Weekly Fintech Newsletter | 2021 #15

Hi, there!

Last week we discussed the Open Banking hype bubble.

However, this week are seeing a partnership between a leading Open Banking FinTech and a established card, paving the way to the future.

Open banking FinTech 🇸🇪 Tink has joined forces with 🇺🇸 American Express to help improve the credit card giant’s process of adding new customers.

“Tink's account verification, income verification and risk analysis technology will streamline the onboarding process for American Express customers, as we work together to create the future of financial services,” Daniel Kjellén, co-founder and CEO of Tink.

By integrating Tink’s open banking capabilities, AmEx will allow prospective card members to seamlessly connect their bank accounts and instantly verify their identities.

👉 Read more here.

REPORT

🇺🇸 Marqeta, Inc, the global modern card issuing platform, released a report highlighting the unique financial needs and concerns of those aged 12–23 in the UK, known as Generation Z or ‘Zoomers’ (in a nod to the ‘Boomers’ generation).

Key report findings include:

Just 12% report using challenger banks like 🇬🇧 Monzo and 🇬🇧 Revolut in some capacity: with 4% saying they use them explicitly, and 8% saying they bank with both traditional providers and challenger banks.

In the future, Zoomers say they would be most interested in banking with 🇺🇸 PayPal (44%), 🇺🇸 Apple (27%), 🇺🇸 Amazon (27%) and 🇺🇸 Google (22%).

More than one in five (22%) say that an easier way to pay through social media would be a key feature in selecting a financial services provider.

Eighty percent of Zoomers still use cash weekly, suggesting that they are not yet ready to forego their physical wallets.

More than half (54%) say offers and incentives would make financial services more attractive; other popular features include convenience and speed (34%) and better prices (31%).

👉 Read more here.

INTERVIEW

This month's CEO Monthly Wealth & Capital Markets Tech Update & Analysis by 🇺🇸 Financial Technology Partners / FT Partners features an exclusive interview with Adam Green, Co-founder and CEO of 🇺🇸 YieldXInc.

👉 Read more here.

FINTECH MAPS

NOW, ON TO THE SUMMARY OF LAST WEEK'S FINTECH SPACE

FINTECH SPOTLIGHT

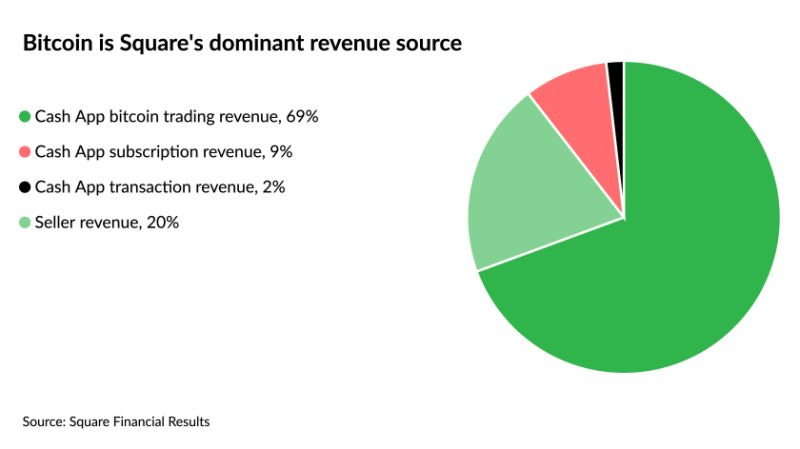

🇺🇸 Square's bet on crypto keeps paying off: the Cash App business, fueled by bitcoin trading, generated the bulk of the company’s revenue in the first quarter.

Meanwhile, the makeup of 🇺🇸 Square's seller ecosystem — the payment acceptance business the company is best known for — is transforming, with less emphasis on small merchants.

The Cash App ecosystem generated approximately 80% of Square's $5.06 billion in revenue for the quarter, with bitcoin trading contributing $3.5 billion, or 70% of the total.

👉 Read more here.

FINTECH HIGHLIGHTS

For my Angel Investors Syndicate, I’m scouting for early-stage Open Banking FinTech startups. Link here.

Also, during the past 6 months, we've reviewed hundreds of fintech startups and learned a lot about running an angel syndicate. Link here.

🇺🇸 Mastercard has been in the spotlight when it comes to women's empowerment in recent times, and today, they have shown support for African women and small businesses by leveraging on their relationship with 🇰🇪 Kasha Global, Inc. through an investment in the purpose-driven eCommerce platform. Link here.

