😎 SPONSORED CONTENT

We make it easy for businesses to integrate crypto payments, implementing the platform for unique client needs and opening up new customer bases and revenue streams.

👀 NEWS HIGHLIGHT

Kuady announces the opening of a new office in Sofia, Bulgaria for 100+ employees.

The new office marks a significant milestone in Kuady’s ambitious growth plans, having recently launched its digital wallet in Peru and Chile, with further expansion in Latin America, Europe and Africa planned.

📰 ARTICLE OF THE WEEK

NOW, ON TO THE SUMMARY OF LAST WEEK'S NEWS

🌎 FINTECH HIGHLIGHTS

⭐️ Yuno rides Latin America's FinTech wave to global expansion.

⭐️ British regulators to examine Big Tech's digital wallets.

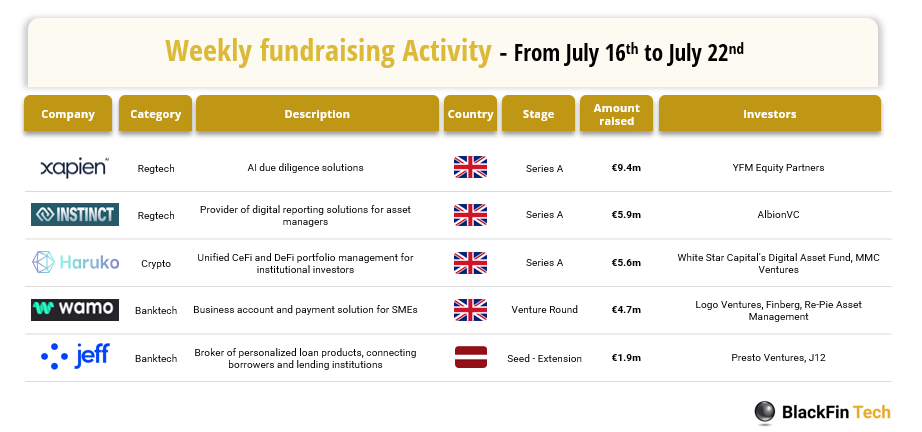

⭐️ Latvian startup Jeff App reaches profitability and raises $2M.

⭐️ Inside FinTech Founders, the exclusive network of FinTech execs with a line to the UK government.

FINTECH

Webull UK, a digital investment platform, announced the launch of Webull Savings, an offering that provides users with access to a marketplace of savings accounts and the ability to move funds quickly between trading accounts and banks.

Swiss FinTech Klarpay Shares H1 2024 Updates, Achieving Key Milestones. Klarpay has been active on the global stage, “participating in many renowned events to strengthen our international relationships and explore new opportunities.”

American FinTech Council (AFC) Responds to Consumer Financial Protection Bureau (CFPB) Interpretive Rule on Buy Now Pay Later.

eToro Ventures into Italian FinTech through Collaboration with SDA Bocconi. This project is promoted by I.C.E. SDA Bocconi and involves various partners from the financial services sector, including industry associations.

Kraken signs sponsorship deal with Tottenham Hotspur. Kraken has also become one of the largest UK-registered crypto platforms, and has over 13 million clients globally accessing the crypto markets through its consumer and pro mobile apps, and a state-of-the-art trading platform.

Cash App Pay Integrates with Google Play, Giving Next Gen Consumers More Choice at Checkout. This partnership represents an opportunity to engage with a broad range of consumers, particularly in the gaming space.

Toyota Financial Services Italy and Fabrick collaborate to advance embedded finance. The collaboration, which aims to explore new growth and investment opportunities with FinTech entities, includes working with Fabrick to integrate embedded finance services into vehicles.

FinTech Mintos Targets Cautious Czech Investors in Latest European Push. The move comes as the company seeks to capitalize on growing investment interest in the Czech market, while addressing the cautious approach of local investors.

PAYMENTS

End-to-end payments platform, Ecommpay, has fully integrated the Mastercard Click to Pay flow within its online payment interface for merchants across the UK and Europe.

