REPORT

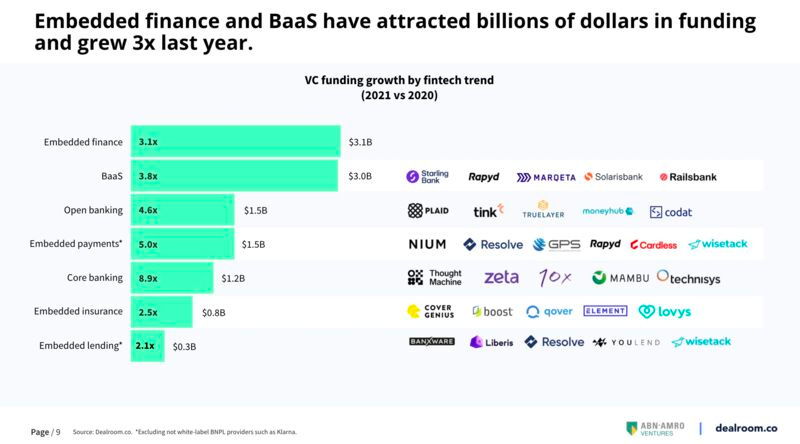

The rise of embedded finance: Embedded finance can unlock an opportunity bigger than the current value of all FinTech startups and the top global banks and insurers, combined.

👉 Read the full Dealroom.co and ABN AMRO Ventures report here

👀 NEWS HIGHLIGHT

An appeal has been launched to encourage businesses in the FinTech sector to donate and raise much-needed funds for those affected by the crisis in Ukraine.

Fintechs For Ukraine aims to encourage tech firms to raise as much money as possible to help support victims of the crisis, with donations going directly to Save the Children’s Ukraine Appeal.

👉 Check out the full article here

🔦 Would you like to bring your company/service to the attention of tens of thousands of FinTech enthusiasts?

👉 Sponsor my newsletters and/or podcast episodes!

😎 SPONSORED CONTENT

The basics won’t do in today’s digital-first financial services world. To really succeed, you need to level up your risk decisioning capabilities wherever you can. And the best way to do that is artificial intelligence. Read Provenir's guide on how to simplify your AI decisioning journey and move beyond the hype in under 60 days.

