MVO BLOG

INSIGHTS

Another one of my predictions from 2021 that came true was about crypto moving into the mainstream. It's safe to say this is now the case. Again, I would fully expect to see this trend continue well into the new year. It's clear that legacy financial institutions and venture capital funds are aware of the potential to make big gains in this area, which is always a good sign for maintained growth.

👉Read more here.

Are you a FinTech that needs some help with development? Shoot me a message!

REPORT

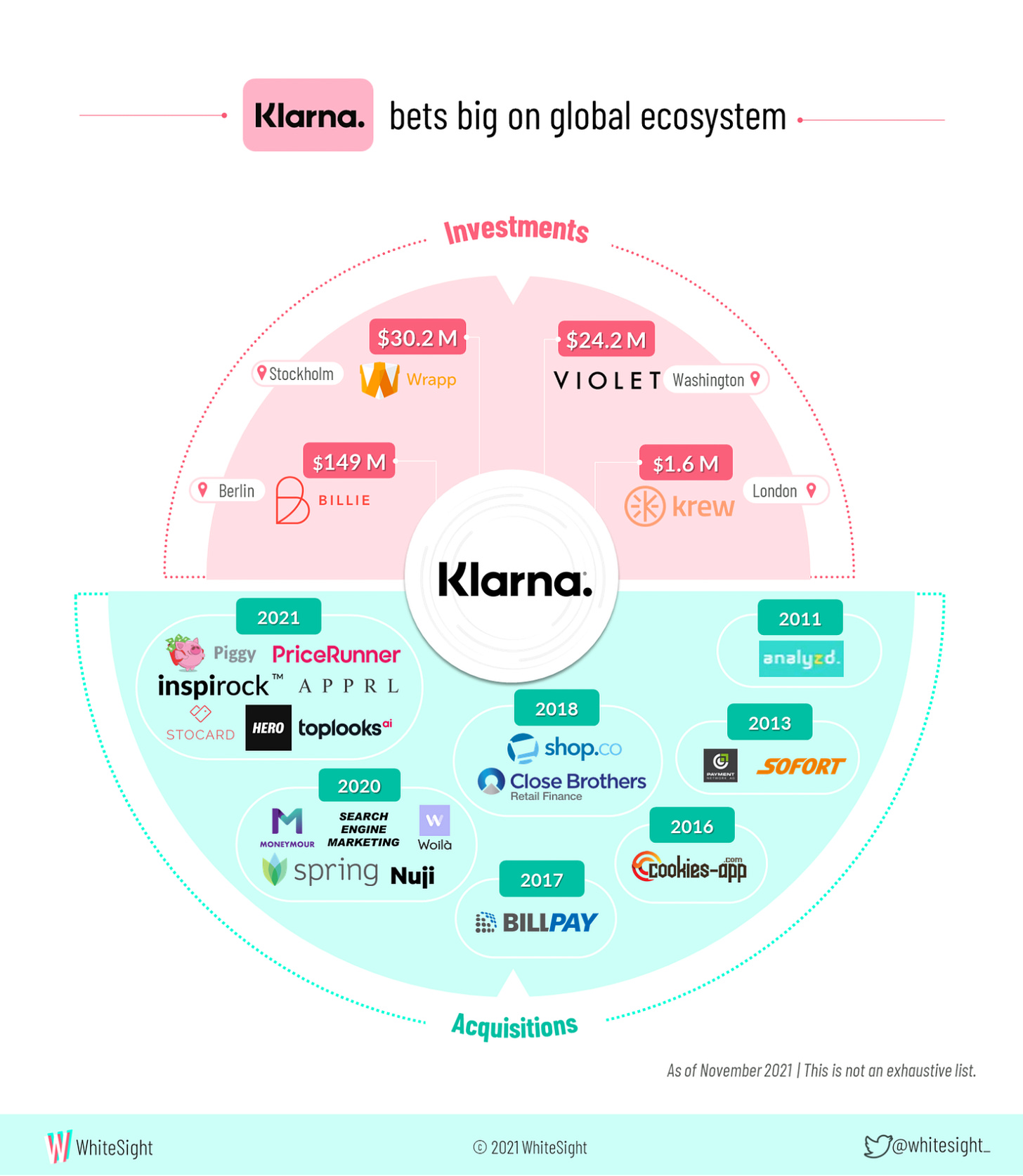

In recent years, the strategic investments that Klarna has cherry-picked in order to maintain its image as a “household brand” have earned it several names, of which the term “Super App” takes the cake.

👉 Read the full WhiteSight article here.

ARTICLE

A new study from Morning Consult revealed the fastest growing brands of 2021, and the findings demonstrate the growing importance of fintech in consumers’ lives.

Looking at the results by age reveals insights into each generation’s financial lives and activities—as well as other aspects of their lives.

👉 Read the full article by Ron Shevlin here.

PODCAST

Check out episode 302 of the podcast series Around the Coin. In this episode, Mike Townsend speaks with Oded Zehavi, the Founder & CEO of Mesh Payments, and board and advisory board member of several Israeli FinTech companies.

👉 Listen here.

