REPORT

Key Takeaways:

‣ 87% of consumers express frustration with payments.

‣ 56% of merchants are dealing with a drop in conversion due to strong customer authentication (SCA).

‣ Half of all consumers will avoid payments that require manual data entry.

‣ 64% of consumers say security is the most important factor in making a purchase.

Download the complete #fintechreport by Truelayer here

👀 NEWS HIGHLIGHT

The co—head of Dutch payment processing company Adyen NV ruled out a share buyback one day after its earnings triggered a stock meltdown that erased more than €18 billion ($20 billion) of its market value.

“We’re focused on building a business and we always had a policy where we continue to invest our funds in the business,” Ingo Uytdehaage, Adyen’s co-chief executive officer said in an interview.

📊 INFOGRAPHIC

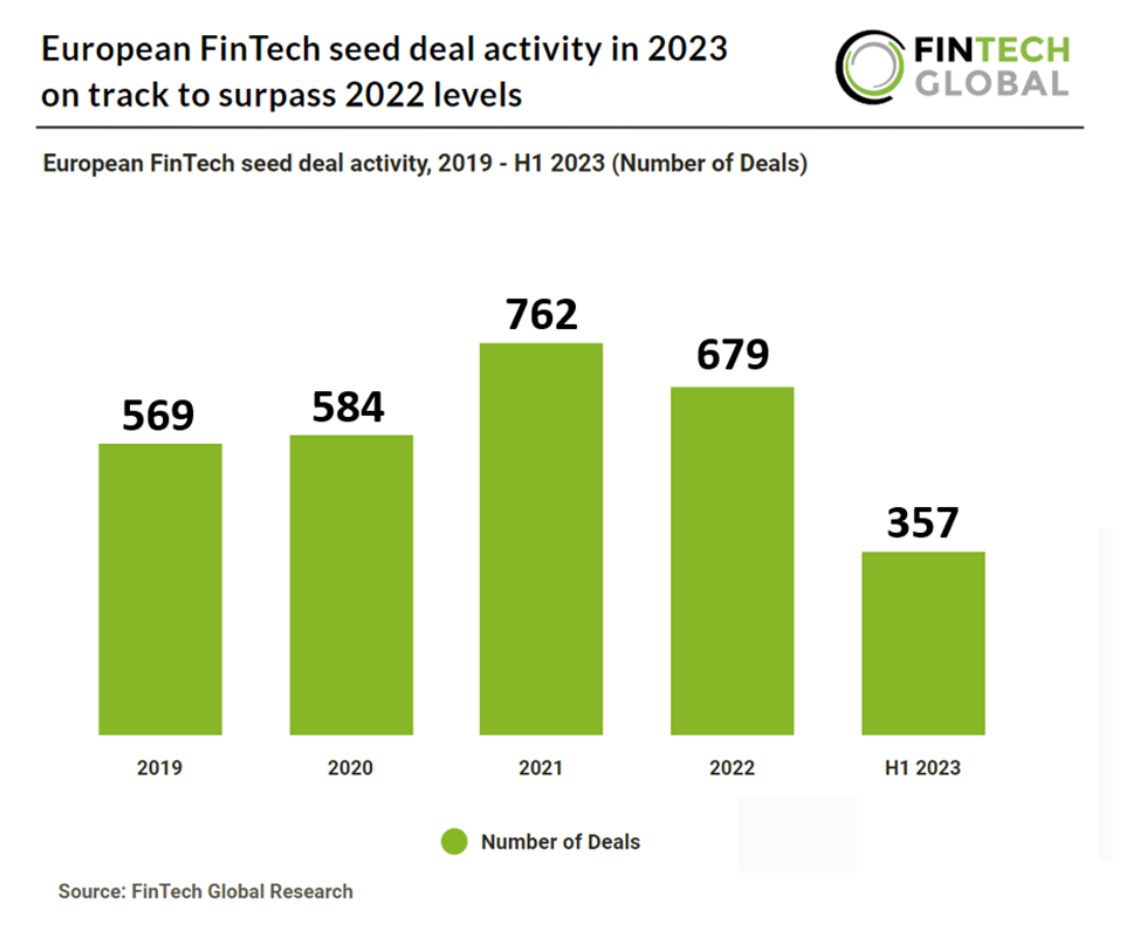

🌱 European FinTech seed deal activity in 2023 on track to beat 2022’s levels.