J D Wetherspoon, the leading pub operator in the UK, and the UK’s most visited licensed brand, has partnered with Payit by NatWest to provide customers with a new way to pay for food and drinks via the Wetherspoon app, which will be available as of today.

SWiM PAY, a digital payment platform, announced the launch of instant payments, providing a solution for buyers and sellers. With this new feature, transactions between buyers and sellers can now be completed instantly, eliminating the need for lengthy waiting periods and traditional payment methods.

JTL-Software GmbH (JTL), a leading German e-commerce solution provider, and the Dutch financial services provider Mollie are entering into a strategic partnership. As partners of local SMEs, JTL and Mollie are now pooling their expertise to offer customised and intuitive tools and solutions - particularly with regard to omnichannel activities.

Klarna combines Sofortüberweisung with Klarna Payments to bring customers and merchants the best of both worlds. The aim is to increase the security of the checkout process for both consumers and merchants and to optimize user-friendliness.

OPEN BANKING

QR code payments FinTech Keepz is the first company to obtain an open banking license from the National Bank in Georgia. With this license, the company is permitted to act as both an account information service provider and a payment initiation service provider.

UK-based D•One has announced that NewDay, an unsecured consumer credit provider, went live with its Open Banking connectivity and transaction categorisation solutions.

After receiving the Account Information Service (AIS) Provider license, the financial data intelligence platform Bud Financial (Bud) is expanding its team in Lithuania.

Online accounting FinTech Keez is now connected to all banks in Romania through the new "Online Statements" service. The new "Online Statements" service launched by Keez is carried out under the PSD2 (Payment Service Directive 2), the European directive for electronic payment services aimed at stimulating innovation and helping banking services adapt to new market technologies.

DIGITAL BANKING

FCA to lift customer onboarding restrictions for Modulr. The company agreed to temporarily pause onboarding certain new customer segments in the UK, due to the many new and revised UK regulations coming into force in 2023 and 2024.

CRYPTO

Australian stablecoin payments startup Stables has announced its expansion to Europe in partnership with Mastercard, which co-founder Bernado Billota says indicates a wider trend of the dollar-pegged assets breaking into the mainstream.

DONEDEAL

Trustap, a payment gateway for marketplace transactions, has successfully secured $5.5 million in Series A funding, bringing its total capital raised to over $9 million.

Tiger Global in talks to lead $500m Revolut share deal at a valuation of at least $40bn and ultimately be as high as $45bn. Tiger Global, which is a shareholder in Facebook-owner Meta, Microsoft and the semiconductor behemoth Nvidia, jointly led Revolut's $800m primary funding round in 2021.

Wamo, a digital business account provider for SMEs, announced that it has secured a bridge to Series A round of $5 million USD in growth funding, as well as an EU Electronic Money Institution (EMI) license from FIN-FSA (Finland’s Financial Supervisory Authority), positioning the company for accelerated growth across Europe.

Estonian FinTech Mifundo gets a €2,5M boost from European Innovation Council. Known for its FinTech successes, such as unicorn startup Wise, it continues to bring novelties in this space.

Ebury has appointed investment bankers at Goldman Sachs to lead work on its planned £𝟮𝗯𝗻 initial public offering (IPO) in London, as the FinTech presses ahead with one of the rare listings set for the UK.

Alternative lender Finbee Verslui raises €35 million investment. This investment will enable more than 1,500 businesses to be financed faster and on more favorable terms than before.

M&As

BUX offloads UK subsidiary to APM Capital. BUX Holding has sold its UK business BUX Financial Services Limited (BFS) to Asseta Holding, the parent company of UAE-based investment firm APM Capital.

Meridien Holdings acquires 27% stake in London FinTech DKK Partners. The funding will allow DKK to continue the firm’s global expansion. It was founded in 2020 by banking industry veterans Dominic Duru, previously of RBS and Citi, and Khalid Talukder, previously of UBS, Citi & Deutsche Bank.

MOVERS & SHAKERS

SMEB, a financial services and payments company dedicated to supporting small business, announces it has appointed Dickson Chu as Head of Payments. SMEB is a principal member of Visa and Mastercard and Dickson will be working closely with the schemes to develop SMEB’s portfolio of services.