👀 NEWS HIGHLIGHT

For many businesses, PayPal is more than just a payment method—it’s a key revenue stream with unmatched global reach. Yet, as merchants scale, they face increasing challenges with PayPal’s risk management system. Higher transaction volumes often bring a surge in chargeback requests, and navigating PayPal’s intricate risk controls becomes progressively harder.

Designed to prevent fraud and protect both parties, these risk metrics can lead to unexpected issues like sudden account limitations, higher dispute fees (High Volume Dispute Fee), and frozen funds outcomes that can disrupt growth and add complexity to managing chargebacks.

📊 INFOGRAPHIC

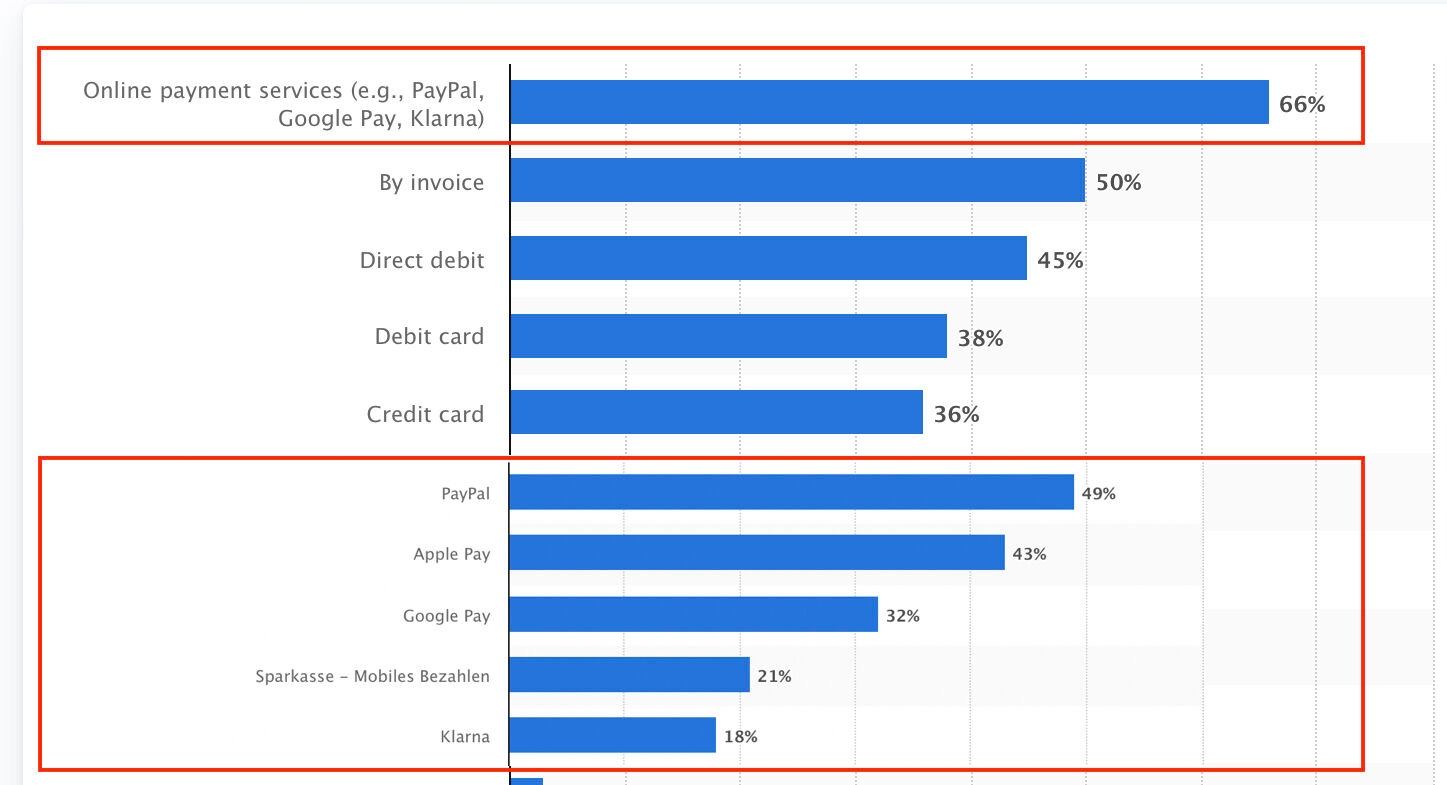

In 2024, the online payment services (e.g., PayPal, Google Pay, Klarna), the "By invoice" and "Direct debit" payments are the top answers among German 🇩🇪consumers in a mobile payments survey from Statista.

