FinTech deals have officially retreated to pre-2021 levels.

So far this year, Dealroom figures show that European FinTechs have raised $13.2bn — still a solid overall sum, but the lowest six-month total since 2020.

Read the full Sifted article by Amy O'Brien here.

👀 Are you interested in funding news from the FinTech space?

💡 Read all about it in my weekly overview article and get the latest funding news from the global FinTech space in your inbox every week.

😎 SPONSORED CONTENT

The basics won’t do in today’s digital-first financial services world. To really succeed, you need to level up your risk decisioning capabilities wherever you can. And the best way to do that is artificial intelligence. Read Provenir's guide on how to simplify your AI decisioning journey and move beyond the hype in under 60 days.

📊 INFOGRAPHIC

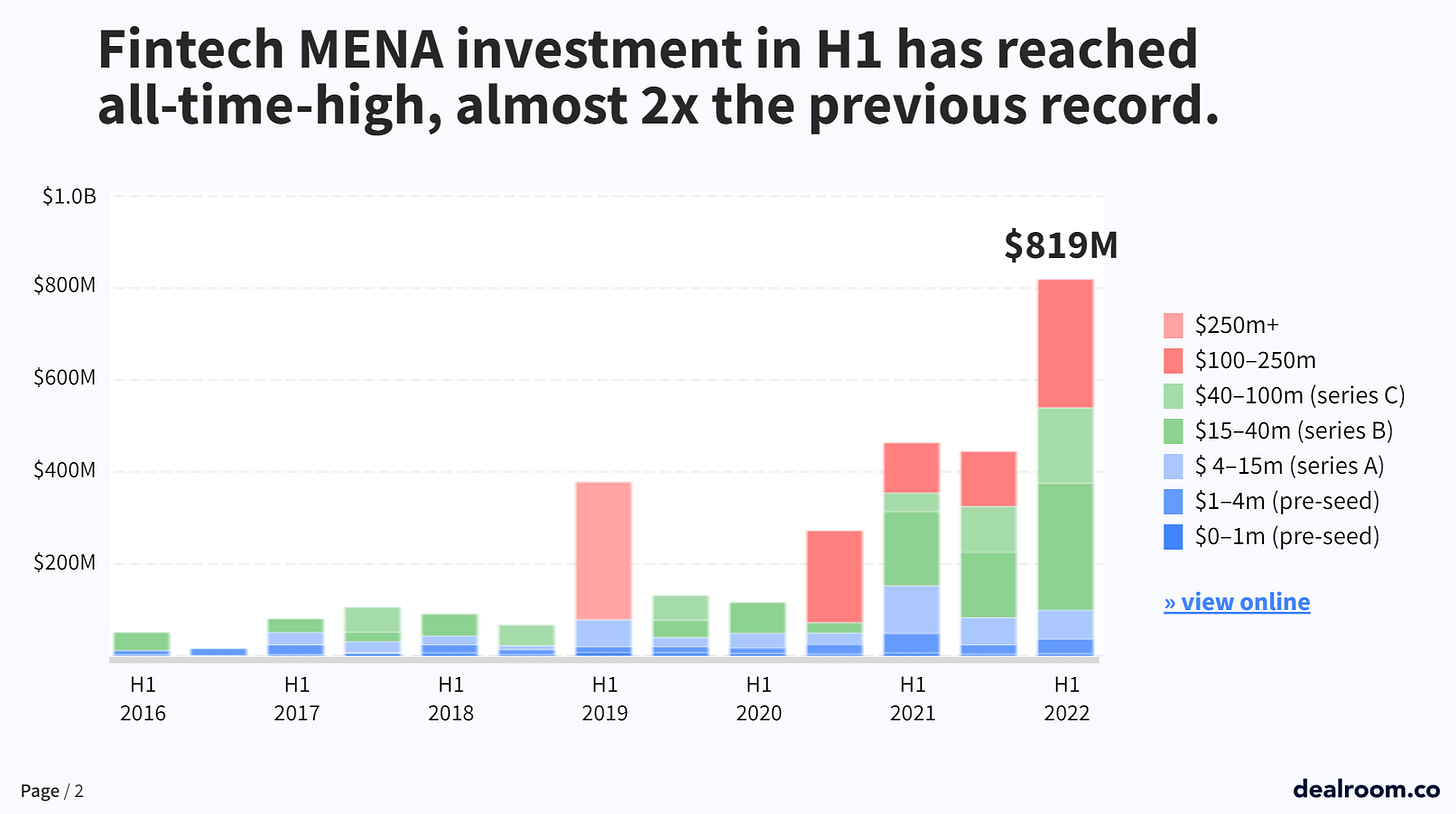

FinTech in the MENA region: a rising star💫

The Middle East and North Africa region opens huge opportunities for FinTechs thanks to the scale of the market and the lack of established financial institutions.

Compared to mature markets, such as the US and Europe, 67% of the adult population are either underbanked or unbanked, 136 million adults.

👉Link to the full Dealroom article, with more stats and figures here.

💡INSIGHTS

Last week, €1,344m was raised across 22 FinTech deals.

BNPL Unicorn Klarna raised a €761m Venture round cutting their valuation to $6.7bn from $45.6bn, followed by wefox which raised a €380m Series D with a combination of debt & equity, and finally congratulations to Smart Pension who raised a €46m Growth round.

👉Read the full BlackFin Tech article by Régis Bouyoux here.

🧐 ANALYSIS

The Covid-19 pandemic has changed the world of work, significantly shifting the expectations and behaviors of the workplace.

This has had a knock-on impact on many supporting industries, not least of all spend management.

👉Read the full FXC intelligence article here.

NOW, ON TO THE SUMMARY OF LAST WEEK'S NEWS

🌎 FINTECH HIGHLIGHTS

⭐️ The milestone earnings of Afterpay co-founders Anthony Eisen and Nick Molnar have crowned them as the top-earning Australian CEOs of the 2021 financial year — no surprise, given the combined $264 million they pocketed. Link here.

