Weekly Fintech Newsletter | 2021 #21

Hi, there! Welcome back to another Fintech Weekly Newsletter. In this newsletter, I cover all the major weekly news related to the fintech industry. The newsletter begins with recommended articles, reports, and Fintech maps. Thank you for subscribing!

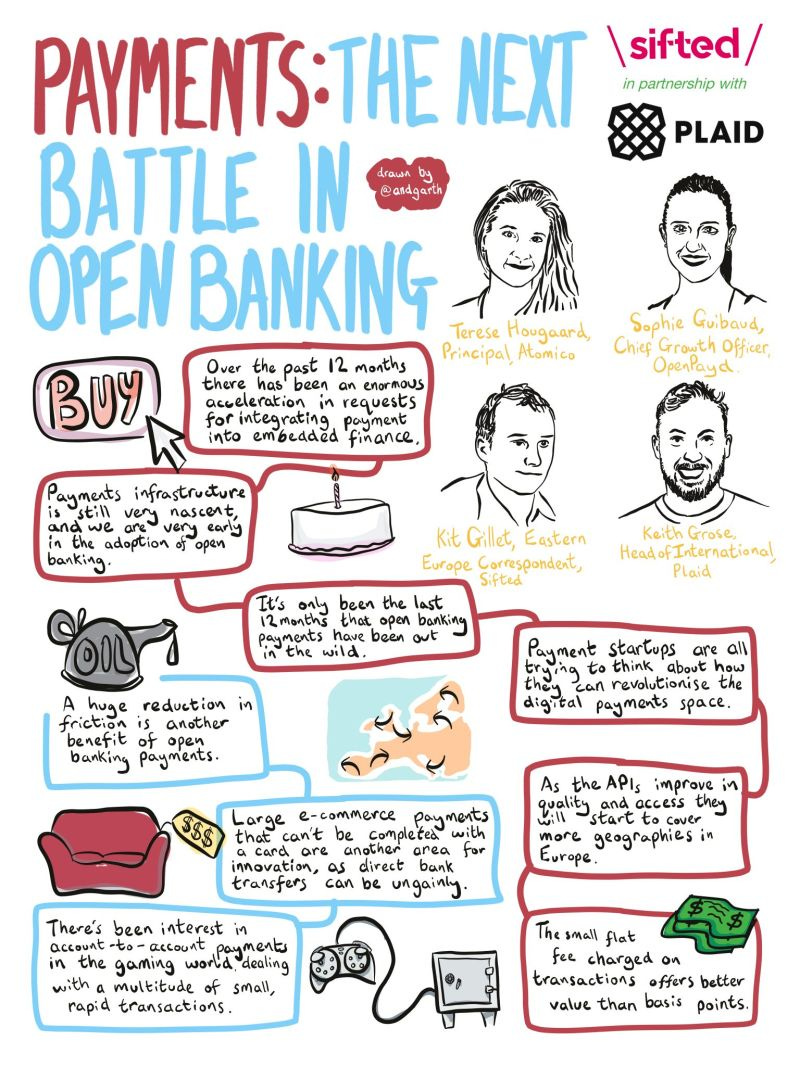

Valuations in the open banking space are soaring far beyond revenues — but is it all unfounded hype?

It’s undoubtedly an exciting space; open banking companies are leading the way in building the so-called “plumbing” of banking, allowing third-party financial service providers open access to consumer banking data via APIs, and letting customers pay directly from their accounts.

But what roadblocks is open banking still facing?

👉 Read more here.

ARTICLE

The average size of a Series A round in France has increased by over 500% over the past decade.

Back in 2011, the average was €2.4m. In 2021, it’s €14.6m. France was broadly below the European average for Series A round sizes until 2016.

👉 Read more here.

