REPORT

This highly anticipated report delves into the transformative world of Embedded Finance and BaaS, providing invaluable insights into essential business models, key players, and the latest trends reshaping various industries. The Paypers sought to cover successful company partnerships with BaaS platforms and vital topics such as use cases, sector applications, product coverage, and the advantages of working with a BaaS provider.

👀 NEWS HIGHLIGHT

The integration with Yapily - rolled out in key markets for Payhawk including the UK, France, Spain, Portugal, and the Benelux - allows Payhawk to offer its customers the ability to link one or more bank accounts from over 2,000 banks and institutions from dozens of countries and lets users easily top up their debit accounts and repay credit accounts from a linked bank account.

📊 INFOGRAPHIC

📰 ARTICLE

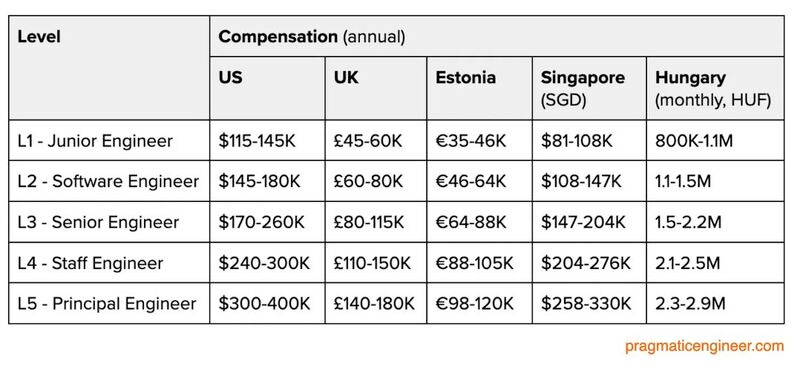

The image comes from the The Pragmatic Engineer article "What is a senior software engineer at Wise and Amazon?" by Gergely Orosz, which goes into more details on what's expected at the senior level at Wise.

Although it was a slightly quieter month, there were still plenty of interesting transactions taking place in the Nordic banking and fintech sector, along with other captivating developments.

💡INSIGHTS

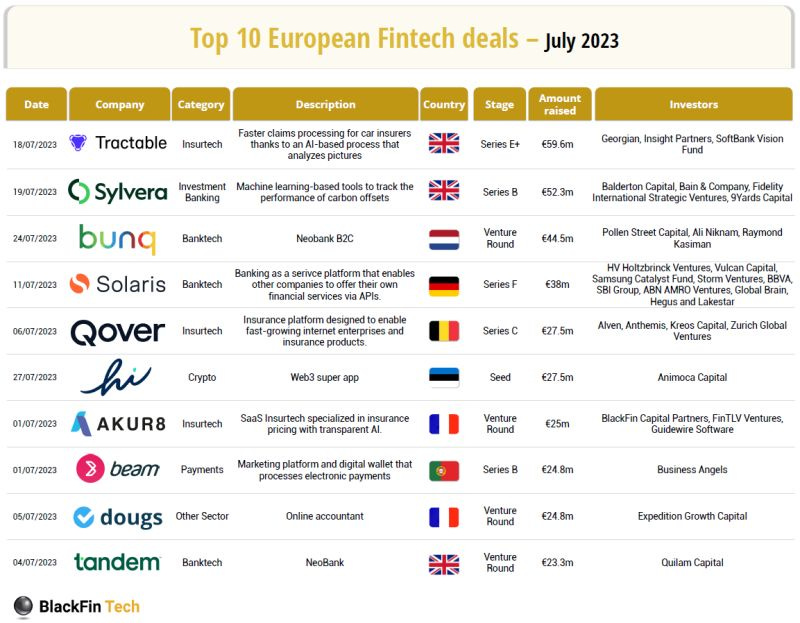

Here are the Key Takeaways /Funding Stats:

𝗝𝘂𝗹𝘆 𝟮𝟬𝟮𝟯

# deals for the period: 𝟱𝟮 (-35% compared to July 2022)

‣ Total Amount raised: 𝟰𝟳𝟯.𝟴𝗺 (-76%)

‣ Total Amount raised by top 10 Deals: 347.2m (-78%)

‣ Average Amount raised: 11.3m (-60%)

‣ Median Amount raised: 4.54m (-9%)

