 Instagram planning to adopt its version of non-fungible tokens (NFT). Link here.

🇬🇧 Wise had a solid stock market debut Wednesday, giving the company a market value of more than £8 billion ($11 billion). Link here.

OPEN BANKING

🇪🇪 IPF Digital, the Estonian EMI and lender providing services globally, joined forces with 🇩🇪 Mambu, a leader in composable banking, and 🇨🇦 Salt Edge, pioneer in developing open banking solutions, to become PSD2 compliant and contribute to a greater financial inclusion on the European market. Link here.

The upside of the Open Banking regulations which have swept jurisdictions like the UK and the EU is that many more challenger banks have appeared. The latest to join this brigade is 🇬🇧 Toqio, a fintech platform with a white label digital finance SaaS that allows anyone to launch a new fintech product. The London-based startup has now secured an €8M / $9.4M seed round of funding led by Seaya Ventures and Speedinvest, with SIX FinTech Ventures participating. Link here.

🇷🇺 Promsvyazbank and 🇷🇺Tochka, a fintech service for small businesses, started using Open Banking API developed by the 🇷🇺Bank of Russia and the 🇷🇺 Russian FinTech Association (RFA). Link here.

INVESTMENTS

🇬🇧 ikigai, the first UK app to bring together everyday banking and wealth management, brings its customers Apple Pay. Link here.

CRYPTO

Members of Argentina’s National Congress submitted a bill that will allow Argentina’s workers to accept salaries in Bitcoin. Link here.

🇸🇪 Klarna acquired London and New York-based social shopping platform HERO®, which helps consumers find inspiration, advice, and immediately shoppable content directly from a retailer’s physical store. Klarna will introduce Hero to its 250,000 retail partners, enabling in-store teams to become content creators instantly, providing reviews and real-time advice to bring the best of in-store shopping to online customers. Link here.

Crypto asset manager 🇺🇸 ValkyrieInvestments, which recently applied for a bitcoin exchange-traded fund (ETF), has raised $10 million in a Series A funding round. Link here.

More than $1 billion worth of cryptocurrency was spent around the world on crypto-linked 🇺🇸 Visa cards in the first half of the year. The card giant says that it is helping to make crypto a viable payments options - and not just speculative investment - by making the process easy. Link here.

PAYMENTS

🇺🇸 Wish has been granted a Payments Services License by the Dutch Central Bank, paving the way for the e-commerce giant to process all EU payments on its platform. Link here.

🇸🇬 Nium, a leading global payments platform, announced it has signed a definitive agreement to acquire 🇮🇳 Wirecard Forex India Pte. Ltd – a foreign currency exchange, pre-paid card, and remittance service provider in India. Link here.

🇬🇧 SumUp brings its UK-based customers Apple Pay, a safer, more secure, and private way to pay that helps SumUp merchants avoid handing their payment card to someone else, touching physical buttons, or exchanging cash — and uses the power of iPhone to protect every transaction. Link here.

🇦🇺 Cape, the Spend Management and Corporate Card issuing platform focussed on helping businesses spend less money announced the start of a new multi-year strategic partnership as a Principal Member with 🇺🇸 Mastercard. Link here.

🇬🇧 GoCardless, a leading fintech in account-to-account payments, has joined forces with 🇫🇷 Pennylane, the first financial management and accounting platform designed for companies and their accountants, to offer SMEs and start-ups a seamless way to manage and collect recurring payments. Link here.

BNPL

Australian investors bought the rumor yesterday, with shares in buy-now-pay-later company 🇦🇺 Zip Co jumping 13.7% on media reports that 🇸🇪 Klarna, the 1000lb Swedish gorilla in the BNPL space, had taken a holding in the Aussie FinTech. Link here.

Melbourne-based tech venture builder and accelerator 🇦🇺 Fatfish Group Limited announced that it is establishing a new retail Buy Now, Pay Later (BNPL) brand PaySlowSlow in South East Asia. Link here.

🇺🇸 Socure, the leading platform for digital identity verification and trust, today announced the introduction of the first identity verification and fraud solution purpose-built for the Buy Now, Pay Later (BNPL) industry. Link here.

FUNDING

🇺🇸 Crush Capital Inc., a Los Angeles, CA-based fintech company behind the upcoming streaming series “Going Public,” raised $2.75m in funding. Link here.

🇨🇦 Float has secured $5 million to bring a Brex-like offering to the Canadian market. Link here.

🇬🇧 StepEx has secured £1.1 million in pre-seed funding. Link here.

🇬🇧 Generation Home raised a $30.4m Series A round and a £300m loan facility from NatWest. Link here.

🇲🇾 MoneyMatch announced the successful closing of its Series A fundraising round totaling MYR 18.5 million over two tranches. Link here.

