Ticombo Selects Mangopay To Transform The Ticket-Selling Experience

Weekly news up to Tuesday, 13th of August 2024

😎 SPONSORED CONTENT

👀 NEWS HIGHLIGHT

iBanFirst, a global provider of foreign exchange and international payments for businesses, has partnered with SeedBlink, Europe’s all-in-one equity and investment platform. The collaboration introduces a bespoke solution for fundraising start-ups and their private investors, ensuring faster onboarding and access to preferential FX rates.

“Collaborating with SeedBlink to introduce dedicated collection accounts represents a significant milestone in enhancing financial accessibility and transaction efficiency for scaling startups,” said Johan Gabriels, Regional Director for Southeast Europe at iBanFirst. “This strategic partnership demonstrates our dedication to empowering businesses with seamless international payment solutions and personalized financial services tailored to their unique needs.

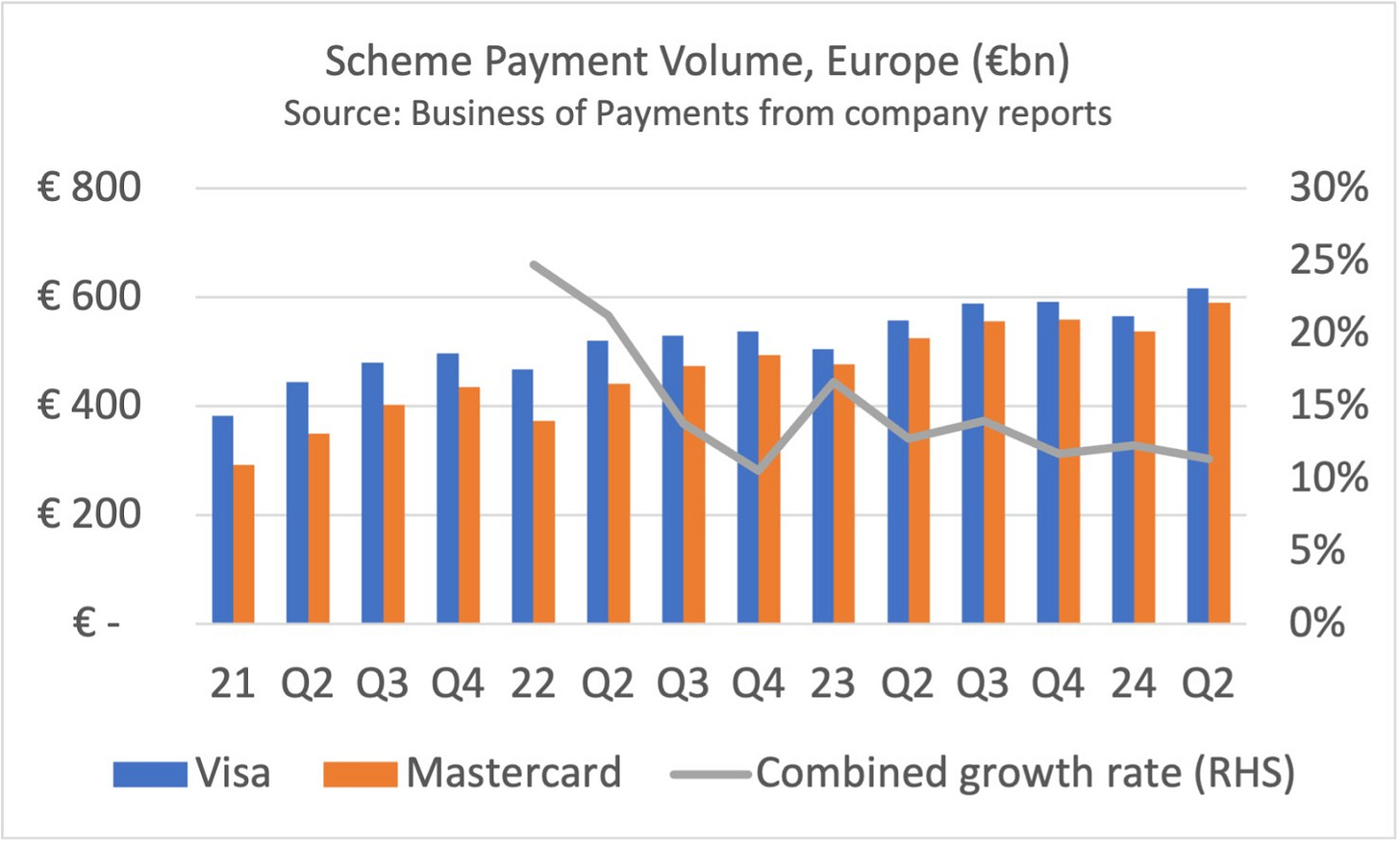

📊 INFOGRAPHIC

NOW, ON TO THE SUMMARY OF LAST WEEK'S NEWS

🌎 FINTECH HIGHLIGHTS

⭐️ Ticombo Selects Mangopay to Transform the Ticket-Selling Experience.