ANALYSIS

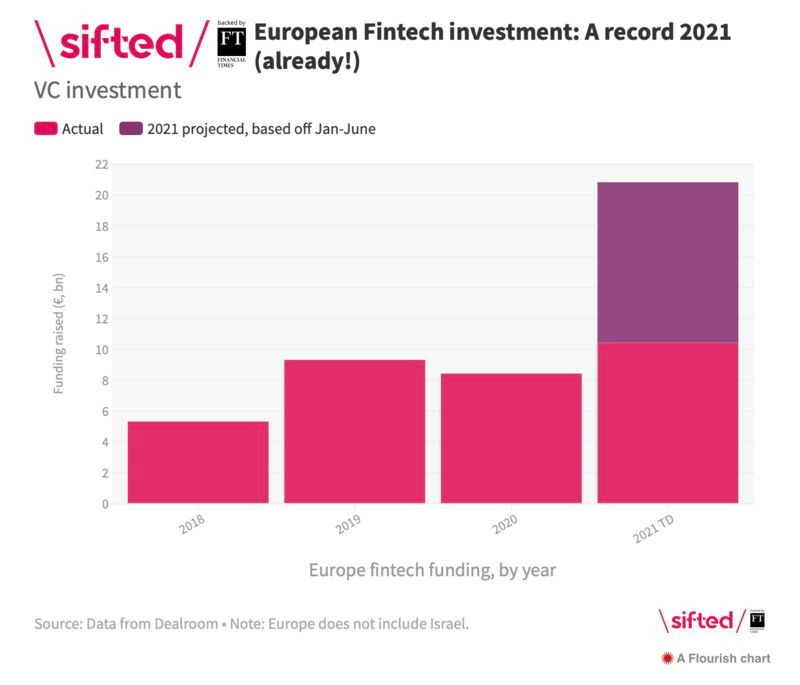

Barely halfway through 2021, Europe has already broken the record for annual investment into FinTechs.

👉 Read more here.

FINTECH MAPS

NOW, ON TO THE SUMMARY OF LAST WEEK'S FINTECH SPACE

FINTECH SPOTLIGHT

🇳🇱 Mollie announced the closing of US$800m (665 million Euro) in a Series C funding round, taking the total amount raised by the company to over US$940m (780 million Euro).

👉 Read more here.

FINTECH HIGHLIGHTS

New Billion-Dollar Tech companies in 2021 by geography. Link here.

🇺🇸 Stripe Inc. has yet to go public, but investors are still craving a piece of it. Link here.

🇩🇪 Target Global recently brought together founders of several Nigerian startups and local tech investors at an exclusive interactive session that was held in Lagos, Nigeria. Link here.

🇬🇧 Wise (formerly TransferWise) has underlined its commitment to join the London stock market this week. Link here.

OPEN BANKING

Less than a year after its creation, 🇮🇹 faire.ai published the first API of its platform on its website, making it accessible and testable to all current and future partners. Link here.

According to an in-depth European research conducted by 🇺🇸 Mastercard, the Nordic countries and the UK, have been crowned best placed to take advantage of the open banking ecosystem. Link here.

🇬🇧 Credit Kudos launched a new open banking-powered credit decisioning product, Assembly. The new launch will see lenders save thousands of hours in manual underwriting. Link here.

🇩🇪 Novalnet AG - Empowering Payment and 🇩🇪 Tink have partnered to bring a new open banking payment solution to the European payments market. Link here.

INVESTMENTS

🇳🇱 BUX’ launch in Ireland marks the first time a digital-only investment platform has touched down in the country, much to the delight of budding Irish traders. Available from in both Google and Apple App Stores, the BUX app gives users the chance to invest in over 2,000 stocks. Link here.

CRYPTO

Many people still aren’t sold on the cryptocurrency craze. About 1 in 3 US adults who don’t own cryptos said they don’t consider them legitimate, while 1 in 4 said they don’t understand these digital currencies. 👉 Read more here.

After six months of testing with a selected group of users, 🇨🇭BBVA Switzerland makes its first crypto-asset trading and custody service available to all its private banking clients. Link here.

🇸🇬 Contour, a blockchain trade finance network, has closed its Series A+ funding without disclosing the amount. Link here.

DeFi – short for Decentralized Finance – has started to become a real buzzword in recent months, with investments in the space growing by leaps and bounds. Link here.

E-Livestock Global LLC launched a first-of-its-kind solution powered by 🇺🇸Mastercard’s blockchain-based Provenance solution, empowering Zimbabwean farmers to prove the origin and health records of their cattle, while reducing risks to buyers. Link here.

PAYMENTS

🇺🇸 Visa has launched its first Tap to Phone pilot in the United States, providing minority-owned small businesses in Washington with the ability to accept payments with a simple card tap on an Android handset. Link here.

🇺🇸 Stripe is currently offering the new point of sale device on an invite-only basis and only to North American customers although on its UK website it features the machine alongside pricing in UK pounds. Link here.

Holders of 🇺🇸 Conotoxia multi-currency cards can make contactless payments with their phone and smartwatch, use online payments, and withdraw cash from ATMs using Google Pay. Link here.

A pair of former 🇺🇸 PayPal executives has launched a decentralized global payments network to connect banks, merchants, and payment providers to transact in digital currencies around the world. Link here.

🇺🇸 Bakkt Holdings, LLC unveiled broader Peer-to-Peer (P2P) capabilities that enable Bakkt users to send bitcoin, gift cards, and cash to anyone, including those not currently using the Bakkt App. Link here.

