REPORT

Check out Briter Bridges’ latest report on Africa’s payments landscape. The report focuses on growth factors and untapped opportunities in the region. Written by Tom Collins this report provides valuable insights on the sector as it matures. More companies are building out are growth models while doubling down on current strategies.

The question’s whether payments companies can sustain the incredible growth rates that they have engineered and experienced over the past few years.

👉🏻 Read the full report here.

👀 NEWS HIGHLIGHT

E-money institution FROST has become a principal member of Visa, a world leader in digital payments, to further its mission of helping working professionals conquer their finances.

The company is now ready to issue Visa debit cards and launch its app, bringing a multitude of different financial services together in one digital space.

👉 Read the full article here.

😎 SPONSORED CONTENT

In the final months of 2021, ComplyAdvantage surveyed over 800 C-suite and senior compliance decision-makers across North America, Europe, and Asia Pacific to see how they are navigating anti-financial crime compliance. Download the report today.

📊 INFOGRAPHIC

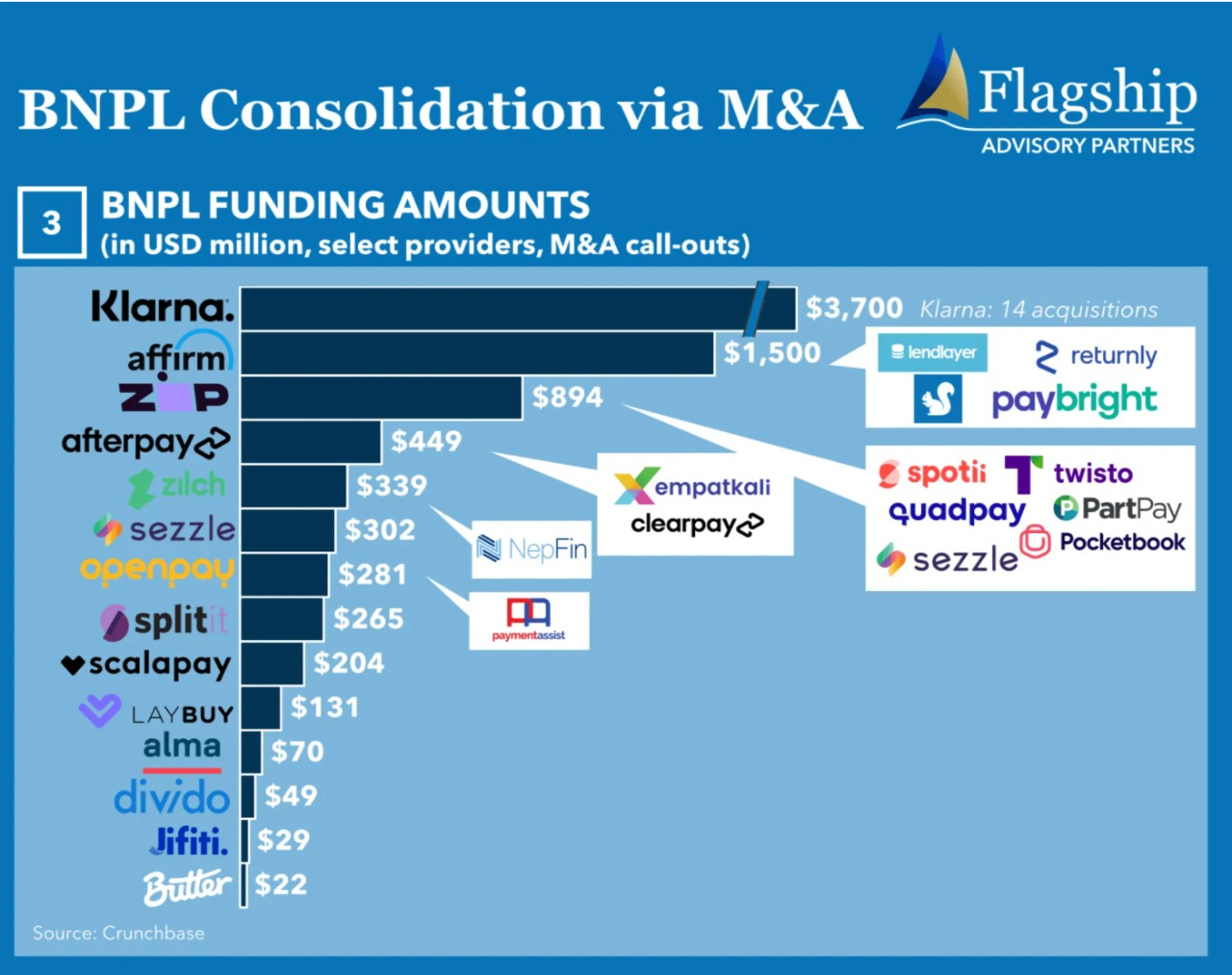

👉🏻Check out Flagship Advisory Partners' BNPL consolidation via M&A infographic here.

📰 ARTICLE

FT Partners’ report discusses the history of the Supper App, the various Super App models that have emerged globally, and examines the global landscape and the players that are leading the way as well as new potential entrants across all key geographies.

👉 Read the full report here.

🎤 PODCAST

👀 Looking for funding news? We've moved them to their own special weekly newsletter here.

👉 Read all about M&As, VCs, Down Rounds, IPOs, Funding Rounds, etc.

Subscribe to our #DoneDeal Newsletter and never miss an important update again.

NOW, ON TO THE SUMMARY OF LAST WEEK'S NEWS

🌎 FINTECH HIGHLIGHTS

⭐️ Sokin, the next-generation payments provider, has partnered with Visa as the London-based fintech prepares to roll out its inclusive Global Currency Account and debit cards across Asia Pacific. Link here.

⭐️ British FinTech Railsbank is eyeing up ‘unicorn’ status as it looks to raise $100m funding that would value the firm at over $1bn, according to news reports. Link here

⭐️ Discussing Q4 earnings with analysts, PayPal CFO John Rainey disclosed that 4.5 million accounts had been shut down after “bad actors” took advantage of incentives and rewards programmes, resulting in shares falling by 25%, according to Bloomberg LP. Link here

⭐️ The Bengaluru-based Jar said on Thursday it has raised $32 million in its Series A financing round, just months after securing its seed funding. Link here

