Weekly Fintech Newsletter | 2021 #14

Hi, there!

I’m always looking for new ways to learn more about FinTech.

News covering everything from major players in the industry, trends, and highlights, to up-and-coming challengers, are essential.

I’ve found that the best way to stay informed with a busy schedule is to maintain a healthy appreciation for remarkable podcasts.

Therefore, I’d like to share with you my recommended FinTech and digital banking podcasts.

👉 Read more here.

REPORT

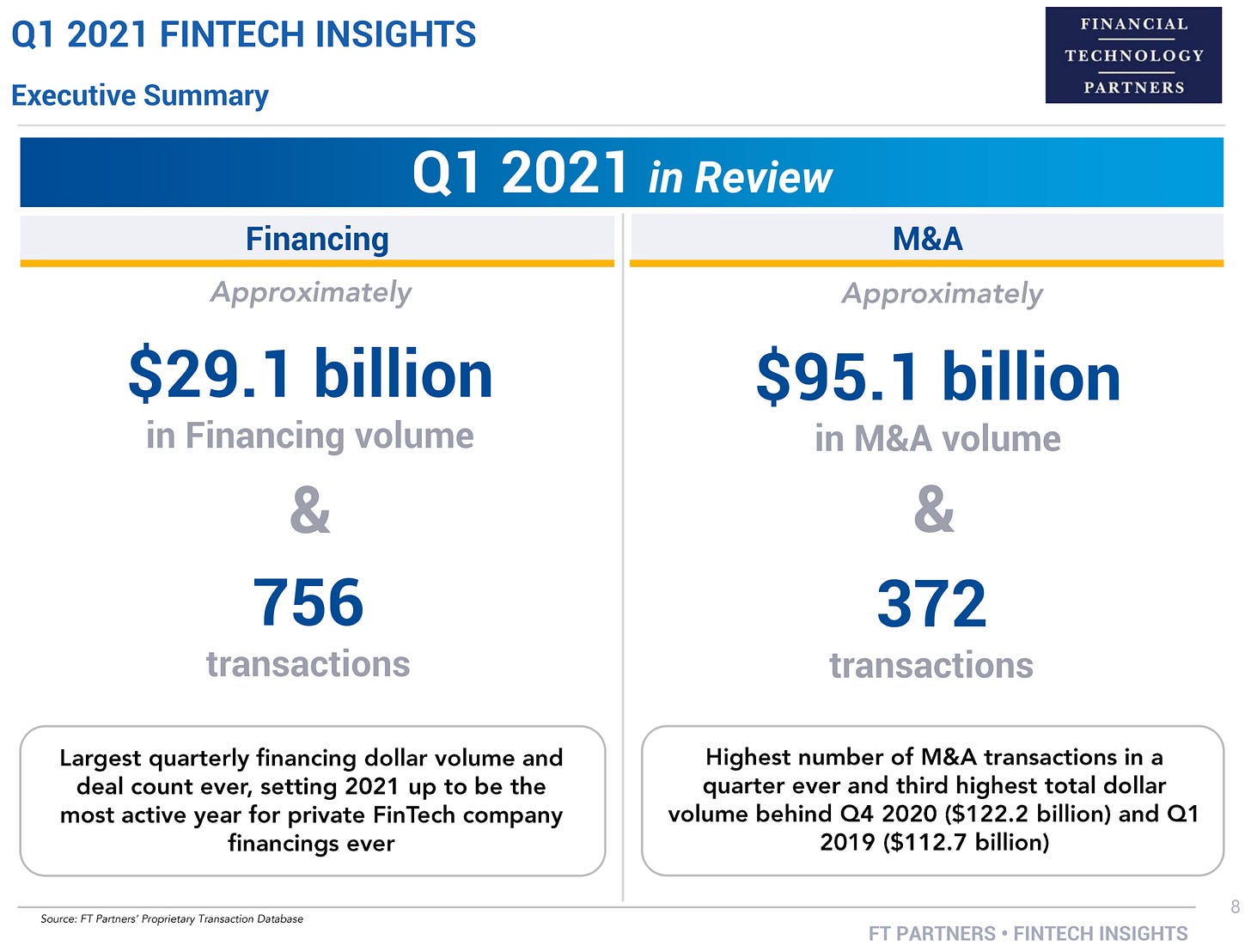

Q1 2021 was the largest and most active quarter ever for FinTech financing.

Total financing dollar volume reached $29.1 billion, a level that is higher than the annual volume of 2017 as well as the annuals totals of all the years prior.

With 756 financing transactions in the quarter, Q1 2021 had over 200 more deals than Q4 2020, which was the previous record high.

If this pace continues for the rest of the year, 20201, is sure to be the FinTech sector's biggest year ever.

👉 Read more here.

FINTECH MAPS

NOW, ON TO THE SUMMARY OF LAST WEEK'S FINTECH SPACE

FINTECH SPOTLIGHT

We love to talk about the neobank hype bubble. But there’s another bubble possibly brewing in the open banking sphere, dominated by the likes of 🇸🇪Tink, 🇬🇧TrueLayer, and 🇺🇸 Plaid.

