REPORT

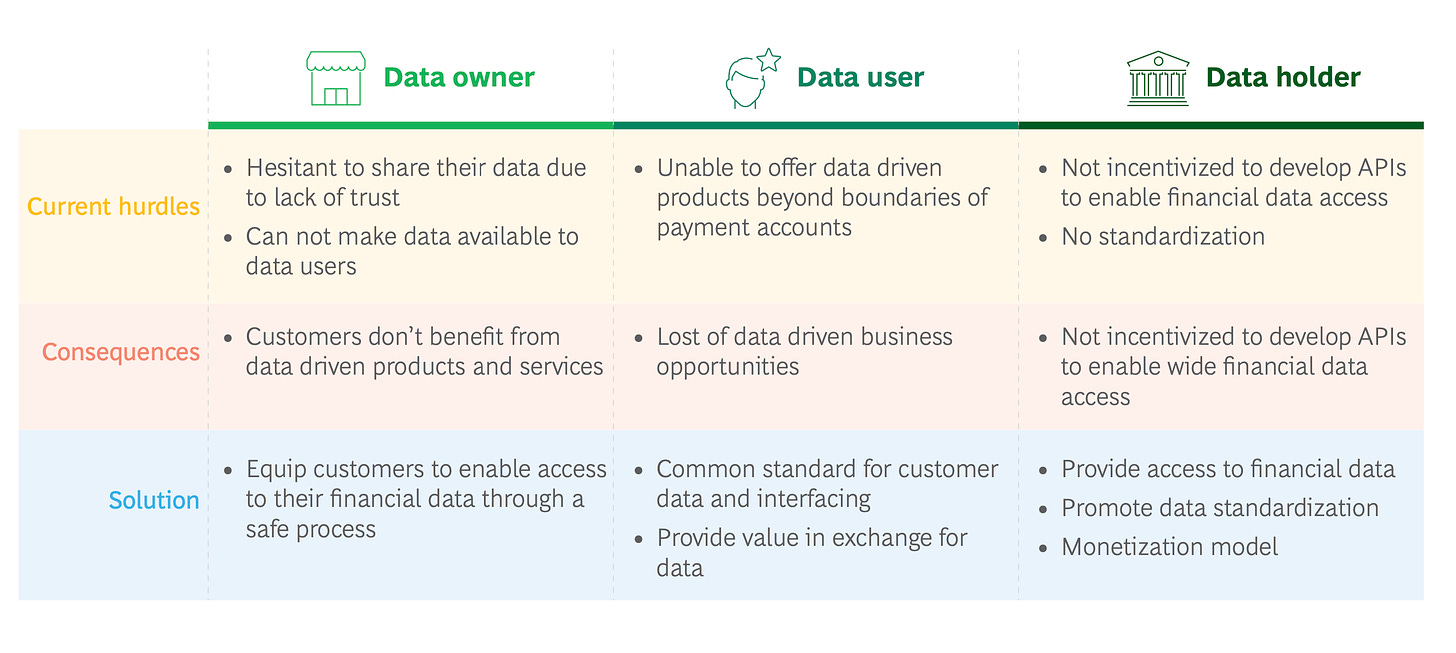

Without clear, robust rules in place and the tools to manage data sharing permissions, to- day’s customers are hesitant to trust that potential risks have been addressed. Compound- ing this resistance to share data, a lack of infrastructure standardisation and divergent inter- ests are prohibitive for all parties involved.

Raised officially with three deals in the UK🇬🇧, two deals in Germany🇩🇪, France🇫🇷, Sweden🇸🇪, Switzerland🇨🇭, and Spain🇪🇸 and one deal in Norway🇳🇴 and Croatia🇭🇷.

Read the complete BlackFin Tech source article for more info, stats, and figures here

👀 NEWS HIGHLIGHT

This funding is in parallel to news that Form3 will provide Visa’s clients with access to their best-in-class payments platform, to enable them to modernise their payments’ infrastructure.

