REPORT

As we can see, the industry is clearly getting back from summer break and gearing up for the second half of the year. Compared to July, there’s a definite rise in the number of funding rounds and announced partnerships, which is a positive sign for the autumn to come.

Read the full Helsinki Fintech Farm report here

👀 NEWS HIGHLIGHT

This move reflects the company’s vision to strengthen its presence on the European continent while seeking to discover and capitalize on new opportunities in the global landscape.

The decision to establish an operation in Sofia marks a significant milestone in PayRetailers’ expansion agenda. The city, with its rich blend of tech talent and fintech operational expertise, presents itself as a favorable hub for key product development activities, operations, and strategic alliances.

💡INSIGHTS

Open banking, the ground-breaking financial technology, has reached a significant milestone, surpassing 11.4 million payments in July 2023. This achievement reflects a 9.3% increase in total payments compared with the previous month, highlighting the growing adoption of open banking services.

Klarna has shown time and again that its approach to underwriting short-term lending to responsible consumers with a customer-centric, merchant-funded approach works. Credit loss performance has improved -41% YoY, bringing the global credit loss rate to 0.39% for the first half of the year. This has been achieved while growing the top line, with GMV continuing to outpace e-commerce, growing at 14% YoY in Q223 while global e-commerce remained flat at 0%.

In the final week of August, just two fintech deals were announced in Europe for a total amount of €29.3m raised, with one deal in Germany and one deal in France.

Read the complete overview article by BlackFin Tech for more info, stats and figures here

‣ Spanish FinTech deal activity is on track to reach 104 transactions in 2023, a 21% increase from 2022.

‣ Spanish FinTech deal activity totalled at 52 deals in the first six months of 2023, a 16% decrease YoY.

‣ Spanish FinTech companies raised a combined $94m in H1 2023, a 51% decrease from 2022.

Read the complete overview article by Fintech Global for more info, stats and figures here

