REPORT

Stablecoins may play a role in the future of finance, but absent robust regulatory frameworks, they will introduce significant risks.

The single most important force of innovation and value-creation in North American fintech over the last decade was integrated payments, specifically the embedding of payment acceptance and payment initiation into commerce and business management software.

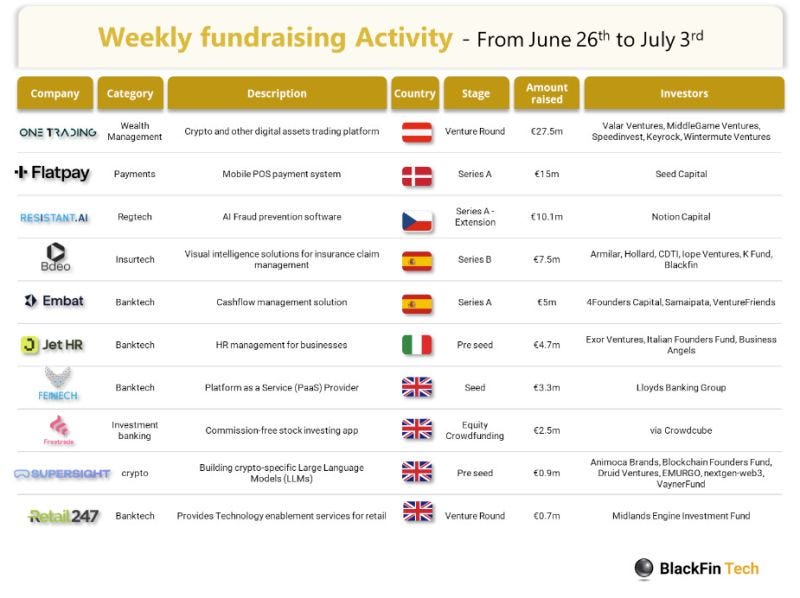

Last week we saw 17 FinTech deals in Europe for a total of 103m€ raised with 4 deals in the UK🇬🇧, 3 in Spain🇪🇸, 2 in Italy🇮🇹, and 1 in Germany🇩🇪, Belgium🇧🇪, Austria🇦🇹, Czech Republic🇨🇿, Portugal🇵🇹, Denmark🇩🇰 and Switzerland🇨🇭.

👀 NEWS HIGHLIGHT

The introduction of Pay by Bank is a response to shifts in the payments market which created a growing need for a low-cost alternative to iDEAL. With Pay by Bank, Buckaroo offers an alternative payment method that speeds up the checkout process for webshops up to 25% without paying extra.

📰 ARTICLE

Open banking has been given a potential new set of rules after the European Commission today released its proposals to update the rules governing payments.

The revised Payment Services Directive proposal (which will replace PSD2 with PSD3) comes alongside the new Financial Data Access (FIDA) proposed rules as well as separate Payment Services Regulation (PSR).

👨💻 BLOG

The main institutional actors of the Fintech industry in Lithuania signed a Memorandum of Understanding (MoU) to confirm the National Fintech Guidelines for 2023-2028.

💡INSIGHTS

🎤 PODCAST

Miroslava Betinova, Head of FinTech at Griffin, speaks to Robin Amlôt of IBS Intelligence at Money 2020.

NOW, ON TO THE SUMMARY OF LAST WEEK'S NEWS

🌎 FINTECH HIGHLIGHTS

⭐️ Binance to retract license application in Austria.

⭐️ Zipzero relocates from London to Aberdeen.

⭐️ Bitpanda Pro has been spun out into a separate business named One Trading.

⭐️ Payoneer is laying off 200 employees, about 10 per cent of its workforce.

PAYMENTS

Aria is launching in the UK to help fix the late payments crisis. Aria aims to help workers and businesses in the UK with early payments and deferred payment options.

Flowie wants to make invoices flow freely. The company wants to facilitate money movements between companies.

BNPL

Clearpay is set to exit its EU operations, although its business in the UK will continue to operate.

OPEN BANKING

Pleo is extending its partnership with open banking leader Yapily as it branches out further across Europe and adopts variable recurring payments (VRPs).

Lloyds Banking Group has hailed the success of its inhouse Innovation Sandbox as a key measure in improving its ability to collaborate with fintechs.

Tandem has secured a £20 million capital raise from Quilam Capital after turning in its first full year of underlying profit last month.

NatWest calls for step change in industry approach to open banking.

CRYPTO

Ripio has been approved to operate in Spain, a move that follows competitors including Bit2Me and Bitpanda gaining regulatory approval to set up shop within the country.

Binance’s euros banking partner, Paysafe Payment Solutions, will stop supporting the crypto exchange after Sept. 25.

Shares, has announced it has become the first fintech in the country to secure both crypto registration (PSAN) and a stock trading licence as an investment company (PSI- Entreprise d’Investissement).

Royal assent makes the Financial Services and Markets Bill an Act, and includes measures to bring crypto and stablecoins into the scope of regulation.

BLOCKCHAIN / DEFI

Mastercard to continue crypto foray with beta launch of ‘blockchain app store’. The product was set to be launched as a beta in the United Kingdom.

INVESTMENT

ResistantAI has extended its Series A to $27.6m, with $11m of new funding from Notion Capital.

Crowdcube joins team of rivals launching new retail investment platform Retailbook.

LendInvest scores a £500m investment boost. This investment will strengthen their BTL proposition and newly launched residential mortgage product.

INSURTECH

Qover partners with Monzo to provide a simple, tailored travel insurance solution that can be accessed by Monzo Premium account holders in the UK through the Monzo app.

MOVERS & SHAKERS

Fiinu said that Philip Tansey resigned from his role as chief financial officer and will leave the group with immediate effect. Charles Resnick will step in as interim CFO replacing Tansey.

The cofounder of Primer is stepping down as CEO.

If you are a fintech startup and have over 100 questions send me an email, maybe I can answer a few.