💡INSIGHTS

Last year, when the business swung to a loss, Funding Circle clocked up £678m of lending for the second half of the year showing growth may be returning from the declining macro environment seen in 2022.

Overall, however, Funding Circle reported a £3m loss for the H1 2023 period owing to what it said were investments in “attractive growth opportunities” in its US loans business and its BNPL-like FlexiPay products.

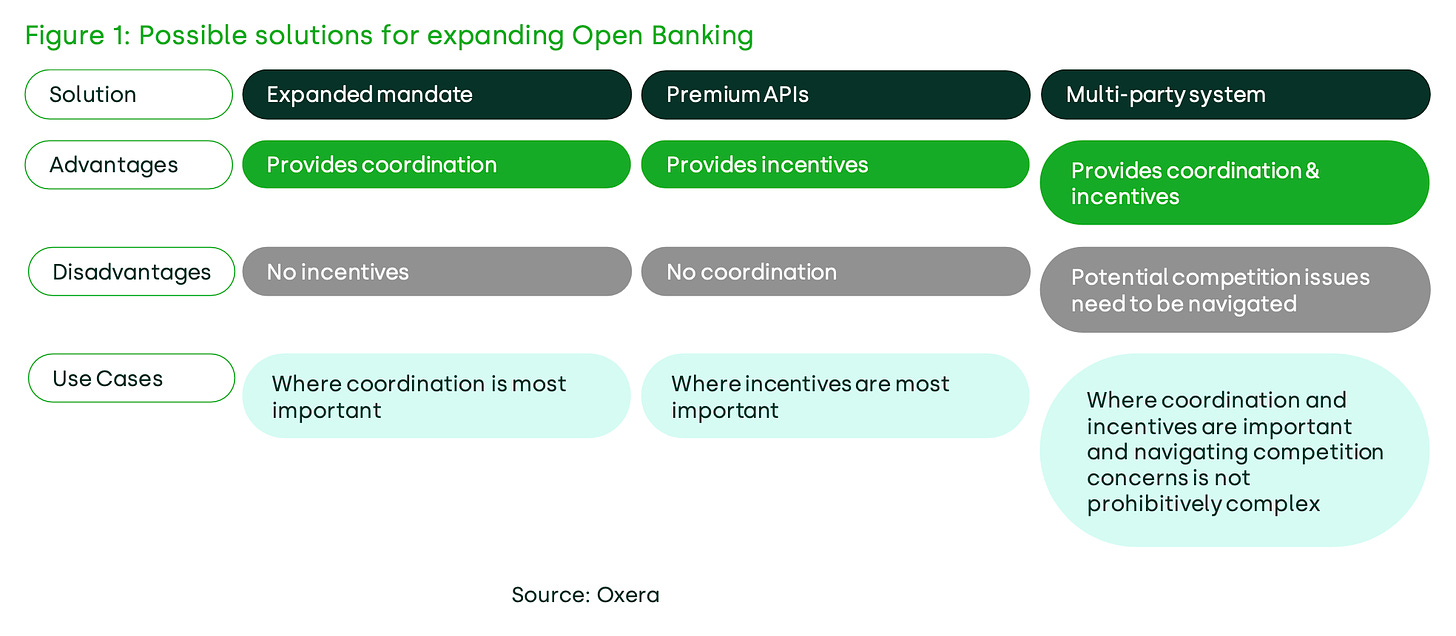

Open Banking in the UK has been a qualified success to date. It is used by 7m consumers and businesses and 68m Open Banking payments were made in 2022. However, this success must be kept in perspective. These users only account for around 10% of the UK’s adult population and far more payments are made on cards (20bn a year) and through direct debit (4.5bn a year). Open Banking use cases remain relatively limited.

NOW, ON TO THE SUMMARY OF LAST WEEK'S NEWS

🌎 FINTECH HIGHLIGHTS

⭐️ Twentyone goes live with beta launch.

⭐️ Incard partners with Currencycloud.

⭐️ Klarna global boss doubles down on UK investment despite regulation uncertainty.