📰 ARTICLE OF THE WEEK

With Black Friday around the corner, balancing cash flow amid extra expenses is challenging. In the past, companies seeking funds faced long waits and heavy paperwork for uncertain bank decisions.

NOW, ON TO THE SUMMARY OF LAST WEEK'S NEWS

🌎 FINTECH HIGHLIGHTS

⭐️ In House Payment Gateway VS White Label SAAS.

⭐️ Amsterdam-based Payaut acquired by Ryan Reynolds-backed FinTech company Nuvei.

⭐️ Klarna’s Seb Siemiatkowski from burger flipping to billionaire club.

⭐️ Ant Group's quarterly profit nearly triples.

Stay Updated on the Go. Join my new Telegram channel for daily updates and real-time breaking news. Stay informed and connect with industry enthusiasts —subscribe now!

FINTECH

Mirakl and Mangopay announce strategic partnership to accelerate growth of European marketplaces with Mirakl Payout. Through this partnership, Mirakl Payout integrates Mangopay’s e-wallet technology and know-your-business (KYB) capabilities, enhancing marketplace payouts.

UK financial watchdogs set out new rules for overseeing critical third party tech providers. UK financial regulators have announced new rules to strengthen the resilience of technology and other third parties that provide essential services to financial firms.

Which FinTechs are winning the battle for Gen Z? FinTechs are facing challenges capturing the Gen Z market despite the potential of this growing demographic. Dive into the full article to see who's winning the race.

Western Union launches Media Network Business supported by user data. This allows companies to advertise to its customers through company-owned channels, including its website, mobile app, digital-out-of-home (DOOH) screen network, and audience extension.

Visa recognizes creators as small businesses. At Web Summit in Lisbon, Visa announced new commitments to digital creators, officially recognizing them as small businesses. Now, creators can securely manage payments using Visa’s financial tools, resources, and products for small businesses worldwide.

Temenos shares jump as investors greet ‘More Realistic’ targets. Temenos shares jumped after the Swiss banking software company pushed back its mid-term targets by one year to 2028, a move that was welcomed by investors as more realistic.

Cinkciarz.pl (Conotoxia) transforms into a joint stock company and prepares an application for a banking licence. The company states that once the banking license is acquired, customers' funds will be protected by the Bank Guarantee Fund, ensuring a high level of security.

FinTech Payhawk reports 114% YoY revenue increase. In addition to revenue growth Payhawk reported an increase in group gross profits from “71% to 77%, driven by key strategic moves that strengthened its financial infrastructure and expanded its customer offerings.

BBVA readies remedies to secure Sabadell deal despite competition setback. The Spanish bank is working on concessions aimed at securing regulatory approval for a takeover of rival Sabadell "in a few months", CEO Onur Genc said.

SaveLend Group has entered into a non-binding letter of intent regarding the sale of all shares in the wholly-owned subsidiary Billecta. As part of the deal with the potential buyer, Billecta’s management, board, and staff will have the opportunity to invest in a minority stake in the company acquiring all shares of Billecta.

Sales tax automation startup Kintsugi doubled its valuation this year. Kintsugi raised a $6M Series A round earlier this year that valued it at a $40M post valuation in April. The company has since reopened its Series A round, taken on additional $4M in capital, and doubled its valuation to $80M.

The 11 Klarna alumni who’ve become entrepreneurs since last year. According to Accel and Dealroom’s reports released the past month, Klarna alumni have now launched a total of 62 startups, pipping last year’s top dog Revolut to second place with 49. Discover eight businesses launched by ex-Klarna employees in 2023 and 2024.

PAYMENTS

Getting a payment strategy ready for the festive rush. Amid fierce Black Friday and holiday competition, Ecommpay helps merchants optimize checkouts, reduce drop-offs, and tackle failed payments. Chief Revenue Officer Moshe Winegarten highlights how even small checkout delays can cost sales. Ecommpay's new free e-book offers practical tips, including using alternative payment methods, open banking, and tokenization to increase conversions and minimize chargebacks.