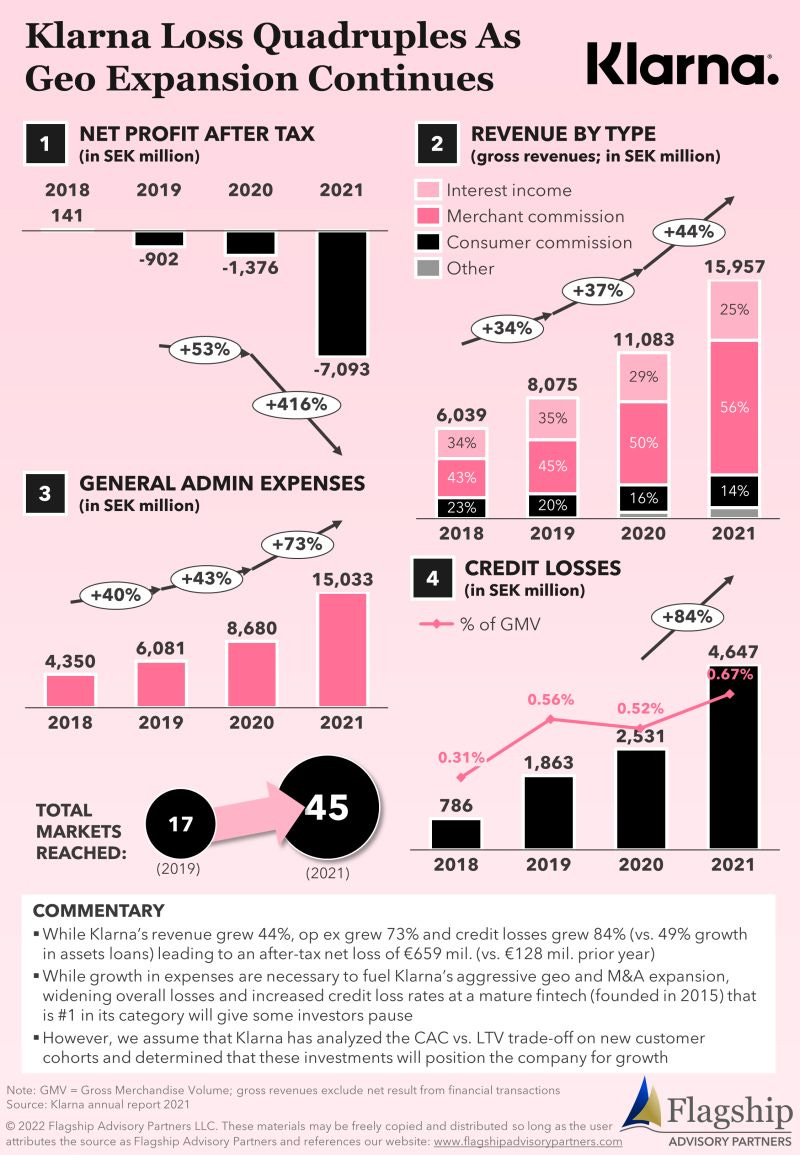

📊 INFOGRAPHIC

Infographic: Klarna Loss Quadruples As Geo Expansion Continues 👇

👉 Check out the infographic here

📰 ARTICLE

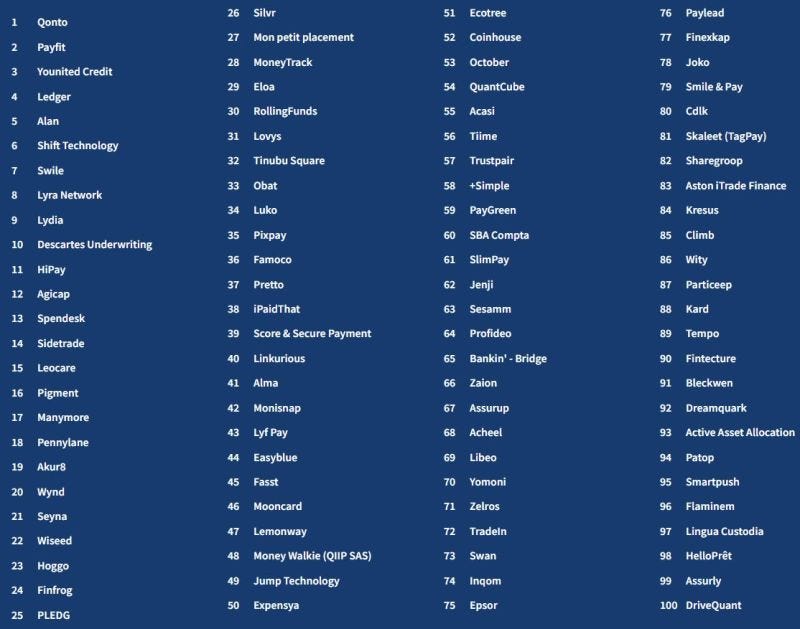

France FinTech 100 by FINANCE-INNOVATION 👇

Not a big surprise that Qonto is topping this impressive list.

👉 Check out the full list here

💡INSIGHTS

“Buy Now Pay Later: Solving for commercial sustainability in Asia Pacific BNPL industry”

👉 Read the full Quinlan & Associates report here

🎤 PODCAST

Felix Gerlach, Co-Founder & CPO at Passbase, celebrates $17 Million funding and identity infrastructure for the next wave of builders.

Felix Gerlach is the co-founder and Chief Product Officer of Passbase, a privacy-focused identity infrastructure company. Launched in 2018, Passbase has since raised over $17 million in funding from Cowboy Ventures, Eniac & Lakestar with offices in Berlin and New York. He discusses identity infrastructure for the next wave of builders.