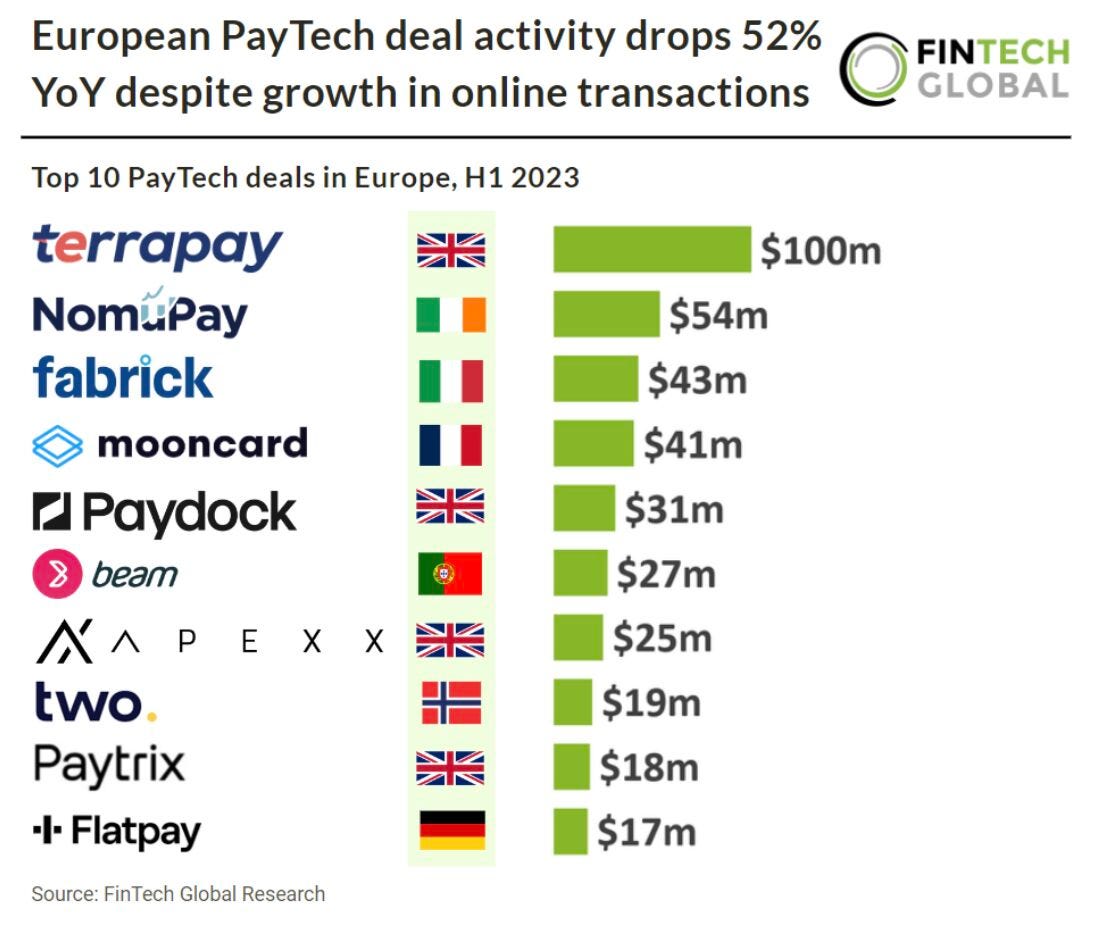

‣ European PayTech deal activity reached 93 transactions in the first half of 2023, down 52% YoY.

‣ European PayTech companies raised a combined $469m in H1 2023, a 92% reduction compared to the same period last year.

Read the complete overview article by Fintech Global for more info, stats and figures here

NOW, ON TO THE SUMMARY OF LAST WEEK'S NEWS

🌎 FINTECH HIGHLIGHTS

⭐️ Zilch hits 3.5m customer milestone.

⭐️ Freedom Finance becomes Aro in rebrand.

⭐️ Moneyfarm sees AUM leap to £3.5bn, customers hit 125,000.

⭐️ Qover secures FCA authorisation license.

⭐️ Wise allowed Russia sanctions target to withdraw money.

PAYMENTS

Atlantic Money launches fixed fee international transfers for businesses. With this launch, Atlantic Money provides businesses with a new opportunity to save on their global payments during times of rising inflation and logistical post-corona issues.

SEPAY has announced it will merge with Buckaroo to create solutions for an omnichannel payment experience.

OPEN BANKING

GoCardless has partnered with Commusoft to offer its customer base cost-effective payments via open banking.

LHV Bank has teamed up with Raisin UK to move into the personal savings market.

Ivy raises $20M to take open-banking payments international. The funding will be used both to expand its banking deals into more geographies, and to continue picking up more merchant customers in those markets to build out its business.

Acquired.com has launched an all-in-one Hosted Checkout solution to equip merchants with the ability to offer all major payment methods, including Open Banking payments, via a single integration.

wamo announces that it is partnering with Modulr as its new Banking-as-a-Service (BaaS) provider.

CRYPTO

London Stock Exchange Group’s focus is on using crypto technology to improve traditional asset transactions, not on trading cryptoassets.

INVESTMENT

Mangopay and Spryker collaborate to revolutionise online platform development. The collaboration seeks to empower businesses in constructing flawless marketplaces encapsulating everything from seller onboarding to the crucial payment processing.

Klarna is the only bank among ChatGPT Enterprise launch customers.

Moneyfarm has launched a portfolio of money market funds managed by global asset managers.

Deutsche Bank is reportedly engaged in early stage talks with digital investment and broker platform Scalable Capital over a potential investment or partnership deal.

Banking Circle is strengthening its presence in Spain with membership of the Spanish Association of FinTech & InsurTech (AEFI).

Wirecard’s whistleblower plots new startup to avoid Wirecard 2.0. Pav Gill’s new startup, Confide, wants to make it easier for employees to call out company wrongdoings and for companies to avoid media leaks.

OnBuy and YouLend offer sellers fast, flexible finance.

DONE DEAL

OneID has secured £1 million in new funding from ACF Investors. The investment will be used to further develop its product and bolster its mission to make the world a safer place by helping people prove who they are online easily and securely.

GenTwo raises $15 million, Point72 Ventures has led a $15m Series A investment round.

ThetaRay has completed a $57 million fundraising round. The new funding will be used to accelerate global growth plans and capitalise on surging demand for new AI-based technologies in the $9 billion financial crime fighting market.

M&A’s

Friday Finance acquired by competitor Pliant in a strategic shift. The deal aims to streamline Friday Finance's broad product range, focusing primarily on corporate credit cards.

Clear Junction acquires Altalix. This strategic acquisition represents a significant milestone in Clear Junction’s growth journey as it works towards becoming a one-stop shop for its clients to manage their payment and treasury needs globally.

Pagaya bidding to acquire GreenSky for up to $800 million. Pagaya advanced to the final stage in the bid to acquire GreenSky. If it wins, the deal is set to range between $600-$800 million.

MOVERS & SHAKERS

The Board of Directors of Alpian announces that the Chief Executive Officer (CEO), Schuyler Weiss, has resigned in order to embark on a new journey in public service in the United States.

FINTECH MAPS

If you are a fintech startup and have over 100 questions send me an email, maybe I can answer a few.

-