Weekly Fintech Newsletter | 2021 #20

Hi, there! Welcome back to another Fintech Weekly Newsletter. In this newsletter, I cover all the major weekly news related to the fintech industry. The newsletter begins with recommended articles, reports, and Fintech maps. Thank you for subscribing!

REPORT

With over 550 active FinTech companies, Australia is one of the hottest FinTech hubs with the most prolific FinTech landscape in APAC, outside China and India. Australia ranks fifth among countries with the highest number of FinTechs startups founded since 2015 and has a 58% FinTech adoption.

MEDICI's report on the Australian Fintech Industry considers the period between January 2018 to May 2021. Within this period the sector received more than $2.67 billion in investments. MEDICI’s analysis of the market over the past few years suggests steady growth in FinTech funding in the continent between 2018 and 2019.

👉 Link here.

ARTICLE

There are now 31 billion-dollar FinTechs in Europe, with ten new ‘unicorns’ materializing so far this year — and more on their way.

That means Europe now represents ~25% of all 120 FinTech unicorns globally, according to CB Insights. The FinTech sector has cemented its position as the dominant category of unicorns in Europe. In total, there are over 70 European unicorns across different sectors, and nearly half of those are FinTechs.

👉 Link here.

FINTECH MAPS

NOW, ON TO THE SUMMARY OF LAST WEEK'S FINTECH SPACE

FINTECH SPOTLIGHT

🇺🇸 Stripe continues to expand beyond payments, launching a tool that help internet businesses securely verify the identities of their users from over 30 countries.

StripeIdentity is designed to help online firms comply with age requirements and KYC laws, as well as to reduce fraud and prevent account takeovers. Built on the same infrastructure that powers Stripe’s own global onboarding compliance and risk management, the tool can be rolled out and ready for use within minutes, with no code required.

👉 Read more here.

FINTECH HIGHLIGHTS

Earned wage access (EWA) platforms that allow workers to withdraw their earnings on demand instead of waiting until payday are proliferating around the world. Link here.

🇺🇸 Square Inc. announced the allocation of the remaining $25 million of its $100 million investment in support of minority and underserved communities. Link here.

OPEN BANKING

🇱🇻 Nordigen, a Latvian startup that is challenging the foundational business models of Tink, Plaid and TrueLayer by providing fee-free access to over 1000 European bank APIs, has raised €2.1 million in a seed financing round. Link here.

INSURETECH

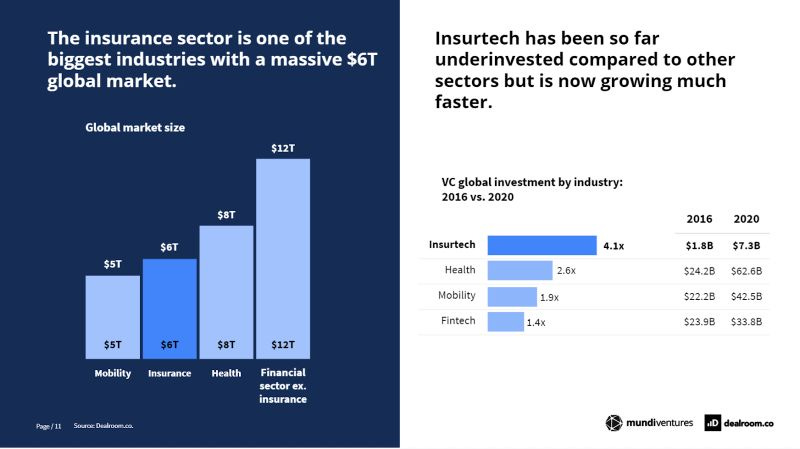

Insurance is a massive global industry ($6 trillion) that has been largely undisrupted for centuries. A new generation of startups, accelerated by the pandemic and new customer demand is accelerating innovation. Link here.

INVESTMENTS

🇸🇬 BondEvalue, a Singapore-based debt trading platform for the masses, has raised $6 million in its Series A round of fundraising, with MassMutual Ventures Southeast Asia and Citigroup among the new investors. Link here.

CRYPTO

🇺🇸 BlockFi is raising new funding just three months after its last round. It's the latest sign that VC interest in cryptocurrency, supercharged by Coinbase’sdirect listing two months ago, is overriding a recent steep retreat in crypto prices. Link here.

Blockchain startup 🇺🇸 Solana Labs Inc. says it has raised $314 million of new funding to develop technology used in the fast-growing area of the cryptocurrency markets known as decentralized finance or DeFi. Link here.

British billionaire fund manager Alan Howard has led a $25 million investment in the London-based crypto custodian 🇬🇧 Copper.co Link here.

Cryptocurrency exchange 🇺🇸 Gemini has acquired 🇬🇧 Shard X, a developer of secure multi-party computation (MPC) cryptographic technology. Link here.

Retirement investment platform 🇺🇸ForUsAll partnered with Coinbase to offer employees exposure to cryptos, in what the company said is a first of its kind. Link here.

PAYMENTS

Mastercard has announced the expansion of its True Name card feature across the globe as Global Payments, a leading provider of payment technology and software solutions, implements the feature for its TSYS issuer customers. Link here.