⭐️ Tencent offloads stake in British challenger bank.

⭐️ Klarna Weighs Secondary Share Sale Ahead of IPO.

⭐️ Two more former Wirecard executives charged in sprawling criminal investigation.

Stay Updated on the Go. Join my new Telegram channel for daily updates and real-time breaking news. Stay informed and connect with industry enthusiasts —subscribe now!

FINTECH

Papaya Global reports a record-breaking quarter. Recent achievements showcase a strong commitment to innovation and client satisfaction. The focus remains on driving innovation, exceeding expectations, and delivering outstanding value to clients worldwide.

Papaya Global, the ultimate workforce payroll and payments platform, and Cegid, a European leader in cloud management solutions for professionals in the finance (treasury, tax, ERP), human resources (payroll, talent management), accountancy, retail and entrepreneurship sectors, today announced their partnership offering clients a holistic solution for hiring, managing, and paying their global workforce.

Lemonway, a French FinTech and key partner for Italian crowdfunding platforms, has been blocked by Banca d’Italia from opening new wallets until further notice. This unexpected restriction affects Lemonway's ability to enter into new agreements for payment services and introduce new products and services in Italy. The regulatory action impacts new customers but does not affect existing accounts or services.

Finatechs launches revolutionary trading platform to empower global traders. The platform enables users to make rapid, data-driven decisions, thriving in the dynamic and fast-paced world of global trading.

London unicorn Thought Machine cuts losses by a quarter as IPO remains long-term goal. Thought Machine has cut its annual losses by a quarter to £63m in 2023 while new deals boosted revenues to £48m. The London-based FinTech reported that pre-tax losses were reduced from £84m in 2022 to £63m in 2023.

Payhawk expands partnership with Marqeta. The new capability is available across all 32 countries served by Payhawk where it operates its premium Visa debit and credit cards. This marks the next step towards corporate expense management that is safe and convenient in equal measure.

PAYMENTS

Thunes and Alipay+ enhance cross-border payments for Paris merchants. This collaboration leverages the Thunes Global Network, enhancing convenience for Asian tourists in France, as they enjoy a summer of sport and travel.

Vodeno and Aion Bank to offer BLIK-as-a-service to financial institutions across Europe. This cooperation will enable both Vodeno and Aion Bank, which participates in the BLIK system as an issuer, to offer FinTechs, banks and other financial institutions access to BLIK services.

Translink completes rollout of contactless payments. The transport provider said that passengers could now use contactless on all bus and train journeys. Some Ulsterbus and Goldliner services were the last to receive the update, which was first introduced to some Translink services in March 2022.

Mondu BV secures an EMI License from De Nederlandsche Bank (DNB) in the Netherlands. The license will accelerate Mondu’s expansion across Europe while enabling the company to evolve even faster, support more customers, and launch complementary payment services like eWallets and Credit Cards.

Bamboo Payments, a global payment solutions, announced its recent acquisition of a Financial Institution Licence issued by the Malta Financial Services Authority (MFSA). This pivotal licence marks Bamboo's official entry into the EU, setting the stage for an expansive service rollout across the EU/EEA regions.

OPEN BANKING

Flexys partners with Moneyhub. By partnering with Moneyhub, Flexys will enhance its offering with cutting-edge Open Banking technology, providing unprecedented insights and streamlined processes for both collections professionals and their customers.

CRYPTO

Bitstamp announces a partnership with Stripe to support Stripe's fiat-to-crypto onramp in EU. Through this partnership, Bitstamp will manage fiat-to-cryptocurrency conversions and transfers to consumers, expanding Bitstamp-as-a-service and solidifying cryptocurrency's role in digital payments.

Crypto exchange activity hits $845 billion in July, up 105% from 2023. The total volume of the largest centralized platforms has maintained multi-month highs, growing by over 100% compared to last year. However, it's impossible to ignore the 60% decrease compared to the record-breaking March.

France starts issuing crypto service provider licenses. France is the first major European Union economy to implement this step as the bloc's Markets in Crypto Assets (MiCA) regulations are set to become more comprehensive by the end of the year.

DONEDEAL

New figures, published by KPMG, show that the UK had a near tripling of FinTech investment to $7.3bn in the first half of 2024 but global FinTech investment fell by 17 per cent period-on-period. The figures show the UK FinTech sector seeing signs of recovery, compared to the giddy heights of 2021.

Standard Chartered invests in United FinTech to bolster its digital transformation agenda. The investment supports Standard Chartered's ambitions to contribute to the advancement of digital transformation solutions across capital markets, wholesale banking and wealth management, and the broader financial services arena.

UK’s CloudPay raises $120m in latest funding round. The funding will enable CloudPay to enhance its product and technology offerings, including AI-driven data management, process automation, and improved connectivity through API solutions within its global payroll, payment, and HCM ecosystem.

Revolut backer Balderton Capital has raised $1.3bn in Europe’s largest venture funding focused on start-ups in the region, as capital returns to private technology companies. The fundraise follows new capital for several of the region’s top VC firms this year.