BNPL

🇸🇪 Klarna, a leading global retail bank, payments, and shopping service, announced the launch of their new Comparison Shopping Service (CSS) in 21 markets. Link here.

Also, Sebastian Siemiatkowski, CEO of Klarna would want a golden share to veto a takeover if the company lists on the London Stock Exchange. Link here.

🇺🇸 Kafene raises $14M to offer buy now, pay later to the subprime consumer. Link here.

🇳🇿 Laybuy is launching its digital BNPL card in the UK, enabling customers to make in-store purchases with a tap of their phones. Link here.

🇬🇧 Trust Payments has partnered with Zip Co, the first Buy Now, Pay Later provider to join its network of payment partners. Link here.

FUNDING

Cryptocurrency compliance and risk management platform 🇺🇸 TRM Labs has closed a $14 Million Series A funding round. Link here.

🇵🇱 Ramp Network raised around €8.3 million to bring its next-level payment infrastructure to even more people globally. Link here.

🇳🇱 Change Invest has closed a €3.7 million crowdfunding round that saw a buy-in from 50 private investors. Link here.

🇺🇸 Securitize raised $48 million in a Series B funding round led by funds managed by Morgan Stanley Tactical Value and Blockchain Capital LLC. Link here.

🇺🇸 Crediverso closed a $3.1 million seed round to help launch its platform later this summer that hopes to connect the growing Hispanic community with the financial offerings it needs. Link here.

🇬🇧 10x Future Technologies has sealed an oversubscribed $187 million Series C financing round. Link here.

🇩🇪 finleap connect raised €22 million as part of a push to create a pan-European Open Banking platform. Link here.

🇬🇧 Volt.io raised $23.5 million in a Series A funding round led by EQT Ventures. Link here.

🇺🇸 Splash Financial has secured $44.3 million in a new Series B funding round. Link here.

🇬🇧 Coupay Limited has secured £200,000 pre-seed funding from early-stage venture capitalist SFC Capital and leading tech founders and angels including serial entrepreneur Will Wynne of Smart Pension, Arena Flowers, and Trulience. Link here.

🇺🇸 Nymbus CUSO landed a $5 million second round investment from the Curql Fund, a venture capital fund founded last year and managed by credit unions. Link here.

🇮🇩 BukuWarung raised $60 million in Series-A funding, increasing the total fund raised to about $80 million. Link here.

🇵🇰 KASB Securities raised $4.5 million in a funding round led by Hong Kong-based investment firm TTB Partners and New York-based global VC HOF Capital. Link here.

🇵🇱 Booste raised a €12m Series A funding round. Link here.

🇬🇧 Mode Global Holdings Plc is proud to announce that it has signed an MoU with THG Plc, which will see THG brands offering Mode as an additional payment option for customers. Link here.

FOUNDERS & INVESTORS

🇬🇧 Fi911 has launched a new micro-mentorship program to empower female leadership across the thriving fintech and payments arena. Link here.

Xolo (previously known as LeapIn) has raised an additional €3 million. This funding follows a €6 million Series A round in July of 2019, bringing the total capital raised to €11.2 million. Link here.

🇺🇸 Credit Sesame is planning to file for a U.S. initial public offering that could value the credit checking and financial services provider at more than $2 billion, according to people familiar with the matter. Link here.

The next financial services all-star could come from Latin America, where FinTech is exploding. 🇺🇸 QED Investors is betting on the region with a new $12 million investment fund named Fontes. Link here.

🇬🇧 Monese announced its partnership with 🇪🇪 Veriff, a global identity verification provider. Link here.

MOVERS AND SHAKERS:

The Swedish tech company 🇸🇪 Fidesmo continues to grow and expand its team with a new star recruitment – Peter Cooper, former VP of Security at the Dutch payment company 🇳🇱 Adyen. Link here.

Crowdfunding pioneer Luke Lang has announced he’s leaving the company he co-founded in 2010. Link here.

🇵🇰 QisstPay, the fastest-growing installment payment service for emerging markets, has appointed banking veteran and fintech enthusiast, Noshad Minhas, as its Chief of Staff and Revenue Officer. Link here.

This ends my weekly digital fintech newsletter. Thank you for reading to the end! If you liked it, I invite you to like, share and/or leave a comment below. You may find more information regarding my newsletter here.

If there is anything else you think I’m missing, please don’t hesitate to reach out by email at bonjour@marcelvanoost.nl.

Let me know if there are any questions or news/insights worth mentioning in next week's newsletter. Until the next!

Regards,

Marcel van Oost

Follow me on Twitter, Linkedin, and Telegram.

Discover other newsletters by MVO.