Key European FinTech seed investment stats in H1 2023:

‣ European FinTech seed deal activity is on track to reach 714 deals in 2023, a 5.1% increase YoY

‣ European FinTech seed deal activity reached 184 deals in Q2 2023, a 6.3% rise from Q1 2023

‣ The UK was the most active seed deal country in Europe during H1 2023

💡INSIGHTS

Adyen reported revenue of 739.1 million euros ($804.3 million) in the first half of the year, up 21% from 2022, but lower than analyst estimates.

EBITDA (earnings before interest, tax, depreciation and amortization) of 320 million euros, down 10% from 356.3 million euros in the first half of 2022. The first-half 2023 result matches an analyst prediction of 320 million euros profit.

• Dutch FinTech deal activity reached 35 deals in the first half of the year, a 46% drop from H1 2022

• Dutch FinTech companies raised a combined $108m worth of funding in H1 2023, a 68% decrease YoY

• PayTech and Blockchain & Crypto were the most active Dutch FinTech subsectors in H1 2023

Funding levels in Ireland's fintech sector have fallen again in the last 12 months due to economic and geopolitical challenges.

According to data from KPMG, there were nine fintech investment deals completed in the first half of 2023, raising a total of $59.2m.

NOW, ON TO THE SUMMARY OF LAST WEEK'S NEWS

🌎 FINTECH HIGHLIGHTS

⭐️ TerraPay announced that it has secured authorization as an Electronic Money Institute (EMI) in Italy.

⭐️ Hindenburg Research targets $4.6 billion Kazakh brokerage for allegedly helping Russian oligarchs evade sanctions.

⭐️ Wirecard’s byzantine fraud grips courts in Munich and Singapore.

⭐️ Klarna outsources customer services staff, cutting 250 employees.

CRYPTO

CityPay.io has raised a seed funding round of more than €2 million, which includes $500k investment in cryptocurrency. Funding will help escalate the expansion into CIS region and other markets, as well as see the development of a B2C platform.

DONE DEAL

Ex-Habito CEO, Daniel Hegarty, raises £2.5m for the new savings app, Communion, targeting cash-strapped millennials.

INVESTMENT

BUX is thrilled to announce it is offering iShares iBonds ETFs, an innovative investment solution developed by BlackRock, one of the world’s leading providers of investment, advisory and risk management solutions.

A new U.K. investment fund with up to £1 billion ($1.27 billion) in capital raised has been launched to back growth-stage financial technology companies.

Param has acquired Twisto, from Zip Co, in its bid to expand further across Europe and push Twisto towards profitability.

Genesis Bidco Limited announced its intention to acquire the entire share capital of Glantus.

FRAUD PREVENTION

Orlin Roussev, recently arrested in the UK for espionage, has been confirmed as the owner of a signal interception company that provided surveillance equipment to former Wirecard top manager Jan Marsalek.

FINANCIAL LITERACY

Alviere has become the second fintech firm in the last few weeks to withdraw from a process to secure an e-money licence from the Central Bank of Ireland.

MOVERS & SHAKERS

TrueLayer has appointed Michael Brown as Head of Ecommerce to lead the company’s push into the vertical as more firms look to adopt open banking payments.

WealthKernel announces the appointment of Aqsa Tariq as its new Chief Financial Officer. Aqsa will play a fundamental role in shaping the company's financial strategy, driving growth and improving WealthKernel’s ongoing processes.

MercadoLibre’s Pedro Arnt joins DLocal as new co-CEO ahead of European expansion.

FINTECH MAPS

If you are a fintech startup and have over 100 questions send me an email, maybe I can answer a few.

-