Mollie enables Tap to Pay on iPhone in The Netherlands, France and Germany. This exciting development empowers Mollie’s customers with a fast, convenient, and secure way to accept payments in the palm of their hand, adding new benefits for businesses that use the app daily to track payments, access funding, and manage accounting.

Settlements and Settlement Reconciliation with Solidgate. The company announced a new feature in its payment orchestration platform: Integrated settlements and settlement reports from multiple PSPs, acquirers, processors, and APMs — now accessible in its admin panel and API.

Mastercard debuts platform to help small businesses consolidate digital tools. The Mastercard Biz360 platform provides a “one-stop shop” that allows business owners to access new features while also integrating their existing digital tools, the company said in a press release.

BANCOMAT, Bizum, and SIBS MB launch EuroPA. The companies have enabled interoperability between their services and completed the first instant payment transaction, improving how customers make instant mobile payments using their preferred solution and a European infrastructure.

Adyen and Zalando strengthen partnership to enhance seamless payments for millions of European shoppers. This collaboration strengthens Adyen's role as one of Zalando's payment partners across 15 European markets and makes it the exclusive partner for local payment methods like Cartes Bancaires in France and Bancontact in Belgium.

Digital Wallet and eCommerce growth drive Paysafe Merchant Solution sales. Shares of Paysafe slumped 25% Nov. 13 in the wake of earnings that missed Wall Street forecasts. But the company’s materials and management commentary revealed growth in core segments, gains in average transactions per active users of digital wallets and expanding reach in Europe

DIGITAL BANKING

PayPal unveils innovative Money Pooling feature, simplifying group expenses between family and friends. Launching across the US, Germany, Italy, and Spain, the new feature lets customers create a pool in the PayPal app or online, invite contributions from friends and family, track totals, and transfer funds to their PayPal balance.

CRYPTO

FinPlanet and NOUMENA DIGITAL form strategic partnership with AllUnity. The collaboration focuses on supporting product development, operational setup, service provider management, and preparing for AllUnity's e-money license application.

Bitget relaunches UK platform after compliance update with FCA rules. On Nov. 12, Bitget confirmed it had reactivated its UK website, now fully compliant with the financial promotions regime. This follows the temporary restriction of the site in May to align with the regulations.

MoonPay turns non-custodial crypto wallets into primary bank accounts. The company has launched MoonPay Balance, a payment solution that enables users to hold and spend fiat balances within the decentralized crypto ecosystem through direct integration with non-custodial wallets and exchanges.

PARTNERSHIPS

Paymentology announces strategic partnership with Zand Bank to accelerate FinTech growth in the UAE. Through this partnership, both firms will enable FinTechs to thrive by offering a range of specialised services, including BIN-sponsorship, virtual IBANs, and Client Money Accounts.

DONEDEAL

SeQura sets new record of €410 Million in funding. This milestone highlights the confidence of some of Europe’s top investors in seQura’s business model and vision. With the new funds, seQura is set to enter four new international markets, including the US, UK, and Germany, aiming to triple its business volume by 2027.

Revolut facing potential legal action in battle with Crowdfunding platform after a years-long battle over the sale of its shares by early investors. The row is currently at a flashpoint as the British banking company resists a US private equity investor’s efforts to snap up shares at a heavy discount through start-up investment platform Republic Europe.

MOVERS & SHAKERS

PayQuicker announces Kevin Zeman’s promotion to Vice President of Banking Operations. Since joining in 2016, Kevin has contributed to the company's global growth, overseeing multiple departments and strengthening banking partnerships. His leadership will continue to support PayQuicker's expanding network.

Sibstar appoints GoHenry co-founder and CEO Louise Hill as on-Executive Director. Louise will offer independent advice and provide oversight to Sibstar’s executive directors, ensuring optimal performance while providing strategic guidance and support to the executive team as needed.

Jeremy Nicholds steps down as CEO of UK paytech Judopay. In a statement posted to LinkedIn, Nicholds says, 'It’s time for me to turn the page and start a new chapter.' He also stated that, while he is eager for future opportunities, he will always value the lessons and experiences gained at Judopay.

EML Payments focusses on growth with the appointment of three global Executives. Bryan Lewis has been appointed as Global Chief Operating Officer, Shabab Muhaddes as Chief Revenue Officer, and Tom Cronin as Chief Product Officer. These strategic appointments are part of the company’s ongoing transformation.