WEEKLY FUNDRAISING ACTIVITY

Last week we spotted 13 European FinTech deals for a total amount of €90m;

REPORT

⚫ What does the future hold for the BaaS market in Europe and the UK?

The UK🇬🇧 and Germany🇩🇪 have been the traditional breeding grounds for BaaS providers in the region. The two countries are the largest market for BaaS platforms, representing around 60% of the market share in Europe.

Check out "The State of Banking-as-a-Service in the UK & Europe", a WhiteSight #fintechreport commissioned by Toqio 👇

⚫ Fintech Projected to Become a $1.5 Trillion Industry by 2030

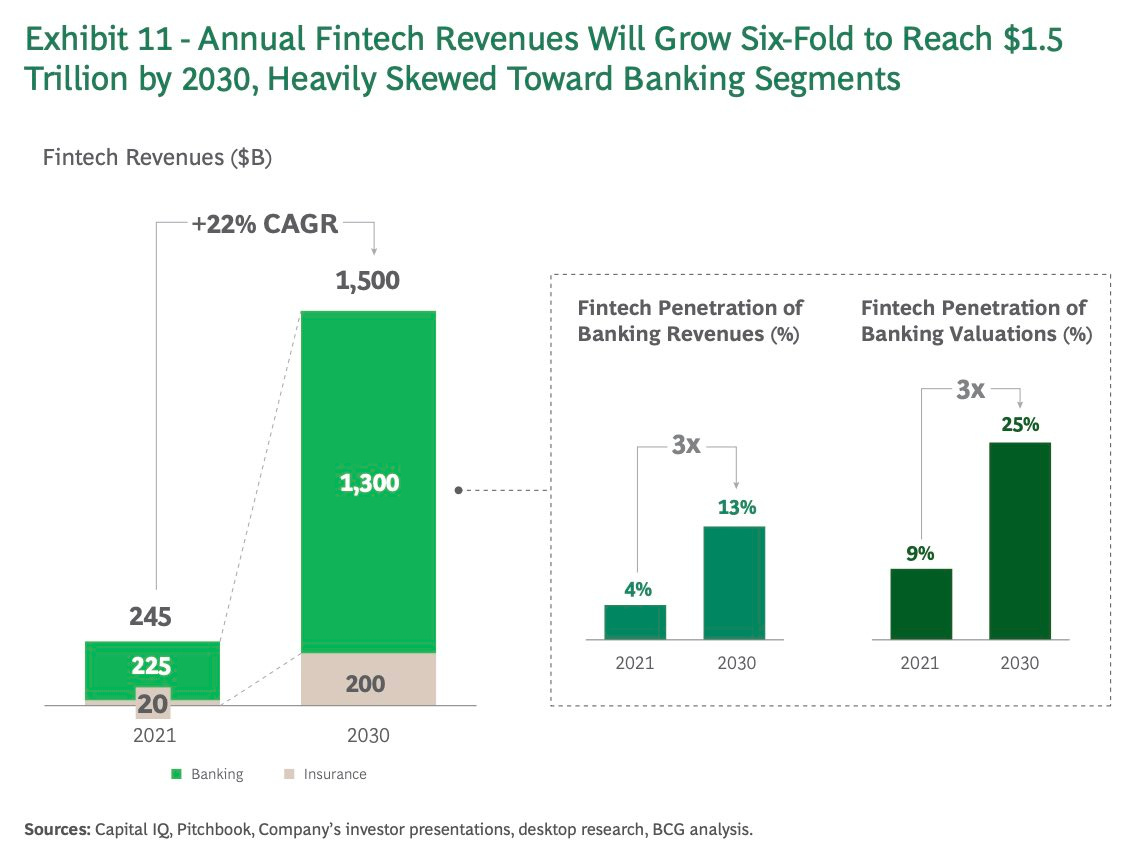

A recent report from BCG & QED Investors projects #FinTech revenues to grow sixfold from $245B to $1.5T by 2030. Currently holding 2% of the $12.5T global financial services revenue, the sector is estimated to grow to 7%.

👀 NEWS HIGHLIGHT

In April 2023 the European Payments Initiative acquired iDeal, the Netherlands’ leading online payment platform. The company is consistently facilitating over 100 million payments a month and is growing volume at approx. 30% YoY.

Max Cutler from Swan dives into what iDeal is and how it works to contextualize this bit of news.

📊 INFOGRAPHIC

German FinTech investment on track to fall 73% in 2023 after weak Q1 results.

German FinTech investment stats in Q1 2023:

German companies raised a combined $293m in Q1 2023, a 60% drop from the same period last year.

German FinTech deal activity reached 48 deals in Q1 2023, a 14% reduction YoY.

Berlin was the most active German city with a 41.6% share of deals.

📰 ARTICLE

Want to know what happened in the FinTech industry in the Nordics in April?

Read the full overview article "Nordic Fintech Snippets – April 2023" by Helsinki Fintech Farm👇

NOW, ON TO THE SUMMARY OF LAST WEEK'S NEWS

🌎 FINTECH HIGHLIGHTS

⭐️ Paysend secures a partnership deal with TelevisaUnivision.

⭐️ Tangem raises $7m in an investment round led by Shima Capital.

⭐️ Coconut is set to be acquired by rival GoSimpleTax.

⭐️ TAS acquired Mitobit via its subsidiary Global Payments.

PAYMENTS

Mamo chose Checkout.com as its payment provider of choice for its flagship product Mamo Business. Mamo will offer a swift onboarding process for its SME customers that can be done in just 24 hours.

Paytently moved out of stealth - the company's AI-driven platform streamlines transactions by intelligently routing them to the ideal acquirer, offering local acquiring in more than 35 markets with over 50 payment connections worldwide.

Cardlay partners with LUNADIS which operates payment cards for the DKV Mobility Group.

BNPL

Innovate Finance says its members are "deeply concerned" by the UK government's plans to regulate the BNPL sector, arguing that the measures would be more onerous than those that apply to credit cards.

DIGITAL BANKING

184 investors have contributed to Frost’s funding campaign since it launched in March. In total, the company is issuing 12.12% equity to those who have invested through the crowdfunding platform.

Deutsche Bank announced that it had reached an agreement on the terms of a recommended all-cash offer for the acquisition of Numis Corporation Plc.

The co-founders of Revolut strongly criticize Britain as a place to run a business, complaining of high taxes, red tape, and a skills shortage and adding that they would never consider a flotation on the London stock exchange.

By acquiring a further 26% stake in TTMzero, United Fintech reached the 51% tipping point to gain majority ownership in the company, one of five acquisitions made during its just a two-and-a-half-year lifespan.

OPEN BANKING

Kreditz raised €10 million from investment company Creades and the venture arm of retail furniture giant Ikea.

Neonomics expanded the launch of its core open banking driven Checkout solution to the Danish market.

GREEN FINANCE

Green-Got banks €5 million to grow its green banking platform in Europe. As a community-led venture, the neo-bank opened up its investment opportunity to its community through crowdfunding.

MOVERS & SHAKERS

ThetaRay announced 260% revenue growth in 2022, and the appointment of Eran Fishov as Vicepresident of Customer Success & Enterprise to accelerate market momentum.

Total Processing announced that Martin Gilbert will be joining its board. Gilbert's invaluable knowledge and experience will be instrumental during a time of rapid growth as the company continues to scale its operations.

If you are a fintech startup and have over 100 questions send me an email, maybe I can answer a few.