⭐️ MEDICI Global identified that PayPal, Square, Razorpay, Adyen, and Stripe are the largest payment gateways based on their Total Payment Volume (TPV). Link here.

⭐️ In 2021, Swiss fintech funding activity regained some of its strength after underperforming for three years in a row. Link here

PAYMENTS

Venture capital firm Founders Fund has led a new investment in Ramp, a corporate credit card and spending management software startup that is less than three years old, at an $8 billion valuation, including the investment, said two people familiar with the matter. Link here

One new startup, Pluto, is hoping to gain traction in the Middle East. Pluto is still in the pre-launch phase, but in just the few months since its inception, the startup already has 35 customers in its pipeline with zero marketing efforts. It is gearing up to formally launch in the UAE and Saudi Arabia in the coming weeks. Link here

Paysend, the card-to-card pioneer and international payments platform, announces the company is expanding its peer-to-peer money transfer services globally. Link here

Africa-focused payments startup PalmPay raised a $100 million Series A round last year. TechCrunch spotted this news in Partech Africa’s latest end-of-year report on venture capital investments in Africa. Link here

The Central Bank of The UAE has selected a consortium formed of Accenture, SIA, Nexi Group and G42 to steer the development of a new instant payments platform. Link here

noon e-commerce launched ‘Noon Payments’, an integrated online payment gateway, with the aim of helping small and medium businesses in Egypt grow by providing world-class payment solutions. Link here

South Africa-based Revio helps SaaS and subscription businesses across Africa better manage recurring payments and collections. Stitch and Revio have partnered to offer Revio customers a simple and secure way to enable payments via bank transfer, and improve their user experience. Link here

Swedish fintech Northmill Bank has acquired native payments firm Moreflo, as it makes a play in the B2B retail sphere. Link here

Simpler wants to bring "one-click checkout" payments to Europe, hoping to beat giant overseas rivals like Fast and Bolt to the mark. Link here

Instant, a startup founded by two teenagers based in Brisbane, has just taken claim to Australia’s largest ever pre-seed funding round, with a score of $2.2 million. Link here

Indian payment gateway provider Razorpay announced its first international expansion into Southeast Asia with the acquisition of a majority stake in Curlec, a Malaysian payments firm. Link here.

