Hello FinTech Fanatic!

I'm happy to present to you my latest newsletter Connecting the dots in RegTech newsletter in collaboration with my neighbors in Amsterdam: Fourthline

In this weekly newsletter, we'll be your intrepid guides, leading you through the winding paths of compliance, risk management, and all things regulatory.

With news updates and podcast episodes we'll bring you the latest trends, emerging technologies, regulatory updates, and inspiring success stories from the pioneers who are reshaping the industry.

So sign up for this great newsletter to make sure you'll stay up to date on all things RegTech!

And now on to other FinTech industry news I listed for you today:

REPORT

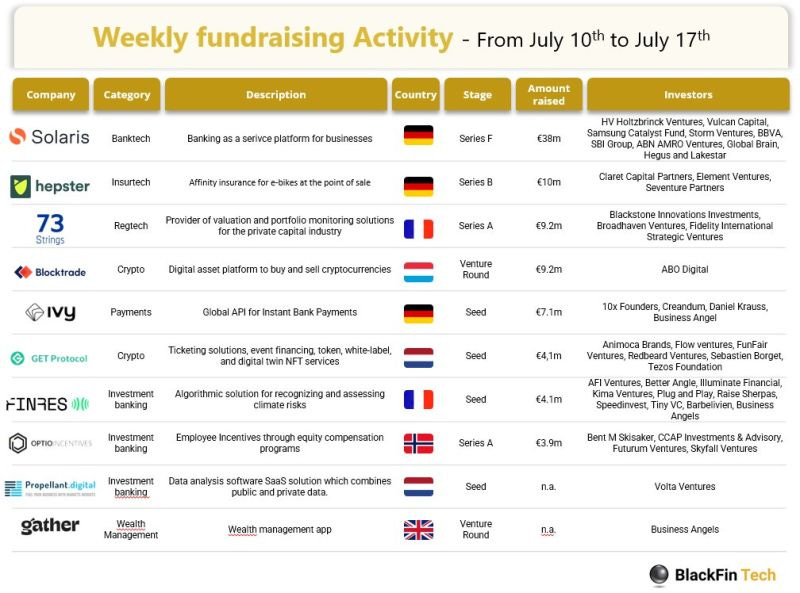

Last week we saw 10 FinTech deals in Europe for a total amount of 81.4m€ raised with 3 deals in Germany, 2 in France and in the Netherlands, and 1 the United Kingdom, Luxembourg, and Norway.

👀 NEWS HIGHLIGHT

Payhawk has received an EMI licence and opened an office in Lithuania, increasing its global presence to eight offices. This recent milestone culminates 12 months of high growth for Payhawk, during which it opened an office in New York, and the total headcount grew 82%.

😎 SPONSORED CONTENT

At Klarna Kosma, we want to make accessing open banking solutions as smoooth as possible for our potential partners. So, we’ve brought everything you need to start plugging into the power of open banking together in one place.

Whatever stage your business is at, whether it’s:

🟣 Still exploring the possibilities

🟣 Wanting to play around with our products (for free)

🟣 Looking for more support or guidance from our open banking experts

🟣 Fully ready to start developing and testing our API

It’s all here for you 👉

📊 INFOGRAPHIC

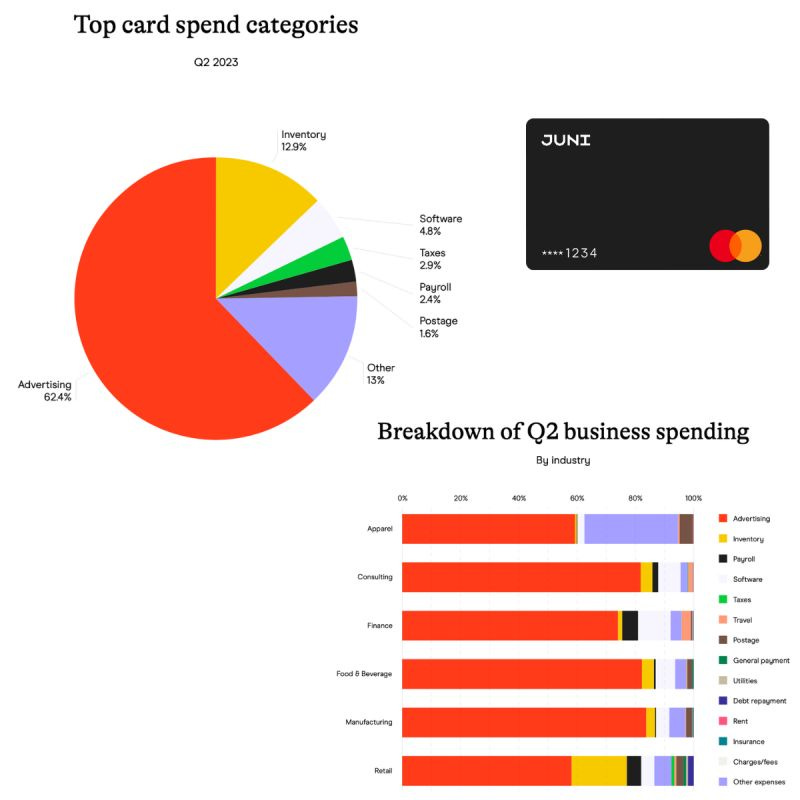

Data released by Juni, the financial platform built for digital commerce, reveals that British online retailers spent 19% more on ads, inventory, and software in Q2 2023 compared to Q2 2022.