👉 Read more here.

FINTECH HIGHLIGHTS

I like to highlight Angel Investors from my Angel Syndicate. This week’s Q&A is Craig Dixon who is running his own syndicate on Angel List. Link here.

Millions of consumers are being introduced to alternative payment methods for the first time. Link here.

Over the past five years, the Southeastern region, led by Atlanta, has gone from being “one of the best-kept secrets” in tech, to a vibrant ecosystem teeming with a herd of the billion-dollar tech businesses that are referred to in the investment world as “unicorns” (thanks to their supposed rarity). Link here.

It goes without saying that 2020 was a tumultuous year on the back of the pandemic that has unfortunately affected the livelihood of millions, which also served as fuel for the rapid growth of Malaysia’s FinTech space. Link here.

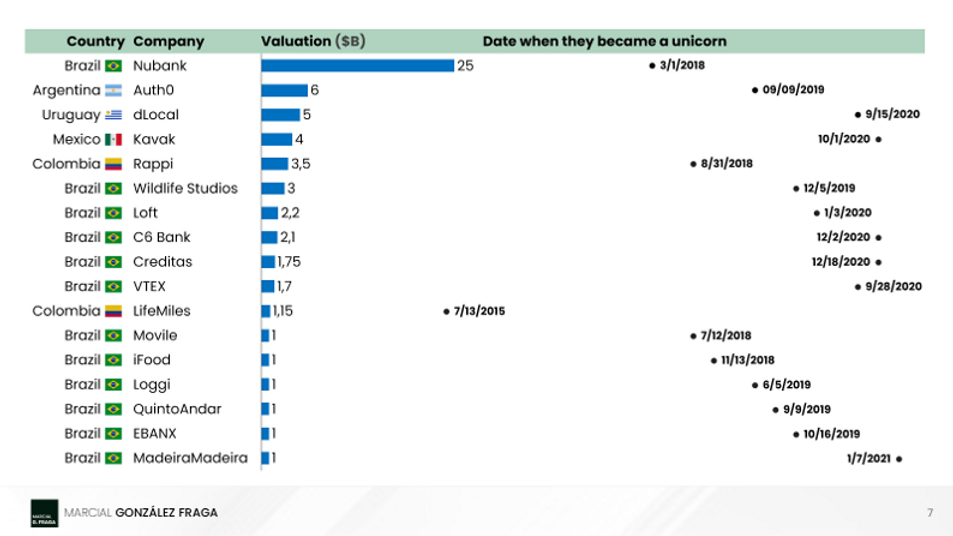

Currently, Latam is home to 16 unicorns, of the +600 unicorns worldwide. The US is home to +330 of them, so we can say that for every Latam Unicorn, the US has 20. Link here.

CRYPTO

Germany has passed a new law that would allow thousands of institutional investment funds to invest in cryptocurrency. The new legislation permits wealth and institutional investment fund managers (called Spezialfonds) to invest as much as 20% of their portfolio in cryptocurrencies. The law is set to come into effect on 1 July. Link here.

🇨🇦 Mogo Inc. announced that it has purchased approximately 146 Ether (ETH) at an average price of US$2,780. Ethereum is an open-source, block-chain based, decentralized software platform that uses its own cryptocurrency, Ether. Link here.

Multi-asset investment platform 🇬🇧 eToro has announced the launch of a new thematic portfolio – BitcoinWorldWide. Based on the companies in the value chain behind bitcoin, the portfolio is intended to further catalyze the adoption of the booming cryptocurrency. Link here.

🇮🇪 HIPS Payment Group (hips.com), a provider of innovative and cost-effective e-commerce and mobile payment solutions, and The Payment House, a Nordic, European, and Global entity that is the leading payment processor for taxi companies in Scandinavia announced their partnership, which will enable payment with cryptocurrency in over 20,000 taxis in Scandinavia and 10,000 taxis in the UK. Link here.

🇺🇸 Wealthfront announced new features for its investment portfolios that will enable clients to invest in a wider range of carefully vetted ETFs and Socially Responsible Investing (SRI) options. Link here.

🇺🇸 Gemini, a cryptocurrency platform, announced details of its first-of-a-kind cryptocurrency rewards credit card, including a partnership with Mastercardand WebBank, a leader in digital lending and the bank issuing the credit card. Link here.

OPEN BANKING

🇬🇧 Paysend is now working with 🇺🇸 Plaid to provide their 3.5 million customers with simple open banking payments that enable fast, low-cost international money transfers. Rather than typing out card numbers or doing manual bank transfers, Paysend has enabled a smooth “click, confirm, and carry on” experience using Plaid’s open banking platform. As a result, Plaid’s instant payment initiation service reduces the time and clicks it takes to authorize a transfer by up to 80%. Link here.