⭐️ Curve makes its first step towards becoming a financial marketplace.

⭐️ European fintech funding drops as investment discipline returns.

⭐️ PayPal, Meta to enable donations on Facebook, Instagram in the US, UK, Australia, Canada.

PAYMENTS

Adyen NV has won approval for a UK banking license, replacing its temporary post-Brexit permission to offer embedded finance and other payments services.

Pleo is partnering with Banking Circle for greater payment volume capacity and faster settlement times.

SAP Fioneer partners with Mastercard to embed commercial payments and services into its embedded finance, card management and lending platform.

Sprinque announces its expansion into Germany and Spain with the opening of new offices in Berlin and Madrid.

Mastercard and Paysend collaborate to enhance cross-border payments for SMEs.

OPEN BANKING

PayPoint, has become the first Open Banking provider to offer bank to bank transfers as a Payment Initiation Service Provider (PISP) to Pay-As-You-Go energy customers with its new Pay By Bank service.

CRYPTO

Several Binance executives have left in recent days, including leaders overseeing its Russian business and its connections to the traditional financial system, extending a period of rapid senior turnover at the cryptocurrency giant.

tell.money supports crypto banking platform, Colossos in expanding open banking capabilities to their customers by powering their PSD2 dedicated interface.

BLOCKCHAIN / DEFI

The UK Centre for Blockchain Technologies (UK CBT) has officially launched.

INVESTMENT

Upvest is set to provide Plum, the smart money app, with its investment API, enabling Plum to expand its range of investment opportunities to EU customers.

Wayflyer announced that it has agreed to an off-balance sheet programme that will purchase up to $1bn of assets from funds managed by investment management firm Neuberger Berman.

ClimateAligned launches at The Drop 2023 in Sweden. ClimateAligned is developing the first AI platform designed to integrate end-to-end sustainability, ESG and climate factors and data applicable to debt investment decisions in a single application.

Payhawk, announces ‘Payhawk Green’, the new platform features to help companies make more sustainable decisions related to company spending.

DONE DEAL

Strise announced that it has secured $10.8M (nearly €10M) in a Series A round of funding.

Zopa is announcing another fundraise of a different kind as it continues to wait for the IPO markets to reopen.

Treyd announced the completion of a €11.2 million extension of its March 2022 Series A funding.

yeekatee announces an additional CHF 550k funding milestone, backed by FiveT Fintech and existing investor Ronald Strässler.

Tradeteq announces the completion of its $12.5 million A Plus funding round.

VC NordicNinja is announcing the closing of its second fund of €200m, and following a trend set by other Europe-based VCs in recent years, is broadening its focus to include the UK and Benelux.

M&A’s

Clear Junction has acquired Altalix. The firm will remain as a separate company, but be rebranded to Clear Junction Digital Ltd under the new ownership, shifting from serving retail clients to solely providing services for regulated institutions.

Saxo Bank is pleased to announce the successful completion of its transaction involving the sale of Saxo Geely Tech Holding A/S (Saxo Fintech) to Geely Financials Denmark.

FRAUD PREVENTION

Ntropy is excited to announce a strategic partnership with Yapily to enrich and improve financial information and transaction data for customers across the UK and Europe.

Cleafy raises €10m from Moneyfarm investor to battle fraud in neobanking.

MOVERS & SHAKERS

Provenir has appointed Andres Elizondo as its new chief financial officer to support the company’s expansion.

PPRO announced that its Board has promoted Chief Commercial Officer, Motie Bring, to the role of Chief Executive Officer, effective 2nd October 2023.

FinTech Scotland has announced the appointment of a new senior leader, Trish Quinn, who joins as Strategic Innovation Director.

Qonto announces the appointment of its first CFO: Anita Szarek.

Moonfare brings Marine Eugène on board as new chief commercial officer.

Spendesk appoints Sarah Whipp as new chief marketing officer.

FINTECH MAPS

If you are a fintech startup and have over 100 questions send me an email, maybe I can answer a few.

-