👀 NEWS HIGHLIGHT

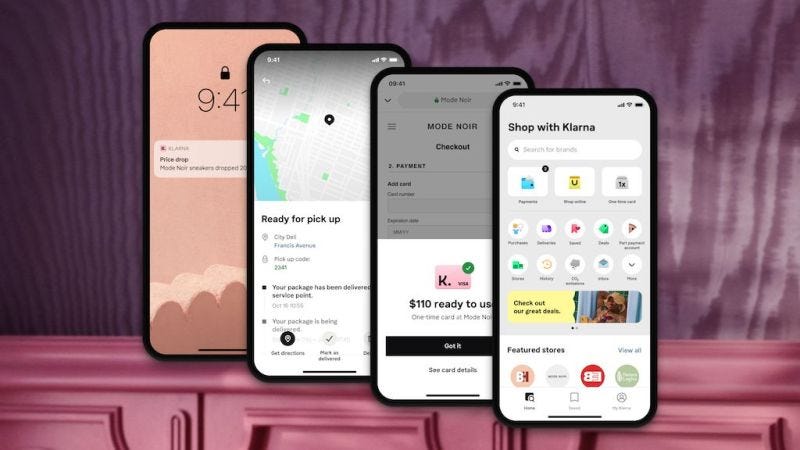

Swedish fintech giant Klarna is keen to ditch its association with its main product, buy now, pay later (BNPL).

It instead wishes to move towards being known more for being a global retail bank and one-stop eCommerce shop, according to the company’s chief marketing officer.

This could be attributed largely to the amount of criticism the BNPL sector receives, Klarna often bearing the brunt due to it being the largest company in the sector.

“The first myth that irritates me is that we are just Buy Now Pay Later – we do so much more than that,” Klarna chief marketing officer David Sandstrom told The Drum.

👉 Read the full article here.

🔦 Would you like to bring your company/service to the attention of tens of thousands of FinTech enthusiasts?

👉 Sponsor my newsletters and/or podcast episodes!

😎 SPONSORED CONTENT

YieldX is leveling the fixed income playing field. Their technology and investment management solutions offer firms complete flexibility, by enabling the creation of custom, white-labeled investment universes. so advisors can select from the capabilities that best meet their investors' needs.

👨💻 BLOG

💡INSIGHTS

“Embedded commerce” started with things like PayPal and has evolved with products like Stripe, many years later. But “embedded finance” is appearing as a new wave in fintech, with the likes of Contis, Solaris, Swan, and Stripe Treasury (not yet live in the EU).

Indeed, you may recall that Angela Strange (of a16z) made the proclamation in 2019 that “every company will be a Fintech company”, and some predictions put the embedded finance opportunity at being worth around $7.2 trillion by 2030.

Intergiro has been a stealth-mode, privately funded, bootstrapped startup for the last five years, but is now emerging as part of this embedded banking movement, calling itself “a financial cloud” on which almost any kind of company can offer banking services.

👉 Read more here.

NOW, ON TO THE SUMMARY OF LAST WEEK'S NEWS

🌎 FINTECH HIGHLIGHTS

⭐️ Apple has reportedly shelled out $150M for Credit Kudos, an open banking technology firm. Link here.

⭐️ Wise has introduced Auto Conversions for users who regularly convert between currencies. Link here.

⭐️ Mollie is continuing its global expansion in a partnership with carmaker Mazda. Link here.

⭐️ Payhawk has partnered with Curve to launch a guide to how fintechs can work with the existing financial system, and how disruptive startups can partner with banks. Link here.

PAYMENTS

Belgium-headquartered financial services consulting group Projective has hit a milestone, breaking through the 500 employees mark following the acquisition of Netherlands-based Enigma Consulting. Link here.

The Central Bank of Egypt announced the official launch of the national system for the instant payments network and the InstaPay application for banking sector customers: allowing financial transactions to be conducted electronically and instantly. Link here.

Vattanac Bank, a leading Bank in Cambodia announced a partnership with global payments network EMQ, to facilitate real-time cross-border payments across Asia, with more markets in the pipeline. Link here.

Global Processing Services, a leading global payment technology platform, announced a new strategic partnership with Mastercard. The announcement expands on the two firms’ longstanding relationship stretching back over a decade. Link here.

Mastercard is introducing two new payment solutions to lower risks while improving costs, boosting speed, reducing friction, and making payments smarter. Link here.

Trust Payments, the disruptive leader in fintech specializing in frictionless payments and value-added services, is launching Stor, an innovative e-commerce platform for small and medium businesses. Link here.

CRYPTO

Cryptocurrency exchange Coinbase Global (COIN) will soon require its customers in Canada, Japan, and Singapore who send cryptocurrency to another financial institution or exchange to provide the name, address, and, in the case of Japan, the destination wallet of the recipient. Link here.

REGTECH

To better address, the tougher compliance rules resulting from recently extended sanctions and the resulting increase in money laundering activity, ComplyAdvantage, and Resistant AI have partnered to expand their offering for the financial industry. Link here.

FRAUD PREVENTION

Mitek, a global leader in digital identity (ID) verification and fraud prevention, announced the acquisition of UK’s leading KYC (know your customer) technology pioneers, HooYu. Link here.

MOVERS & SHAKERS

PayPal has hired Intel's Archana Deskus as executive vice president and chief information officer. Deskus has been SVP and CIO at Intel since 202. She has also held CIO roles at Hewlett Packard Enterprise, Baker Hughes, Ingersoll Rand, Timex, and United Technologies. Link here.

BUX, Europe’s fastest-growing neobroker, has announced the appointment of Jean-Raphael Nahas as the new Managing Director of its Cyprus CFD operations. This follows the hiring of veteran online brokerage executive, Salim Sebbata, as CEO, BUX CFD, in the summer of 2021. Link here.

Zumo, the Edinburgh-based crypto wallet and payments platform, has appointed Dagmara Aldridge as its first Chief People and Culture Officer as it seeks to reflect Future of Work trends and the latest neuroscience teachings. Link here.

FINTECH MAPS

If you are a fintech startup and have over 100 questions send me an email, maybe I can answer a few.