Open banking payments are getting ever more competitive, with the arrival of 🇬🇧 GoCardless as the latest provider offering the service. After announcing its intention to break into the open banking space last year, GoCardless just launched one-off bank-to-bank payments for its customers. Link here.

🇬🇧 Volt.io, the leading open payments gateway, unveiled new cash management functionality providing merchants and payment service providers (PSPs) with complete visibility of open banking payments made through the UK's Faster Payments Service and the European SEPA Credit Transfer and SEPAInstant Credit Transfer schemes. Link here.

INVESTMENTS

Check out this report that is based on aggregated data from millions of retail investors around the world who trade fractional shares of U.S. equities on the 🇺🇸 DriveWealth platform. Link here.

PAYMENTS

🇺🇸 Stripe announced that it has entered into an agreement to acquire TaxJar, a leading provider of sales tax software for internet businesses. Link here.

🇬🇧 Curve, the fintech that brings your cards into one smart card and an even smarter app, introduces today its stunning suite of Autopilot features that help customers take more control over their money management. Link here.

🇬🇧 Vyne, the specialist account-to-account payments platform for eCommerce, is announcing a partnership with Kinetic, the UK’s leading provider of student accommodation, event and catering management software for 80% of the UK and Ireland's universities. Link here.

🇬🇧PPS, formerly PrePay Solutions and an Edenred company announces a new partnership with leading Finnish accounting company, 🇫🇮 Talenom. Link here.

🇸🇦Saudi Payments, a wholly-owned subsidiary of Saudi Central Bank – SAMA, has added Geidea Solutions and STC pay to the national payment system (Mada) as the first two non-bank entities. Link here.

BNPL

🇺🇸 Barclays is joining forces with fintech firm Amount to offer merchants a white label point-of-sale buy now, pay later financing service. As the BNPL market continues to boom, Barclays is hoping to entice merchants with the prospect of letting them use their own brands to "deepen connections with their customers". Link here.

🇲🇽 Graviti is developing a buy now, pay later concept aimed at millions of low-income, unbanked families in Latin America for whom purchasing home appliances is difficult. Link here.

FUNDING

🇺🇸 Current raised $220M in its Series D funding round. Stuart Sopp, Current CEO, and founder joins CNBC ‘Closing Bell’ to discuss the company’s latest funding round, the recent growth, and how it differentiates from similar companies. Link here.

🇺🇸 Step, the new modern-day financial services company built for teens and families, announced a $100 million Series C round of funding. The round was led by General Catalyst, with participation from returning investors Coatue Management, Stripe, Charli D’Amelio, The Chainsmokers’ Mantis VC, Will Smith’s Dreamers VC, and Jeffrey Katzenberg’s firm WndrCo. Step also welcomed Jared Leto and Franklin Templeton to the round and formally announced NBA All-Star Stephen Curry as an investor, who has supported the company from the early days. Link here.

🇺🇸 Securrency, Inc., a leading developer of institutional-grade blockchain-based financial and regulatory technology, has announced that it has raised USD $30 million in its Series B funding round, with participation by WisdomTree Investments, Abu Dhabi Catalyst Partners Limited (ADCP), State Street, and U.S. Bank, among other investors. Link here.

Digital asset custodian 🇩🇪 Finoa has secured $22 million in a Series A funding round led by Balderton Capital. Link here.

Blockchain infrastructure platform 🇺🇸 Paxos has closed a $300 million Series D round of funding, giving the firm behind the crypto offerings of PayPal a $2.4 billion valuation. Link here.

FOUNDERS & INVESTORS

Venture capital funding in Europe grew 6x over the last decade, to nearly $24bn in 2020 ($34.3bn in 2019). The US VC ecosystem, by contrast, grew just 1.5x over the same period — although it raised a mega $73.6bn in 2020.

A new comparative study by Different Funds, which looked at 600 investment firms across 74 regions in Europe and the US, has found European funds are more international, more diversified in funding and more generalist — with some interesting insights into the makeup of partners, too.

👉 Link here.

Before 2020, I used to travel around 50% of the time to all kinds of events and meet people in person all over the globe. I attended several FinTech events and had a great time networking. I'll still refer to 2020 as a "Virtual Year" when I reflect on it.

Sometimes I find myself really missing the hustle and bustle of physical events and the kind of networking that only a face-to-face meeting can provide.

👉 Read more here.

Sponsored Content: Fintech Meetup cuts straight to the most important part of an event: building connections. Sign up and meet with 1,000+ other knowledgeable & influential industry professionals.

This ends my weekly digital fintech newsletter. Thank you for reading to the end! If you liked it, I invite you to like, share and/or leave a comment below. You may find more information regarding my newsletter here.

If there is anything else you think I’m missing, please don’t hesitate to reach out by email at bonjour@marcelvanoost.nl.

If you are looking for my weekly digital banking newsletter (the one divided by regions), you may find it here.

Let me know if there are any questions or news/insights worth mentioning in next week's newsletter. Until the next!

Regards,

Marcel van Oost