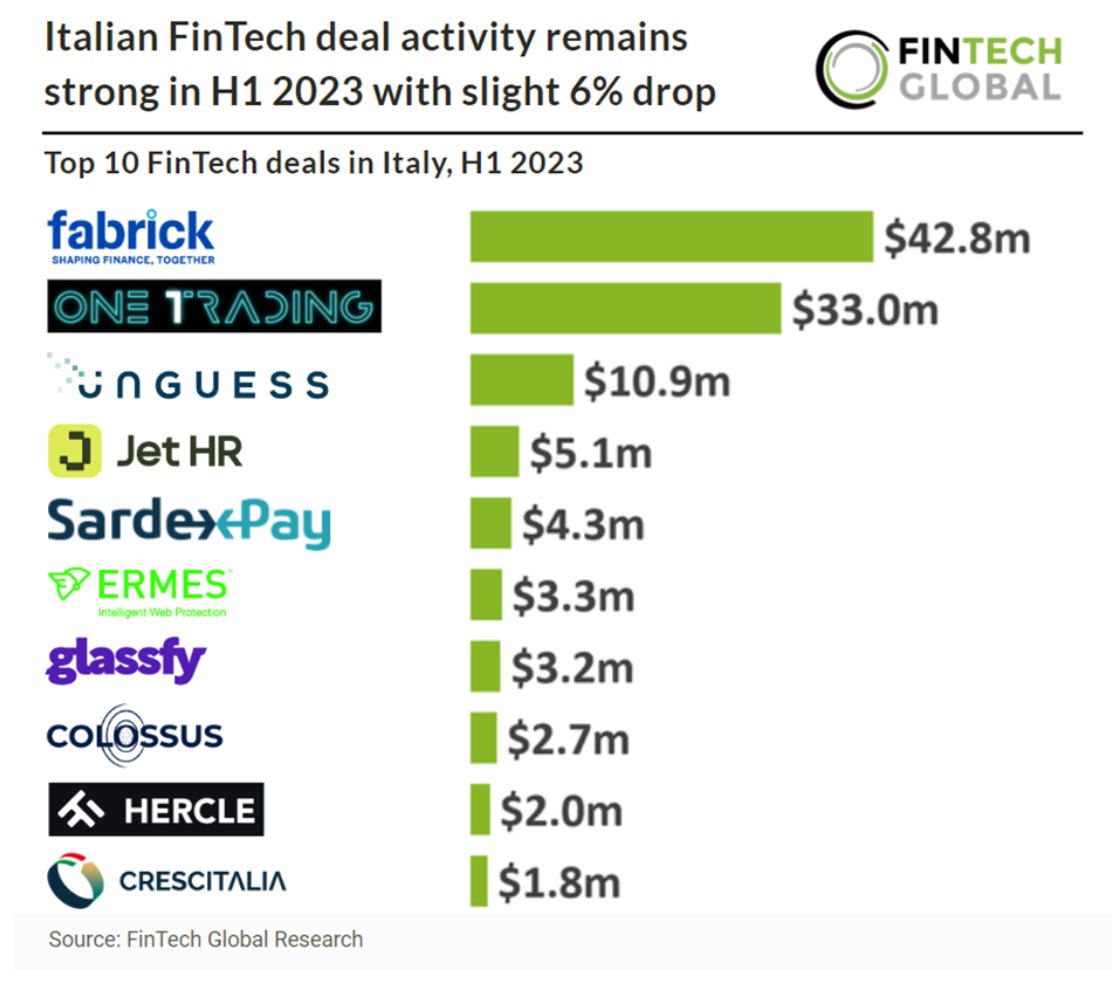

Key Italian FinTech investment stats in H1 2023:

‣ Italian FinTech deal activity reached 33 deals in H1 2023, a 6% drop YoY

‣ Italian FinTech companies raised $113m in H1 2023, 60% decrease from H1 2022

‣ RegTech was the most active Italian FinTech subsector in H1 2023 with seven deals

🧐 ANALYSIS

CNBC partnered with independent research firm Statista to establish a transparent overview of the top fintech companies.

Statista analyzed over 1,500 firms across nine different market segments, evaluating each one against a set of key performance indicators, including revenue, user numbers, and total funding raised.

NOW, ON TO THE SUMMARY OF LAST WEEK'S NEWS

🌎 FINTECH HIGHLIGHTS

⭐️ Proposed PSD3 and Payment Services Regulation (PSR).

⭐️ Pockit has raised $10 million in a growth round led by Puma Private Equity.

⭐️ Tide has added an accrual-based accounting tool to its digital business finance platform.

⭐️ Charles Delingpole’s evolution: From fintech CEO to influential angel investor.

PAYMENTS

Melio announced the launch of Pay Over Time, the first product that enables small businesses to pay vendors and business bills in monthly installments, while their suppliers get paid in full and on time.

TrueLayer announces that global trading platform CMC Markets is live using its closed-loop payments product.

OPEN BANKING

TrueLayer announces that Lopay, the UK’s highest-rated point-of-sale (POS) solution, now offers its real-time settlement solution to its 20,000 businesses.

INVESTMENT

Orbital has raised £5M ($6.4M) in an oversubscribed growth round led by Golden Record Ventures, at an attractive valuation in which the founders are maintaining a large majority.

MOVERS & SHAKERS

Stax Payments announced the appointment of Paulette Rowe to Chief Executive Officer, taking over for John Kristel who was named interim CEO in January.

Klarpay AG is pleased to announce the appointment of Markus Emödi as the Chief Legal & Compliance Officer and Deputy CEO.

FINTECH MAPS

If you are a fintech startup and have over 100 questions send me an email, maybe I can answer a few.

-