🇸🇬Hugo Save SG, co-founded by a team including a founder of London-based gold trading app Glint, has raised $2m to launch in Singapore. Link here.

🇮🇳 Finance start-up Yap is set to nab $35 million from New York-based Tiger Global Management in a new round of financing. Link here.

🇫🇷 Younited has raised $170 million in its latest funding round. Link here.

🇺🇸 Circle has announced plans to go public via a special purpose acquisition company (SPAC) deal that values the company at $4.5bn. Link here.

🇬🇧 Coincover has raised $9.2m in a new funding round led by Element Ventures. Link here.

🇦🇺 Hay has locked away $17 million as part of a larger Series B capital raise due to close in coming weeks. Link here.

🇨🇦 Clearco, a fintech capital provider for online companies, has raised $215 million in a round led by SoftBank Group Corp. Vision Fund II. Link here.

🇺🇸 Willa raised $18 million in Series A funding from a round led by New York-based FinTech Collective. Link here.

🇮🇳 Pine Labs has closed its latest funding round, securing a $600 million investment. Link here.

PayHippo Raises $1m in Pre-seed Funding to Step Up Where Banks Aren’t Servicing — Loans to Small Businesses. Link here.

🇧🇷 Zoop, a payment methods, and financial services technology company, announced Wednesday that it has received R$170 million (US$34 million) from Movile Group, which it will use to expand its operations. Link here.

🇲🇽 super.mx, an insurtech startup based in Mexico City, has raised $7.2 million in a Series A round led by ALLVP. Link here.

FOUNDERS & INVESTORS

It’s never been a better time to be an angel investor in Europe given the incredible quality of companies and talent here. In the first half of this year alone, European startups have already raised more than the total figure for 2020. Link here.

More than a year into the pandemic, investment to startups worldwide exploded to new highs in Q2’21, as funding poured in across regions and sectors. Link here.

Eastern Europe has an angel problem. There aren’t enough and most are men. With this in mind, four women from the region — from diverse startup and investor backgrounds — launched Lumus Investment Collective last July. Link here.

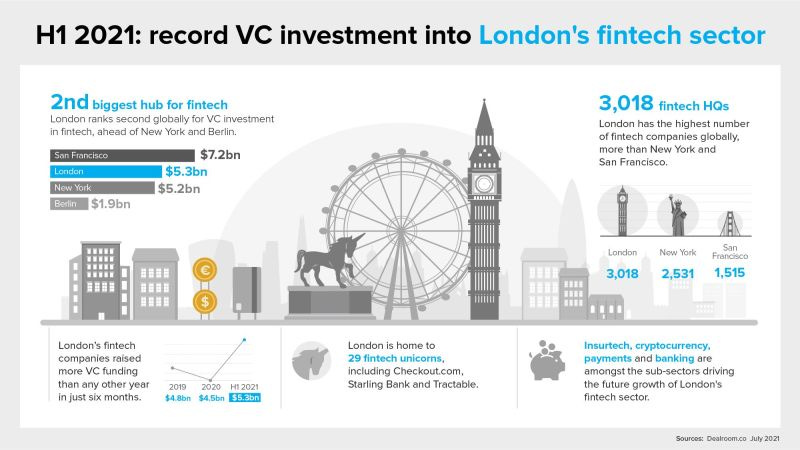

Venture Capital firms invested nearly $5.3 billion into London-based financial technology startups.

The global financial technology (fintech) sector is booming and London-based companies have seen record investment during the first six months of 2021.

👉 Read more here.

MOVERS AND SHAKERS:

Irina Nicoleta Scarlat, formerly of Revolut and Uber, brings extensive expertise to 🇦🇹 Bitpanda; joining the team as Chief Growth Officer (CGO). Link here.

Brian Armstrong, co-founder, and CEO said on Twitter, “Coinbase is building out an office in India! Amazing team already in place - come join us." Link here.

🇬🇧 MultiPay Group Global Solutions is announcing the latest phase of its global expansion with the appointments of its new Nordic CTO, Anders Jacobsen and Sales Director, Jakob Dige. Link here.

🇺🇸 VaynerMedia has hired Eric Jacobs as the digital agency’s first chief innovation officer, it said Thursday. Link here.

This ends my weekly digital fintech newsletter. Thank you for reading to the end! If you liked it, I invite you to like, share and/or leave a comment below. You may find more information regarding my newsletter here.

If there is anything else you think I’m missing, please don’t hesitate to reach out by email at bonjour@marcelvanoost.nl.

Let me know if there are any questions or news/insights worth mentioning in next week's newsletter. Until the next!

Regards,

Marcel van Oost

Follow me on Twitter, Linkedin, and Telegram.

Discover other newsletters by MVO.