Kenya Fines Baltic FinTech Eleving’s Local Arm for Misleading Customers

Weekly news up to Tuesday, 8th of October 2024

REPORT

👀 NEWS HIGHLIGHT

Kenya’s competition authority has fined Baltic lender Eleving‘s Kenyan subsidiary for misleading its customers, casting a spotlight on the continuing unethical operations of a section of digital lenders in the country despite a new law.

The Competition Authority of Kenya (CAK) imposed a fine of $84,120 on Eleving subsidiary Mogo Kenya for violating competition law by misleading customers and secretly altering loan terms so it could force clients to pay extra interest.

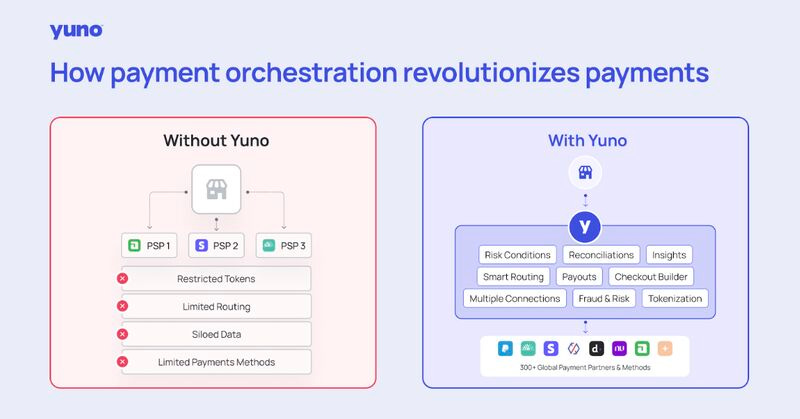

📊 INFOGRAPHIC

📰 ARTICLE OF THE WEEK

💡INSIGHTS

Klarna CEO says a European tech brain drain is ‘number one risk’ for company ahead of IPO. “When we looked at the risks of the IPO, which is a number one risk in my opinion? Our compensation,” said Sebastian Siemiatkowski. He was referring to company risk factors, which are a common element of IPO prospectus filings. Click here to learn more

NOW, ON TO THE SUMMARY OF LAST WEEK'S NEWS

🌎 FINTECH HIGHLIGHTS

⭐️ eToro UK's 2023 Net Income Drops 15% as Trading Commissions Decline.

⭐️ Wealthkernel Expands Into Europe With A Spanish Licence.

⭐️ Interactive Brokers Expands Research Offerings with Acuity Trading Partnership.

⭐️ Visa launches new commercial payment platform.

FINTECH

UK-Wide Innovation Challenge launches, transforming customer outcomes and driving innovation. FinTech Scotland, SuperTech (West Midlands), and eight industry collaborators are launching a new innovation challenge to enhance consumer outcomes through technology and data. FinTech firms worldwide are invited to apply by October 25, 2024.

Klarna has unveiled “𝗔𝗽𝗽𝗹𝗲 𝗳𝗿𝗼𝗺 𝗞𝗹𝗮𝗿𝗻𝗮”, a storefront in the Klarna app and Klarna website where customers can purchase Apple products using its flexible payment options. Now an official Apple reseller, Klarna also launches a brand new, bespoke payment option for Apple products: Upgrade Financing.

PAYMENTS

Ecommpay extends partnership with Token.io to optimize real-time open banking payments in more markets. Ecommpay has added Token.io’s virtual accounts in the Netherlands, Spain, France, and Ireland to its Open Banking Advanced, enhancing cash flow and customer experience for e-commerce businesses.

Italy's Banco BPM has finalized a partnership with Gruppo BCC Iccrea and FSI to create Numia, the country’s second-largest e-payments provider, with a domestic market share exceeding 10%. Banco BPM and Iccrea will each hold a 28.6% stake in Numia, while FSI will own approximately 43%.

Mastercard agrees to buy subscription management startup Minna. The payments giant has struck a deal to acquire Swedish subscription management specialist Minna Technologies. Financial terms were not disclosed. The deal is subject to regulatory approval.

Bank of America introduces Virtual Payables Direct in the EMEA region. This business-to-business (B2B) payment solution provides buyers with the typical advantages of card transactions, such as extended payment terms, while now offering the option to pay suppliers via direct bank transfer.

UK-based SumUP could reach near $9 bln valuation in new share sale, sources say. It would be the latest European FinTech to pursue a share sale, after UK FinTech Revolut secured a $45 billion valuation in August in a share sale by employees to investors including Coatue, D1 Capital Partners and Tiger Global.

Klarna Checkout is now officially Kustom, an independent company by offering a customizable, powerful checkout solution. No immediate action is required, as new features are being rolled out to enhance payment options, customization capabilities, and support services.

UniPAY partners with TransferGo. This collaboration will introduce IBAN payout services from the UK and EU to Georgia, facilitating efficient international transfers directly to bank accounts, especially benefiting the Georgian diaspora in sending money back home.

DIGITAL BANKING

Sonali Bangladesh UK (SBUK) Limited selects Finastra to provide digital banking, including enhanced Shariah-compliant services. By implementing Finastra Essence, SBUK aims to offer its corporate and banking clients a wide range of digital products and services.

Tink launches Merchant Information to give consumers full transaction visibility. The solution within Tink’s Consumer Engagement offering, displays banking app transactions with clear brand names, logos, locations, and details, reducing the need for consumers to contact their bank about unrecognized transactions.

CRYPTO

Crypto "not a focus" for Checkout.com, as it concentrates on e-commerce and FinTech partners. The firm recently launched new products and reported 40% year-on-year revenue growth. As a full-stack payment processor and acquirer, the company reported that crypto represented less than 4% of its payment volume.

Robinhood beefs up EU crypto offering with crypto transfers. The company is looking to ramp up its crypto offering across the EU by offering customers the opportunity to deposit and withdraw more than 20 cryptocurrencies, including Bitcoin.

Mesh collaborates with Paribu in Turkey expansion. The partnership designates Paribu as Mesh’s sole official exchange partner in the region, allowing its users to access Mesh’s connectivity layer with hundreds of platforms, including self-custodial wallets like MetaMask.

SWIFT to conduct live digital asset trials: Way for blockchain integration in banking. SWIFT is set to begin live digital asset transaction trials with banks next year, aiming to enhance platform interoperability and prevent fragmented “digital islands” in the blockchain space.

PARTNERSHIPS

Cardlay announces collaboration with Visa to help revolutionise spend management solutions. Cardlay’s platform will enable Visa’s clients, particularly issuers across multiple segments, to leverage their BINs’ structure with Cardlay’s white label solutions to improve customers’ experience.

M&As

London-based Robinhood rival Freetrade buys UK arm of Australian investing platform Stake. This move is expected to bolster Freetrade’s domestic operations, and comes as British retail investment platforms as a whole are facing heated competition from Robinhood.

Woolsocks AG has acquired loyalty app OK, expanding its financial ecosystem across Europe. This move enhances Woolsocks' financial super-app by integrating OK’s features, benefiting over 5 million users with improved savings tools and brand engagement, while providing retailers with advanced data insights for targeted marketing.

Euronext Securities expands services with acquisition of Acupay. The acquisition of Acupay further expands Euronext Securities’ services offering to investors and issuers, the firm says, leveraging Acupay’s presence in Italy and opportunities to scale services through Euronext Securities’ network across Europe.