THIS WEEK’S FUNDING NEWS OVERVIEW

👀 NEWS HIGHLIGHT

One in three UK-based small and medium-sized enterprises (SMEs) who sought access to finance were denied in the last year, according to new research from Yolt, Europe’s rapidly accelerating smart payments and data enrichment platform.

This resulted in an estimated £3.7bn lost in potential funding for UK SME’s.

👉Link to the full article here.

📊 INFOGRAPHIC

A survey of more than 13,000 consumers in MENAP conducted by Checkout.com, a payment solution provider supporting businesses, found greater penetration of BNPL arrangements in MENA (24%) than in the UK and Europe (23%) in 2021.

👉Link to the full article here.

📰 ARTICLE

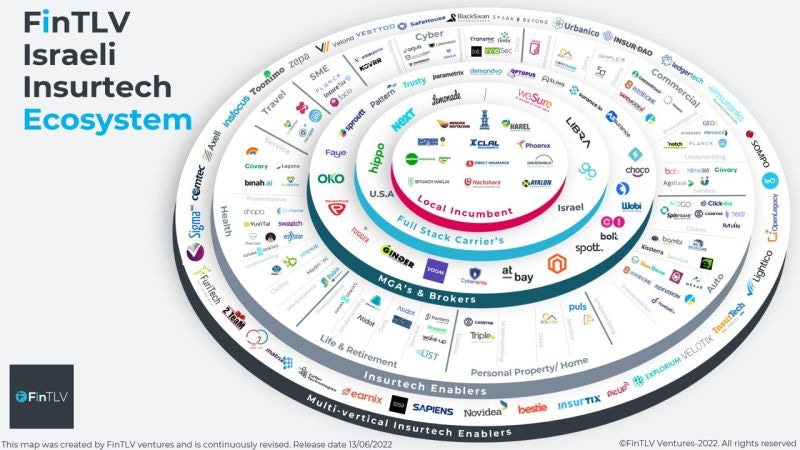

Israel’s insurtech ecosystem continues to grow and develop.

👉Check out FinTLV Ventures map here.

💡INSIGHTS

Today, there are over 150 BNPL providers across the world. Partnering with merchants to offer a variety of BNPL services as a payment option at checkout, these companies represent a significant presence in the payments space, including in some cases for cross-border payments.

👉Download the full FXC Intelligence report by Adeyanju Pinheiro-Aina here.

🎤 PODCAST

Sanjib Kalita host Dawid Rožek, CEO, ZEN.COM in The MoneyPot to speak about going from gamer to creating an online marketplace to creating the payments systems, and what all of it might teach us about the fintech future on Web3.

👉 Listen to the full podcast here

NOW, ON TO THE SUMMARY OF LAST WEEK'S NEWS

🌎 FINTECH HIGHLIGHTS

⭐️ Weavr signals further growth and expansion in Europe with Portugal launch. Link here.

⭐️ Nuula launches in Canada to support small businesses, company founders. Link here.

⭐️ Wayflyer has added a new credit line to its portfolio as part of plans to issue up to $2.5 billion in credit to clients this year. Link here.

⭐️Brex is apparently abandoning the very segment it started out to serve – small and medium-to-sized businesses. Link here.

⭐️Japan’s Financial Services Agency and the Financial Services Authority of Indonesia have exchanged letters on FinTech Cooperation Framework regarding Innovation in the financial sector. Link here.

⭐️Payhawk has launched a new mileage feature that means team members who use their own vehicle for business can be reimbursed quickly and accurately in just a few clicks. Link here.

PAYMENTS

Two years in the fintech industry needs to make sure the correct lessons have been learned from the collapse of Wirecard. Link here.

Mastercard welcomes NymCard as the principal Mastercard issuer to boost UAE fintech landscape. Link here.

APEXX Global partners with RyanAir to ‘transform’ its payments infrastructure. Link here.

Mazepay receives a payment license from the Danish FSA. Link here.

Latitude Group has terminated its deal to acquire Humm’s buy-now-pay-later unit. Link here.

Stripe is making its bank transfer offering available to businesses in the UK, EU and Mexico. Link here.

Qashio, has recently announced the launch of the UAE’s first corporate expense management card and software for business transactions, offering companies new levels of control over spending. Link here.

BNPL

Pngme partners with BNPL fintech Lipa Later. Link here.

Industry urges the UK government to "move quicker" as proposals to tighten buy now, pay later rules outlined. Link here.

OPEN BANKING

Mastercard has launched the Start Path Open Banking global program to engage open banking startups on their path to scale, uncover unique opportunities to co-innovate, and power experiences that enable consumer choice. Link here.

CRYPTO

USDC issuer Circle Internet Financial is set to issue a fully-reserved, euro-pegged stablecoin from the United States called Euro Coin. Link here.

INVESTMENT

A group of local investors joined together to apply for a license from the Financial Regulatory Authority in Egypt to establish the first company to operate in the field of Investment Banking through the use of FinTech, which will be called Exits.me. Link here.

MOVERS & SHAKERS

New fintech Atlantic Money has landed, founded by Robinhood early employees Neeraj Baid and Patrick Kavanagh. Link here.

Atish Shelar has been named chief operating officer of fintech startup IppoPay. Link here.

FINTECH MAPS

If you are a fintech startup and have over 100 questions send me an email, maybe I can answer a few.