🇸🇪 Klarna announced a new initiative aimed at helping small and medium-sized businesses (SMBs) that were most impacted by the pandemic get back on their feet. Link here.

A survey by credit card giant 🇺🇸 Mastercard has revealed that four in ten people plan to use cryptocurrency for payments within the next year. Link here.

CRYPTO

🇺🇸 Visa is working with personal finance app 🇺🇸 Tala to help underbanked populations participate in the crypto economy. Link here.

Zumo, the Edinburgh-based crypto wallet, has announced the launch of its Zumo Virtual Card. This new product allows users in the UK to make purchases at any online retailer which accepts 🇺🇸 Visa. Link here.

🇺🇸 Luno announced that it is the first digital asset exchange in Malaysia to be approved by the Securities Commission Malaysia to offer Bitcoin Cash (BCH) for trading on its platform. Link here.

🇸🇪 Safello, announced late last night that the new share issue of SEK 40.5 million prior to the planned listing on Nasdaq First North was heavily oversubscribed, with a subscription ratio of 1240%, corresponding to more than half a billion SEK. Link here.

🇲🇽 Bitso, a regulated crypto exchange in Latin America, announced that it has raised $250 million in a Series C round of funding that values the company at $2.2 billion. Link here.

🇬🇧 Ziglu, which was created by Mark Hipperson, one of the founders of 🇬🇧 Starling Bank, and which enables customers to buy and sell a range of cryptocurrencies, has reported a doubling in the number of new customers during this year’s lockdown. Link here.

PAYMENTS

🇺🇸 PayPal saw account openings and payment volumes soar as the world shifted away from cash. And as economies reopen, PayPal must determine whether consumers will continue their aggressive use of digital payments — or return to their old habits. So far, the future is looking very digital. Link here.

🇲🇾 Tranglo, a cross-border payment processing hub, announced that it will power the cross-border payments of 🇦🇺 Omipay, an Australian mobile payment platform, across its global network. Link here.

🇺🇸 Google Pay users in the US can now send money to India and Singapore thanks to integrations with 🇺🇸 Western Union and 🇬🇧 Wise Ltd. Remittances are big business, with people around the world sending nearly $700 billion every year to friends and family in their home countries. Link here.

🇺🇸 Mastercard has partnered with 🇰🇪 Billetera to provide millions of unbanked and financially excluded residents in the Democratic Republic of Congo (DRC), access to formal financial and digital services through a diverse range of digital payment solutions. Link here.

Also, 🇺🇸 Mastercard cardholders in Brazil can send and receive money to and from friends and family through 🇺🇸 WhatsApp. Link here.

🇩🇰 Blocser, a Danish fintech start-up, has launched its ‘Butterfly’ card in the UK for gig economy workers. Link here.

🇬🇧 Lanistar, the FinTech start-up with big ambitions and some controversy, has been approved by the Financial Conduct Authorityto provide payments services. Link here.

🇦🇪 Pyypl (pronounced "people") and 🇺🇸Visa have entered into a Strategic Partnership Agreement valid across the Middle East. Link here.

🇺🇾 dLocal Limited, a technology-first payments platform enabling global enterprise merchants to connect with billions of consumers in emerging markets, today publicly filed a registration statement on Form F-1 with the U.S. Securities and Exchange Commission (“SEC”) relating to a proposed initial public offering of its Class A common shares. Link here.