📰 ARTICLE

Discover how Open Banking and Embedded Finance are revolutionizing financial services with superior user experiences.

Regulatory approvals for fintech firms plunged to fresh lows in 2022, the Standard can reveal, as the UK’s financial watchdog mounted a draconian crackdown on London’s fintech sector.

The approval rate of applications for Electronic Money Institution status, required for processing digital cash payments, fell to just 8% in 2022, figures obtained from the Financial Conduct Authority via a Freedom of Information request show, amounting to just 33 approvals.

💡INSIGHTS

‣ 391 FinTechs raised money in H1 2023, equaling a total amount of €3.2Bn

‣ In terms of amount raised, it’s a huge drop compared to last year, with 361 fintechs raising €11.2Bn in H1 2022.

NOW, ON TO THE SUMMARY OF LAST WEEK'S NEWS

🌎 FINTECH HIGHLIGHTS

⭐️ Solaris secures €38 million capital raise.

⭐️ Paynovate moves into France.

⭐️ Nutmeg founder Nick Hungerford dies.

⭐️ Moss selects GoCardless for UK push.

PAYMENTS

Adyen expands in-person payments solutions with Tap to Pay on Android. Adyen works with Oracle Food and Beverage to broaden access to contactless in-person payments experiences for restaurants and food service businesses globally.

Apple has announced the launch of Tap to Pay on iPhone in the United Kingdom, allowing independent sellers, small merchants, and large retailers in the country to use iPhones as a payment terminal.

BNPL

Treasury poised to shelve crackdown on 'buy now pay later' sector. Treasury officials have been told during recent talks with the industry that a number of its biggest players could quit the UK market if they are subjected to "heavy-handed" regulation.

OPEN BANKING

Fiinu have plunged after the lender had its restricted banking licence withdrawn in the face of challenging market conditions.

OakNorth Bank has recently expanded its office network into Scotland. The new office, located in Glasgow’s George Square, aims to strengthen the bank’s presence in the country and tap into the local market.

loyalBe, the open banking loyalty app, is to shut down its consumer service and pivot the business to focus on the B2B sector.

CRYPTO

FCA continues crackdown on crypto ATMs in the UK. The Financial Conduct Authority (FCA) has visited and inspected 34 locations across the UK suspected of hosting crypto ATMs.

Bitstamp and Qi Digital to help banks integrate crypto currency payments. Companies, banks and payment providers can accept cryptocurrency stored on world’s longest running crypto-exchange Bitstamp as regular payment.

The UK Government has opened consultations on the introduction of a Digital Securities Sandbox (DSS), to test innovative new market infrastructures for digital assets.

Public launches in the United Kingdom, entering its first market outside the United States. Public aims to be the preeminent place to invest in US-listed equities, offering over 5,000 stocks, deep data and insights, and a simple and transparent fee structure.

Robinhood is preparing to target British investors. App that sparked 'meme stocks' craze begins hiring key UK roles ahead of possible launch

DONE DEAL

Ivy has secured €7 million ($7.7 million) in a seed investment round led by European VC Creandum.

Defacto has closed a €167m fund securitisation through a deal with Citi and Viola Credit. The new funding capacity will add up to €1bn to Defacto lending.

Hepster has raised €10m Series B as it looks to expand to new markets and work towards profitability.

Channel and Citi provide €230 million credit facility to SME lender Silvr.

Ex-Swile and Qonto product chiefs raise €5m for new fintech Pivot.

GREEN FINANCE

FinRes secures €4.1M funding, revolutionises agricultural finance decision-making with AI.

FRAUD PREVENTION

Veriff announced it has achieved certification against the UK government's Digital Identity and Attributes Trust Framework (UKDIATF), a government initiative aimed at establishing a secure and trustworthy digital identity ecosystem in the region.

The brothers behind a British peer-to-peer style investment platform have been sentenced to a combined eight years in prison for fraud and money laundering.

MOVERS & SHAKERS

FINBOURNE Technology announces the appointment of Neil Ryan in the role of Head of Product Marketing and Solution Positioning.

If you are a fintech startup and have over 100 questions send me an email, maybe I can answer a few.

-