REPORT

The feat of digital currency first saw the light of the day with the creation of Digicash in 1989, but like any ahead-of-its-time innovation, its days were numbered.

A lack of popular support and proper funding were amongst the few grounds that led to its bankruptcy in the 1990s, with almost all its counterparts facing a similar fate.

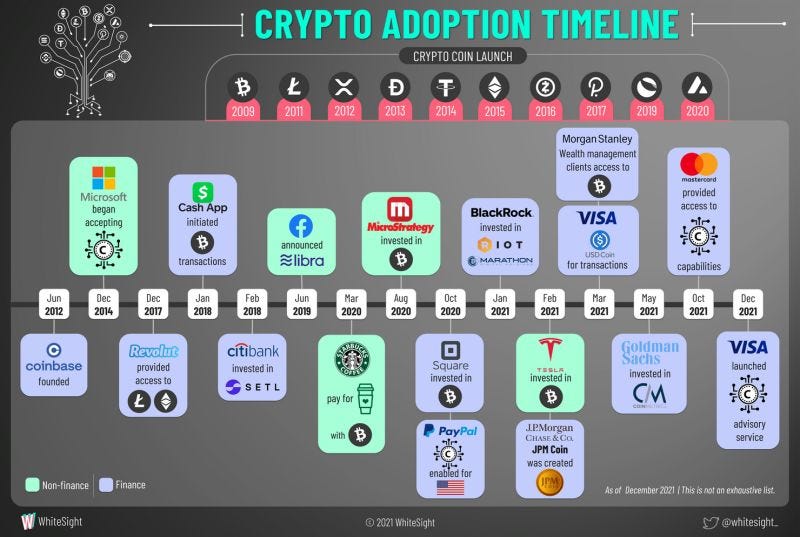

Further efforts to create a notable digital currency proved futile until the advent of Bitcoin in 2009; and as fate would have it, this decentralized cryptocurrency was here to stay and flourish.

👉 Read the full WhiteSight article "DeFi"ying All Odds: The Rise of Cryptocurrencies” here.

👀 NEWS HIGHLIGHT

Shares of several "buy now, pay later" firms sank sharply after the U.S. consumer watchdog opened an investigation into the sector.

The Consumer Financial Protection Bureau said Thursday it was seeking information from Affirm, Afterpay, Klarna, PayPal and Zip on the risks and benefits of their products.

BNPL services let shoppers defer payment for items, typically over a period of monthly installments and with no interest attached — though some do charge hefty late payment fees.

👉Read the full CNBC article written by Ryan Browne here.

📊 INFOGRAPHIC

In 2021, financial services continued to have its moment – fintech fundraising surpassed all years prior; it was a banner year for fintech IPOs, and fintech mega M&A activity was at an all-time high.

We saw one of the largest fintech IPOs just before year-end with Nubank raising $2.6B (as the largest digital bank), one of the largest fintech M&As with Square acquiring Afterpay at $29B, the first-ever direct listing in the UK with Wise, the first-ever fintech/crypto direct listing with Coinbase, and multiple fintech SPACs.

What big ideas might FinTech tackle in 2022?

👉 Read all about Andreessen Horowitz's views here.

📰 ARTICLE

Crypto is on pace to hit a billion users in the next five years, Coinbase President and Chief Operations Officer Emilie Choi said, though usability and regulatory clarity will be key to continued increased adoption.

While speaking during a webinar at the Bloomberg Financial Innovation Summit, Choi said that about 12% of Americans use crypto and that users currently total roughly 200 million globally.

“We’ve hit mainstream adoption,” Choi said. “If you look and track the adoption of the internet, we’re actually on pace or accelerating what the early internet was on the crypto front.”

👉 Read the full blockworks article written by Ben Strack here.

👨💻 BLOG

As of today, Coinbase has 139 tradable assets. The exchange added a whopping 83 assets to its trading list in 2021, nearly double the number of assets it had accumulated in the eight years since its founding.

Is this rapid expansion a simple cash-grab? Are any of these lesser-known tokens and coins securities? Is this irresponsible or overly ambitious? What does this rapid expansion of assets by Coinbase mean?

👉 Read the full cointelegraph article here.

💬 INTERVIEW

I believe in the decentralised world of finance. I expect DeFi will represent much of the fintech world in the next several years.

Billionaire investor Tim Draper says he's been 'ESG forever' and shares his views on fintech, including venture capital, bitcoin, and decentralised finance with FinTech Magazine.

👉 Read more here.

💡INSIGHTS

When venture firm Sequoia Capital changed its Twitter bio this month to misspell the word “build,” include a blockchain reference and sign off “LFG” (crypto-speak for “Let’s go”), people thought it had been hacked.

