Starting this month I’ll be launching a monthly re-cap in collaboration with BlackFin Capital Partners.

In May 2022 there was €1647m raised, over 45 FinTech deals, with an average deal of €37.4m

REPORT

The business-to-business (B2B) market remains one of the last major global opportunities for payment digitization.

Not only is the market still plagued by widespread manual processes and inefficient payment methods, but it is also a massive market estimated at nearly $29 trillion in the U.S. alone.

👉 Download the full (380+ page!) report here.

REPORT

Read Mercuryo's newest report, "Opportunities in a Bear Market: Proof of Viability", delves into the underlying use cases and tech that will contribute to a project's success, when hype and price action no longer can.

👉 Read the full report here.

Mercuryo introduced fiat IBAN accounts for crypto platforms. Issue European banking accounts for your customers and boost your business revenues, while we will take care of compliance, liquidity, and licensing.

👉See IBANs in action here.

👀 NEWS HIGHLIGHT

Mollie partners with open banking specialists Plaid to improve customer experience.

They’re using Plaid’s advanced API to deliver more secure and easier bank verification for Mollie users during onboarding. This will make it easier and faster for them to start receiving payments and launch e-commerce businesses.

👉Read the full article here.

📊 INFOGRAPHIC

The New World Bank report looks at the rise of fintech. These past few years have seen fintech and digital transformation increase in importance, a trend that accelerated with COVID-19.

👉Read the full Fintech News Switzerland article here.

👨💻 BLOG

It can be a tricky balancing act for business leaders who want to offer both spending power to their employees and keep control and visibility of spend to help power growth.

👉 Read more on Payhawk’s blog here.

📰 ARTICLE

2021 was a year of great progress for Open Banking across the EU and UK.

The regions witnessed strong growth both in the volume of API calls and the number of third-party providers (TPPs).

👉Read the full article here.

🎤 PODCAST

💡INSIGHTS

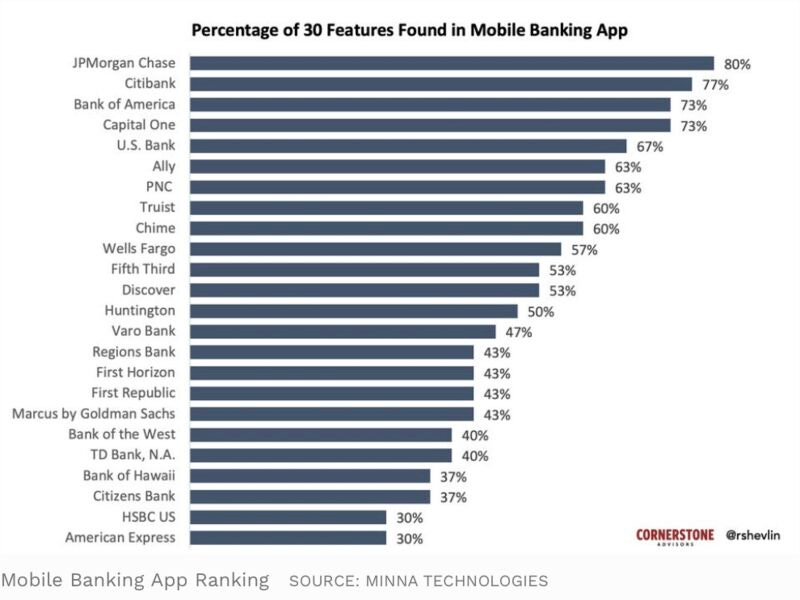

In a recent study of US consumers, Cornerstone Advisors found that Americans now consider the quality of digital banking tools to be a more important factor in their decision of who to bank with than branch locations, the quality of the branch experience, or even what interest rate a bank pays on deposits and savings.

Read the full article by Ron Shevlin here.

NOW, ON TO THE SUMMARY OF LAST WEEK'S NEWS

🌎 FINTECH HIGHLIGHTS

⭐️Revolut, the global neo banking juggernaut and one of Europe’s most valuable fintech companies has long been known for its early bet on crypto. Link here. Also Revolut and Tink partner for European payments. Link here.

⭐️Superapp GoTo Files raised $1.1B in Indonesia IPO. Link here.

⭐️A top fintech body has warned that “significant barriers still exist” to female progression in the sector despite an improvement in gender representation in recent years. Link here.

⭐️Apple has introduced Apple Pay Later, a new feature backed into the company's payment platform that will allow users to split purchases into separate payments. Link here.

PAYMENTS

Finqware received from the National Bank of Romania the payment institution license to act as regulated account information and payment initiation service provider. Link here.

Visa and Kenya’s Safaricom launch virtual card to support global digital payments via M-Pesa. Link here.

Stripe announced that Stripe Terminal is now available in Singapore, making it easy for businesses to build custom checkout experiences for accepting in-person payments. Link here. Stripe launches delegated authentication to improve payment conversion in Europe. Also Wise is the first card issuer to use Stripe’s delegated authentication. Link here.

Curve has made 60-70 people redundant, amid mounting fears of a recession. Link here.

OpenPayd and Yapily unite to meet the demand for simplified payments. Link here.

BNPL

BNPL growth dwarfs all other consumer credit products. Consumer price inflation has correlated with an increase in net credit card borrowing of 11.6 percent in the 12 months to April 2022, according to Bank of England data. Link here.

OPEN BANKING

TrueLayer and Thunes announced their partnership to streamline and improve the payment experience of consumers in the UK and Europe. Link here.

CRYPTO

Central African Republic's crypto Hub Is 'physically impossible' for World Bank to support. Link here.

FTX has launched its service for customers in Japan. Link here.

TripleA has been selected as the global cryptocurrency payment gateway for Binance Pay. Link here.

INVESTMENT

Bitpanda registers as a Virtual Asset Services Provider with the OAM in Italy. Link here.

Clearco has arrived in Germany with an ambitious pledge to lend €500m to support local businesses. Link here.

MOVERS & SHAKERS

BUX appointed Niek van Rens as its new Chief Operating Officer. Link here.