The US Office of the Comptroller of the Currency (OCC) has approved 🇳🇱Adyen’s application to establish a Federal Foreign Branch in San Francisco, California. Link here.

🇦🇺 Send, the Queensland-based international payments specialist has announced a new commercial partnership with award-winning global FX and CFD broker, Pepperstone. Link here.

🇿🇦 UKheshe Technologies, Mastercard, Nedbank, and Telkom collaborate to grow access to the digital economy with a virtual product that enables secure e-commerce payments on the phone. Link here.

🇦🇪 Ziina, another startup based in Dubai, has closed $7.5 million in seed funding to scale its peer-to-peer (P2P) payment service across the Middle East and North Africa. Link here.

BNPL

🇨🇦 Shopify has officially launched Shop Pay Installments — a buy now, pay later product specifically designed for Shopify merchants. Link here.

🇺🇸 Splitit, the company empowering consumers to use their existing line of credit to pay in installments, announced a partnership with ChargeAfter. Link here.

Just over three months after its last funding round, European FinTech giant 🇸🇪 Klarna is announcing today that it has raised another $639 million at a staggering post-money valuation of $45.6 billion. Rumors swirled in recent weeks that Klarna had raised more money at a valuation north of $40 billion. Link here.

As in other markets, 🇳🇱 Mollie is once again one of the first fintechs to move forward on such an agreement with Klarna – and the first online payment solution to integrate it directly into their offering. Link here.

FUNDING

French startup 🇫🇷 Pennylane has raised a new $18.3 million funding round (€15 million). Interestingly, this is Sequoia Capital’s first investment in France after they announced ambitious expansion plans in Europe. Link here.

🇩🇪 wajve, the Berlin-based financial app for Gen Z – has raised a €5 million seed round, led by EQT Ventures with participation from 468 Capital. Link here.

🇬🇧 Outward VC announced their investment in Mazepay A/S, a Denmark-based Fintech that has developed a next-generation B2B payments solution for corporate spend. Link here.

🇨🇦 nesto announced the closing of a $76 million Series B funding round led by Michael Rowell and Michael Paulus, the entrepreneurs behind Assurance IQ, which was sold to Prudential Financial in 2019. Link here.

Karachi-based salary advance platform 🇵🇰 Abhi Pvt Ltd has raised $2 million in a seed round led by Vostok Emerging Finance, it announced in a statement. Link here.

Digital wealth manager 🇩🇪 Scalable Capital has raised a huge series E funding round of $180m (€150m) led by Chinese tech giant Tencent. Existing shareholders also participated in the Series E. Link here.

🇫🇷 Upflow, a Paris-based startup that helps B2B companies get paid, has raised $15 million in a Series A funding round joined by 9Yards Capital, eFounders, and angels N26 co-founder Maximilian Tayenthal and Uberexecutive Pierre-Dimitri Gore-Coty. Link here.

🇸🇬 OSOME raised $16M in a Series A funding from a group of investors including Target Global, Altair Capital, Phystech Ventures, S16VC, and Peng T. Ong, who joined as an angel investor. The fresh amount of capital enables Osome to expand its footprint internationally, as well as to fuel product integrations. Link here.

Now® announced that it has raised $9.5 million in Series A funding. Stacey Abrams and O’Connor Hodgson founded Now in 2010 to provide small businesses a quicker method for getting invoices paid. When a business submits an invoice through NowAccount, the service pays 100% of the invoice, minus a 3% merchant fee. Link here.

FOUNDERS & INVESTORS

🇺🇸 Credit Sesame, an online personal finance platform that helps users monitor their credit scores and manage their debt, has raised fresh funding, bought another company, and revived its IPO plans. Link here.

SoftBank created the Opportunity Fund barely a week after the murder of George Floyd. The firm committed to investing $100 million in companies led by underrepresented racial minorities, establishing the largest fund of its kind. A year later, SoftBank has already allocated half the cash and anticipates creating a second fund by year-end. Link here.

MOVERS AND SHAKERS:

Digital payments platform 🇬🇧 Pomelo Pay has appointed Andrew Doukanaris FCMI as permanent CEO for the UK and Europe to lead its growth in the market. Link here.

Joe Heneghan, who leads 🇬🇧 Revolut in Ireland, has been appointed to run the fintech’s European operations. Mr. Heneghan has been named to the new role of chief executive for Europe. In the new role, he will lead Revolut’s specialized bank and e-money institution-licensed entities in Lithuania and oversee Revolut’s continued expansion. Link here.

This ends my weekly digital fintech newsletter. Thank you for reading to the end! If you liked it, I invite you to like, share and/or leave a comment below. You may find more information regarding my newsletter here.

If there is anything else you think I’m missing, please don’t hesitate to reach out by email at bonjour@marcelvanoost.nl.

If you are looking for my weekly digital banking newsletter (the one divided by regions), you may find it here.

Let me know if there are any questions or news/insights worth mentioning in next week's newsletter. Until the next!

Regards,

Marcel van Oost

Follow me on Twitter, Linkedin, and Telegram.

Discover other newsletters by MVO.