👉 Check the latest episode here

NOW, ON TO THE SUMMARY OF LAST WEEK'S NEWS

🌎 FINTECH HIGHLIGHTS

⭐️ Yoco is in talks to raise about $150 million in funding, sources tell Axios. Link here

⭐️ UkraineDAO, crowdfunded 2,188 Ether (ETH), or $6.1 million, for a 1/1 Ukrainian flag nonfungible token (NFT). Link here

⭐️ Revolut’s Chief Revenue Officer Alan Chang is seeking to raise roughly $100 million in financing for a new cryptocurrency venture. Link here

⭐️ Parpera & Railspay launch Australia's first embedded finance business debit card. Link here.

PAYMENTS

Payments technology company Mastercard has been working closely with related parties everywhere, including Thailand, to prepare for the future of payments in which digital currencies will be a critical choice for consumers, said Aileen Chew, country manager of Mastercard for Thailand and Myanmar. Link here.

MTN added more than R11bn to its market capitalisation as Africa’s largest mobile operator rose past rival M-PESA Africa to become the biggest mobile payments business on the continent by users. Link here

London-based FinTech Curve has launched in the US, offering Americans the option to combine all their debit, credit and loyalty cards into one. Link here

Atlantic Money has moved out of stealth with a promise to take on the likes of Wise and Revolut with a cheaper offering for larger value transactions. Link here

A new female-led bill-splitting app is launching in Brazil in mid-March, with backing from top fintech investors, including ex-Monzo Chief Executive Officer Tom Blomfield. Link here

Railsbank, the leading global Embedded Finance Experience platform, is now the BIN sponsor for the Sodexo Engage Spree Card programme. Link here

Multi award winning Cardstream has announced its partnership with Nomu Pay, a global payments platform whose mission is to reduce the complexity in making global payments and operating international ecommerce businesses. Link here

Bitpanda Payments has been authorised to conduct payment activities as an Electronic Money Institution (EMI) in Austria. Link here

Commerce enabler Payoneer has selected ThetaRay SaaS solution SONAR to monitor cross-border payments on the former’s platform. Link here

Tribe Payments, announced it has been selected for digital banking and card issuing services by business banking platform Fyorin. Link here

BNPL

DoorDash announced a partnership with Melbourne, Australia-based financial technology company Afterpay to offer BNPL on all orders in the fintech company’s home country. Link here

OPEN BANKING

The Open Banking fintech Bud has announced its Australian launch after receiving accreditation from the Australian Competition and Consumer Commission to provide Open Banking services. Link here

Visa announced it has completed its acquisition of Tink – an open banking platform that enables financial institutions, fintechs and merchants to build financial products and services and move money. Link here

Pakistan is the largest nascent fintech market in Asia, with an unbanked population of 100 million. About 70% of the population lacks a bank account. Link here

CRYPTO

Yuga Labs, the company behind one of the biggest and most valuable NFT collections in the industry, the Bored Ape Yacht Club, announced that it has bought the rights to the intellectual property of the CryptoPunks and Meebits collections from Larva Labs. Link here

No company offering crypto-currency services in the UK has a licence to operate a crypto-ATM. The Financial Conduct Authority said all such machines must be shut down or it will take action. Link here

Payments giant Stripe already powers a pretty major swath of the web’s financial infrastructure, now it’s launching crypto payments support to give customers an easier path to onboard web3 users and interact with cryptocurrencies. Link here

BLOCKCHAIN / DEFI

Paxos announced it has received in-principle approval from the Monetary Authority of Singapore (MAS), a premier financial regulator in Asia-Pacific, to operate digital payments token services under the Payment Services Act 2019. Link here

INVESTMENT

Rize Money Inc. and YieldX, a fintech company modernizing and personalizing income investing, announced a strategic partnership and the release of the Rize Target Yield Account (TYA), a high yield account backed by fiat currency. Link here

INSURTECH

Sachin Bansal’s Navi Technologies, an insurtech startup, has filed for a $440 million IPO as the 40-year-old entrepreneur who made his money by kick-starting the e-commerce wave in the country once again makes a bold choice. Link here

FINTECH MAPS

If you are a fintech startup and have over 100 questions send me an email, maybe I can answer a few.