DNA Payments, a leading independent vertically integrated payments provider, and Verifone, a global FinTech leader and payment solution provider to the world’s best-known retail brands, are proud to announce an essential partnership championing innovation and reliability within the payments sector. Link here.

In a move that will see enhanced financial services for people in Egypt, Mastercard and Egyptian fintech Kashat have signed a five-year agreement that will digitize the onboarding, disbursement, and collection processes for MENA’s first nano financial service provider. Link here.

LuLu International Exchange – one of the leading payment service providers in the UAE, has entered a strategic collaboration with Network International – the leading enabler of digital commerce across the Middle East and Africa (MEA), and global payments technology leader, Visa, to enable users to remit digitally on the LuLu Money payments app using Visa debit cards. Link here.

BNPL

Consumers will now be able to easily find sustainable options to shop in the Klarna app — answering growing consumer demand for apparel brands that are more social and environmentally friendly. Link here

Kueski, one of the largest buy now, pay later (BNPL) and online consumer lenders in Latin America, announced the appointment of Krishna Venkatraman as the company's chief data officer. Link here

Biller, an AI-driven Buy Now Pay Later (BNPL) company focused on business invoices, is set to join the Banking Circle ecosystem of financial services and applications. Biller will operate as an independent sister company in the Banking Circle ecosystem. Link here

OPEN BANKING

Doconomy, a Swedish world-leading impact tech provider for banks, SMEs, and corporates, joined forces with Salt Edge, a leader in offering open banking solutions, to use data aggregation and transaction categorization services to speed up the introduction of climate functionality to the European market. Link here.

CRYPTO

DriveWealth, the SoftBank-backed start-up that helps fintech firms including Revolut offer stocks, is getting into cryptocurrency trading. Link here.

Mode Global Holdings PLC, the LSE-listed Fintech Group, announces it has entered into a partnership with technology-driven e-commerce platform Heroes, which will enable employees of the firm to take some of their monthly salary in Bitcoin. Link here

Seeking to dramatically reduce the time and cost of processing fiat to crypto platforms, London’s Fiat Republic is building a compliance-first, crypto-regulated banking and payments API, and has secured $3.5 million in a seed funding round. Link here

Leading payments platform Modulr, announced a partnership with Ripple, the leader in enterprise blockchain and crypto solutions, to enable seamless payments into the UK and Europe. Link here

Chip is now expanding its offer of crypto exposure to its customers. It comes in the form of a Crypto Companies fund, managed by Invesco, which has been added to Chip’s platform today and is available for ChipX customers who pay £3/month. Link here.

BLOCKCHAIN / DEFI

Sequoia Capital India led a $450 million investment in Polygon, a blockchain network that serves as a support layer to Ethereum. Polygon eventually wants to become a decentralized version of Amazon Web Services. It's part of a movement in crypto known as "Web3." Link here.

INVESTMENT

New York-based Capchase, a fintech company that provides financial solutions to startups by allowing access to funds as they grow, announced on Tuesday that it has expanded its services to the Netherlands and Belgium. Link here

Wealth-tech startup Ndovu has officially been launched at a media event in Nairobi, Kenya by its co-founders Radhika Bhachu, Ro N., and Gianpaolo De Biase. Link here

MOVERS & SHAKERS

Ryan Breslow, a founder of Bolt, said he’s stepping down as chief executive officer, two weeks after securing an $11 billion valuation for the business. Breslow, 27, will become executive chairman. Maju Kuruvilla⚡️, a 44-year-old Bolt executive and a former vice president at Amazon.com Inc., will be promoted to CEO. Link here

BlueVine, the leading provider of innovative financial services for small businesses, today announced the appointment of Yael Malek as its new Chief People Officer. Link here.

FINTECH MAPS

If you are a fintech startup and have over 100 questions send me an email, maybe I can answer a few.