Weekly Fintech Newsletter | 2021 #2

Highlights, Investments, Payments, Open Banking, Crypto, Funding, and other topics.

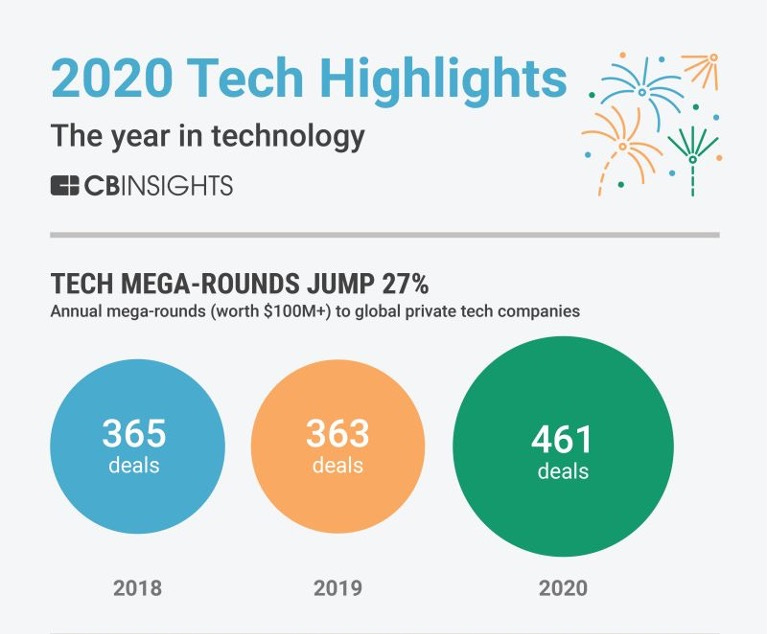

The tech industry proved its resilience in 2020. Despite ongoing economic uncertainty brought on by the global Covid-19 pandemic, the sector continued to reach new highs.

Across industries, VC-backed mega-rounds in the US broke records in 2020. In the global tech sector, mega-rounds jumped 27% year-over-year, reaching 461 rounds.

Check out 🇺🇸 CBINSIGHTS' 2020 Tech Highlights: The Year’s Biggest Deals, Most Valuable Acquisitions, And More. Their report visualizes the year in tech, from a rise in mega-rounds to tech leaders' outsized public market performance to 2020's biggest M&A trends. Read more here.

FINTECH MAPS

NOW, ON TO THE SUMMARY OF LAST WEEK'S FINTECH SPACE

FINTECH SPOTLIGHT

🇺🇸AQUAOSO Technologies announced the completion of a $2 million capital raise. Aquaoso is a public benefit water tech company that reduces financial risk for lenders and investors by providing insight into the impact of water stress.

The platform ensures financial institutions spend 85% less time gathering data and 50% less time closing deals. According to the U.S. Intelligence Community Assessment of Global Water Security, by 2030, humanity’s “annual global water requirements” will exceed “current sustainable water supplies” by 40%.

By finding innovative ways to more efficiently identify and monitor water risk, Aquaoso experienced impressive growth in the past year. Read more here.

FINTECH HIGHLIGHTS

With a new year and a new month, comes a brand-new Fundraising Rap Up from Lewis, aka Ape Diagnosis. He breaks down January’s Fintech fundraising news in little word chunks for you to feast on! From Nayms to Udaan, he’s got it covered, so dig right in. Link here.

One of the 'Trends to Watch' during the upcoming decade in Banking will be how 'Open Banking' unravels in 🇧🇷Brazil. The potential for disruption in the FinTech Digital Banking space is going to be without precedent. Link here.

How VC can nurture more “green zebras”? Here are three suggestions. Link here.

What are the key obstacles for entrepreneurs in Latin America? Link here.

🇺🇸The internationally renowned thought leader in Fintech, David Birch, has been appointed Fintech Ambassador for Jersey. Link here.

PAYMENTS

According to the🇺🇸 J.D. Power 2021 U.S. Merchant Services Satisfaction Study, SM released, challenges with customer service, cost of service, and underwriting and onboarding have been more pronounced among businesses experiencing significant sales declines during the past year. Square ranks highest in merchant services satisfaction with a score of 857. Link here.

Digital payments firm 🇺🇸Payoneer is the latest fintech to go public through a merger with a special purpose acquisition company (Spac) in a deal that values the merged entity at $3.3 billion. Link here.

🇵🇱ZEN.COM, a licensed European Fintech company, has announced its launch in 32 markets, including the UK, with the support of 🇬🇧Currencycloud, a leading provider of B2B embedded cross-border solutions. Link here.

🇺🇸Routefusion, an Austin-based startup that helps tech companies embed cross-border payments in their applications, has raised $3.6 million in seed funding. Link here.