In reality, the new bio, which stayed up for 16 hours, was a winking reference to a larger shift at the half-century-old firm: Sequoia is serious about crypto.

👉 Read the full Bloomberg News article written by Lizette Chapman here.

NOW, ON TO THE SUMMARY OF LAST WEEK'S NEWS

🌎 FINTECH HIGHLIGHTS

⭐️ H&R Block filed a trademark infringement lawsuit over Square’s new name, “Block” on Thursday. Link here.

⭐️ Islamic Finance News launched the Asian IFN Fintech landscape. Link here.

⭐️ Robinhood confirmed it's launching a feature to allow users to gift cryptocurrencies to other users. Link here.

⭐️ Zip Co is understood to have held merger talks with its rival Sezzle in recent months. Link here.

PAYMENTS

Flutterwave announced the launch of Send, a remittance solution, aimed to increase remittance flow and uptake to the African continent. Send is a quick, reliable and secure cross-border person-to-person payments service. Link here.

Business finance marketplace Funding Options has joined forces with Wise to offer Wise Business, the business account for going global, in its marketplace to further expand its offering for SMEs as they recover from the pandemic. Link here.

PhonePe, India’s leading digital payments platform, announced that it has become the first payments platform to tokenise cards on all 3 major payment networks - Visa, Mastercard & Rupay. Link here.

Management and technology consulting company BearingPoint and the Swiss financial market infrastructure operator SIX are partnering to develop a fully integrated invoice-to-payment service. Link here.

Sokin, the next generation global payments provider, has pledged to support Canada’s estimated 8 million international migrant population by giving consumers who are sending money overseas access to 51% cheaper global money transfers. Link here.

BNPL

Visa launched a new installments service that will help consumers with eligible UAE-issued Visa cards access “Buy Now, Pay Later” (BNPL) financing for regular purchases at the point of sale when buying goods. The service is initially made available for purchases at 52 brick-and-mortar stores of Sharaf DG, a major electronics and home appliances chain in the UAE. Link here.

RFI Global has been tracking BNPL since 2016, during 2020 the instant impact of global events resulted in an almost immediate digital transformation. Buy Now, Pay Later (BNPL) has fast become the payment solution shoppers can’t turn away from, allowing them to finance purchases from fashion brands to homeware and travel. Link here.

OPEN BANKING

Yolt, Europe’s leading open banking provider, has announced a strategic partnership with The Digital Debt Resolution Agency (The Digital DRA) to harness open banking payment and data services to improve debt resolution in the UK. Link here.

CRYPTO

Edinburgh-based cryptocurrency start-up Zumo has become the first such company in Scotland to secure Financial Conduct Authority (FCA) registration. It is among the first consumer crypto wallet and payments platforms in the UK to be added to the regulator's list of registered crypto asset firms. Link here.

Digital wealth manager and neobroker Scalable Capital is launching a new offering for investing in cryptocurrencies. The company, which started out as a ‘robo adviser’ and now also has a brokerage business as well as a digital wealth white label solution, will offer access to crypto investments via regulated stock exchanges in Germany that trade exchange-traded products (ETPs). Link here.

BLOCKCHAIN / DEFI

ConsenSys, the leading Ethereum software company, announced the launch of ConsenSys Rollups, to provide enterprise-grade scalability to leading financial organizations and others, addressing the key challenge of scalable applications on the Quorum tech-stack. Link here.

GREEN FINANCE

Stripe is making $6 million in carbon removal purchases from four new companies. These purchases, evaluated by 13 climate science experts, cover a wide range of technologies: permanent geologic storage, ocean alkalinity enhancement, enhanced weathering, and direct air capture. Link here.

FINANCIAL LITERACY

Edfundo, the world’s first teacher-built money management app for kids and teens, has fast-embraced the intelligence offered by IBM’s Hyper Protect Accelerator Program to enable the fast-build of market-leading security for the Edfundo Money Management App. Link here.

MOVERS & SHAKERS

Flutterwave, Africa's leading payments technology company, announced Grammy Award-winning international artist, Ayodeji Ibrahim Balogun, popularly known as Wizkid, as its Global Brand Ambassador. Link here.

Climate impact investing app Clim8 hired executives from some of the world’s leading companies to drive growth and innovation. The new additions include Leon Ho as Chief Product Officer, who joins from Monese where he held the same position. Link here.

OPPORTUNITIES

Stockholm reinforces its position as Europe’s 3rd biggest fintech hub, with green FinTechs as one of the emerging verticals on the Stockholm fintech scene, new report shows.

This year’s edition of the Stockholm Fintech Guide delves into the growth categories in the Swedish fintech world and looks at the latest investments, where Stockholm ranks third after London and Berlin in Europe.

👉 Read more here.

FINTECH MAPS

If you are a fintech startup and have over 100 questions send me an email, maybe I can answer a few.