FINTECH MAPS

NOW, ON TO THE SUMMARY OF LAST WEEK'S FINTECH SPACE

NEWS HIGHLIGHT

The stage has been set for super apps to flourish for some time. An average adult has 80 apps on their phone in total but only uses about nine on a daily basis.

Clearly, customers are drawn to the idea of a one-stop shop, which gathers up and organizes the best features of all their apps — like an operating system for their life.

Super apps offer this.

👉 Read the full “PAYMENTS are eating the world” report by J.P. Morgan here.

Fintech Meetup is where deals get done and partnerships happen! Everyone you want to meet will be there.

Meet Fintechs like Alviere, BitPay, BlockFi, Certa, MANTL, Nymbus, Signal Intent, Sila, Socure & Zero Hash (to name just a few!), Investors like Bain Capital, Commerce Ventures & Tribeca Ventures, Banks like Bank of America, Citi, J.P. Morgan & Wells Fargo, Neobanks like Dave, Revolut & Varo Bank, Credit Unions representing 13 million members and many, many others! Online, March 22-24.

FINTECH HIGHLIGHTS

⭐️ A 2020 survey by Bank of America found that millennials’ top financial priorities include saving for retirement (75%) and building an emergency fund (51%). Link here.

⭐️ Events in Australia, Brazil, India, Sweden, and the USA could have a huge impact on Fintech’s valuations, says Grant Halverson in his latest blog post. Link here.

⭐️ Funding Circle has moved into the embedded finance market, providing third-party firms with a single API to offer loans of up to £500,000 to small businesses within their own website. Link here.

⭐️ Sokin, the next-generation global payments provider, will give customers up to 10% cashback on purchases and money transfers in December. Link here.

PAYMENTS

Facebook Messenger announced that it’s starting to test out a new “Split Payments” feature that introduces a way for users to share the cost of bills and expenses through the app. Link here.

iwoca announced the expansion of its merchant cash advance product to all small businesses accepting card payments in the UK. Link here.

London’s B4B Payments, a company that specializes in smart corporate payments and card solutions for businesses, has partnered with Amsterdam-based AI-powered transaction monitoring startup Sentinels. Link here.

Twig has launched in the UK with the aim to allow customers to turn their unwanted possessions into instant cash. Link here.

Recruitment lender Sonovate is teaming up with a months-old app that speeds up payments to influencers from big brands. XPO, based in London, pays out to content creators on behalf of the brands using them. Link here.

Wise has officially launched its Wise card in Canada to enable customers in the country to make purchases in 200 countries and a multitude of different currencies. Link here.

PPS has debuted Google Pay functionality in the U.K. through challenger bank customer Monese, according to a press release. Link here.

Cash App is a mobile payment service, which was created by Square Inc. back in 2013. Now it has more than 70 million active users, and boldly claims to be the easiest way to send money. Link here.

BNPL

Microsoft is to embed a buy now, pay later option into the Edge browser through a partnership with Zip. Link here.

Mollie revealed its annual insights into online payment trends for small and medium-sized retailers on Black Friday, Cyber Week and Cyber Monday. The data shows that BNPL purchases are rocketing in popularity. Link here.

PayPal CEO Dan Schulman told CNBC’s Jim Cramer on Tuesday that use of the company’s buy now, pay later option surged on Black Friday. Link here.

GREEN FINANCE

PPS announced its partnership with UK-based ekko, an iconic climate-friendly debit card, app, and ecosystem that empowers consumers to make a difference in the fight against climate change. Link here.

OPEN BANKING

The UK’s financial regulator the Financial Conduct Authority is looking to scrap a key open banking rule requiring users to reauthenticate access to customer accounts every 90 days. Link here.

By obtaining a PSD2 license from De Nederlandsche Bank (DNB), open banking provider Yolt has laid a foundation for the rollout of their European expansion. Link here.

Nordigen is launching a suite of new products designed to help developers build open-banking-powered applications with more ease. Link here.

Yapily, the European open banking infrastructure provider, announced a new partnership with Sprinque, the Amsterdam-based B2B checkout platform for marketplaces and merchants, to enable business buyers to seamlessly settle invoices online. Link here.

CRYPTO

Okcoin announced that it is kicking off the next phase of its mission to make the crypto industry more inclusive through the launch of a $1 million commitment to bring more women into crypto. Link here.

A cabinet note seen by NDTV shows the Indian government will regulate cryptocurrencies in the country, rather than imposing a ban on their use. Link here.

INVESTMENT

Canadian robo advisor Wealthsimple is exiting the UK after four years to concentrate on its home market. Link here.

Tillit is launching with its service that rewards investors the longer they remain customers. Link here.

Republic and Seedrs announced that they have entered into an agreement for Republic, the U.S.-based private investment platform, to acquire Seedrs. Link here.

MOVERS & SHAKERS

Bain Capital Ventures has named Christina Melas-Kyriazi, a former Affirm executive and angel investor, as its newest partner. Link here.

OPPORTUNITIES

Amsterdam-based Mollie, a payments platform that offers a process for integrating payments into a site or app, announced that it will open a new fintech Centre of Excellence in the city of Maastricht, Netherlands. 👉Read more here.

If you are a fintech startup and have over 100 questions send me an email, maybe I can answer a few.