The global payment service provider 🇬🇧SumUp has acquired the core banking system provider 🇱🇹 Paysolut, founded in Lithuania. Link here.

🇺🇸 Balance, a digital checkout platform for B2B businesses, has emerged from stealth mode with $5.5 million in seed funding from, among others, Max Levchin's SciFi VC and Stripe. Link here.

BNPL

The ongoing effects of the pandemic continue to shift buying behavior. 🇸🇪 Klarna users are taking advantage of the ability to shop online anytime. The current tempo complements the strong year Klarna had in 2020, which saw a doubling of its user base to reach 15 million. Link here.

OPEN BANKING

🇬🇧sync., the smart open banking app, launched Europe’s most advanced budgeting tools with more than 250 spending categories, in partnership with 🇱🇻Nordigen. sync. promises to manage every aspect of a user’s financial life in one place, and the new budgeting features are a major aspect. Link here.

🇳🇱ING-backed Open Banking vendor 🇳🇱Yolt is to expand its Account Information Services to support UK mortgage lenders, the first step in a move to a more wide-ranging model of Open Finance. Link here.

CRYPTO

🇺🇸Uphold announced its acquisition of 🇬🇧Optimus Cards UK Limited, a leading debit and credit card issuer across the UK and Europe. Uphold platform aims to democratize investments by opening up access to traditionally hard-to-reach asset classes, including cryptos, precious metals, and carbon credits. Link here.

🇺🇸Visa has teamed up with 🇺🇸First Boulevard for the first pilot of its new suite of crypto APIs, which will enable customers to purchase, custody and trade digital assets. Link here.

🇺🇸Gemini, a crypto exchange and custodian, announced the launch of its new interest-earning program Gemini EarnTM. Gemini Earn enables customers to earn up to 7.4% APY — more than 100 times the national U.S. average — on cryptocurrencies. Link here.

🇺🇸Ripple has accused the 🇺🇸Securities and Exchange Commission of distorting the facts about the status of its cryptocurrency XRP in its first formal response to a regulatory lawsuit filed in December. In its formal response, Ripple contends that XRP is a cryptocurrency and therefore outside the SEC's jurisdiction. Read more here.

INVESTMENTS

London-based mobile-first investing platform 🇬🇧Wombat is the UK’s first thematic and curated fractional investment platform. Link here.

🇲🇽Flink attracted the attention of Silicon Valley-based venture capital firm 🇺🇸Accel, which just led a $12 million Series A for the company. Mexico’s ALLVP, Clocktower, Kevin Efrusy, and Oskar Hjertonsson, and existing backer Raptor Financial Group participated in the financing. Link here.

🇺🇸Robinhood has raised $3.4 billion to continue to invest in record customer growth, including $1 billion in funding announced on January 29. Link here.

For the fiscal year 2020, 🇳🇬Carbon, which has about 659,000 customers, said it processed ₦96.54 billion (~$241.35 million), up 89% compared to the same period a year ago. Link here.

Nigerian start-up, 🇳🇬Cowrywise, has closed a $3 million pre-Series A funding round. Link here.

🇺🇸Vested Finance, a Silicon Valley-based online investment platform that enables Indians to buy and sell US stocks, has raised $3.6 million in a seed funding round. Link here.

FUNDING

Israel-based venture capital investment firm 🇮🇱FinTLV Ventures has raised its second fund called FinTLV II. Link here.

Dublin and London-based VC firm 🇮🇪Frontline Ventures has raised its third seed fund of €70m to invest in B2B startups across Europe looking to take on the US. Link here.

🇮🇩GajiGesa Indonesia, a fintech company that offers Earned Wage Access (EWA) and other services for workers in Indonesia, has raised $2.5 million in seed funding. Link here.

MOVERS AND SHAKERS:

🇬🇧Monevo, Europe’s largest personal credit platform & API, announced the appointment of Lee Stretton as Chief Innovation Officer. Link here.

🇬🇧FORM3, the leading payment technology platform provider, has announced the appointment of Jessica Letterman as Chief Customer Officer – High Growth. Link here.

Payments provider 🇬🇧Checkout.com has made two new senior hires to its C-suite, with Ott Kaukver and Nick Worswick. Link here.

Ireland’s largest peer-to-peer lender, 🇮🇪Linked Finance, has appointed a new CEO, Niall O'Grady, to take over from Niall Dorrian, who is stepping down. Link here.

This ends my weekly digital fintech newsletter. Thank you for reading to the end! If you liked it, I invite you to like, share and/or leave a comment below. You may find more information regarding my newsletter here.

If there is anything else you think I’m missing, please don’t hesitate to reach out by email at bonjour@marcelvanoost.nl.

If you are looking for my weekly digital banking newsletter (the one divided by regions), you may find it here.

Let me know if there are any questions or news/insights worth mentioning in next week's newsletter. Until the next!

Regards,

Marcel van Oost