⭐️ Lightyear has raised $25 million of funding in an investment round backed by British billionaire Richard Branson. Link here.

⭐️ SendSprint, has launched with a distinctive feature of a $5 flat fee for all transfers. SendSprint has already partnered with Flutterwave to cross-border transfers to 34 of the continent’s 54 international locations. Link here.

PAYMENTS

GHL Systems has launched the “GHL QR Payment”, an all-in-one QR code payment channel in Thailand for merchants to easily receive payment. Link here.

TrueLayer announced that the innovative credit firm Tymit is delivering an enhanced experience through instant bank payments for its Credit and Booster customers. Link here.

Melio said it entered into a strategic partnership to integrate its accounts payable platform with Capital One Business. Link here.

Adyen officially launches Tap to Pay on iPhone, which allows businesses to use iPhones to accept contactless payments without the need to purchase or manage additional hardware. Link here.

NanoPay Mexico chooses BPC Banking Technologies´s SmartVista to prevent fraudulent credit card transactions. Link here.

Qori introduces multi-channel pay by bank, pay by crypto technology. Link here.

SendSprint has launched in the UK, targeting the country’s 1.7 million-strong African diaspora. The firm has launched in partnership with Nigerian paytech Flutterwave. Link here.

BNPL

ShopBack has launched a buy now, pay later offering alongside its global brand refresh efforts. Link here.

OPEN BANKING

Fintech innovator Zimpler enters Norway as part of their ongoing international expansion. Link here.

CRYPTO

Spanish crypto exchange Bitbase expands to Latam. Link here.

Plaid announced that it’s adding support for leading crypto exchanges to its data network. Link here.

INVESTMENT

Quartr has raised a further US$2.6mn for its consumer app, taking the total amount raised as part of its seed round to more than US$7mn. Link here.

BUX Zero clients can now invest fractionally in Europe’s most established companies. In collaboration with ABN AMRO Clearing, BUX released fractional investing in the DAX40 and MDAX. Link here.

FINTECH MAPS

If you are a fintech startup and have over 100 questions send me an email, maybe I can answer a few.