BNPL

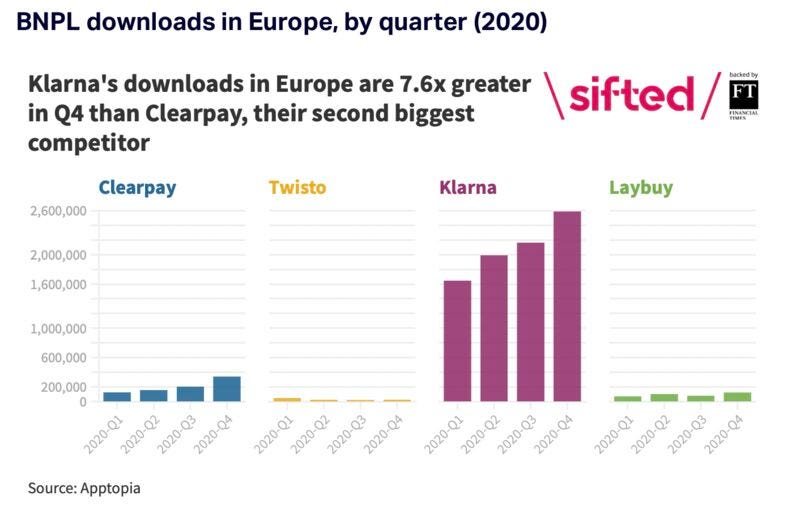

🇸🇪 Klarna, the buy now pay later FinTech, saw its customer base grow faster than any of its European and US rivals last year — putting the company in a strong position ahead of a rumoured public listing.

The Swedish FinTech recorded 8m mobile downloads in Europe alone last year, while its closest rival 🇦🇺 Clearpay (Afterpay Ltd) got just shy of 1m, according to data from Apptopia Inc.. Klarna also topped the leaderboard in the US in 2020, raking up a further 8.5m downloads after years of struggling stateside. Link here.

FUNDING

Newly formed 🇬🇧 Neofin Ventures - founded by fintech experts Matt Oldham, Tony Shawcross and Chris Donnachie - has secured a total of £300,000 in funding via Worth Capital’s The Start-Up Series and angel investors, allowing Neofin Ventures to relaunch 🇬🇧 Unizest, a provider of e-accounts for new residents to the UK. Link here.

🇩🇪 Finoa, a digital asset custody and financial services platform for institutional investors and corporations, announced the close of an approx. €18.1 million Series A funding round. Link here.

🇨🇦 Wealthsimple Technologies Inc. is closing in on a landmark financing deal, backed by some of Silicon Valley’s leading venture funds, which will make the Toronto-based online bank challenger one of Canada’s most highly valued private technology companies. Link here.

FOUNDERS & INVESTORS

“The fintech and paytech space is filled with countless inspirational female leaders, founders, professionals, advisors, and enthusiasts. The only barrier for success is one’s fear or lack of hard work, but neither of those are linked to a particular gender in my opinion.” - Miroslava Betinova - Link here.

🇫🇮 Finnfund, a Finnish development financier and impact investor, announced a USD 10 million commitment to Uhuru Growth Fund I (UGF). Link here.

🇬🇧 Curve announces it’s launching a new crowdfunding round to enable its growing customer base to invest, as it fuels its expansion into the US and further into Europe. The campaign is set to go live sometime in May. Link here.

🇬🇧 B-North, the Manchester-based firm building an SME lending bank for the UK, has so far raised more than £560,000, exceeding the £500,000 target set in an extension of its latest funding round. Link here.

Next generation banking-as-a-service platform, 🇺🇸 HUBUC, has partnered with the hyper-scale Anti-Money Laundering (AML) and risk detection provider 🇬🇧 ComplyAdvantage to integrate its innovative compliance and security screening technology. Link here.

MOVERS AND SHAKERS:

James Hicks has joined 🇩🇰 Nets Group as Chief Strategic Partnerships Officer for its Merchant Services division. Based in Frankfurt, Hicks will be responsible for strategically enhancing the relationships, processes and solutions of Nets and its key strategic partners. Link here.

🇸🇪 Klarna has opened a new headquarter office in London and larger premises in Manchester as it prepares to double its UK headcount to 400 staff over the next year. Link here.

With 🇺🇸 Moven now 100% focused on the B2B financial services sector, new opportunities are evolving quickly, giving Moven a unique opportunity in domestic and international markets. The company has announced several management changes to propel growth through 2021 and beyond. Brett King, Chairman of Moven, announced that Rich Radice, has transitioned from Moven CFO to become CEO. Link here.

Sponsored Content: Fintech Meetup cuts straight to the most important part of an event: building connections. Sign up and meet with 1,000+ other knowledgeable & influential industry professionals.

This ends my weekly digital fintech newsletter. Thank you for reading to the end! If you liked it, I invite you to like, share and/or leave a comment below. You may find more information regarding my newsletter here.

If there is anything else you think I’m missing, please don’t hesitate to reach out by email at bonjour@marcelvanoost.nl.

If you are looking for my weekly digital banking newsletter (the one divided by regions), you may find it here.

Let me know if there are any questions or news/insights worth mentioning in next week's newsletter. Until the next!

Regards,

Marcel van Oost