For the past week’s funding news overview, we recommend reading our weekly #DoneDeal newsletter 👇

👀 Are you interested in funding news from the FinTech space?

💡 Read all about it in my weekly overview article and get the latest funding news from the global FinTech space in your inbox every week.

👀 NEWS HIGHLIGHT

Raiffeisenlandesbank NÖ-Wien became the first major traditional bank in the EU to move into digital assets through a planned collaboration with Bitpanda Technology Solutions.

📰 ARTICLE

⚫Fintech giants Klarna and Block slam ‘outdated’ UK buy now, pay later regulation proposals

The U.K.’s plan to regulate the buy now, pay later industry is “outdated” and will lead to worse consumer outcomes, executives at two of the industry’s giants said, vowing to fight tooth and nail to relax the proposed rules.

Bosses at Klarna and Block laid into the proposals at an event hosted by U.K. fintech industry body Innovate Finance last week, saying that the rules, while well-meaning, were likely to drive people toward more expensive credit options, such as credit cards and car financing plans.

Read the full article here

⚫Instagram and Facebook will force their checkout experience on Shops soon

Meta announced today that it will be phasing out onboarding of new Shops without checkout on Facebook and Instagram enabled. Beginning April 24 of next year, Shops without checkout on Facebook and Instagram enabled will no longer be accessible.

This means that shops that direct people to an e-commerce site to complete a purchase, rather than allowing people to make a purchase directly through Facebook or Instagram, will no longer be accessible.

🧐 ANALYSIS

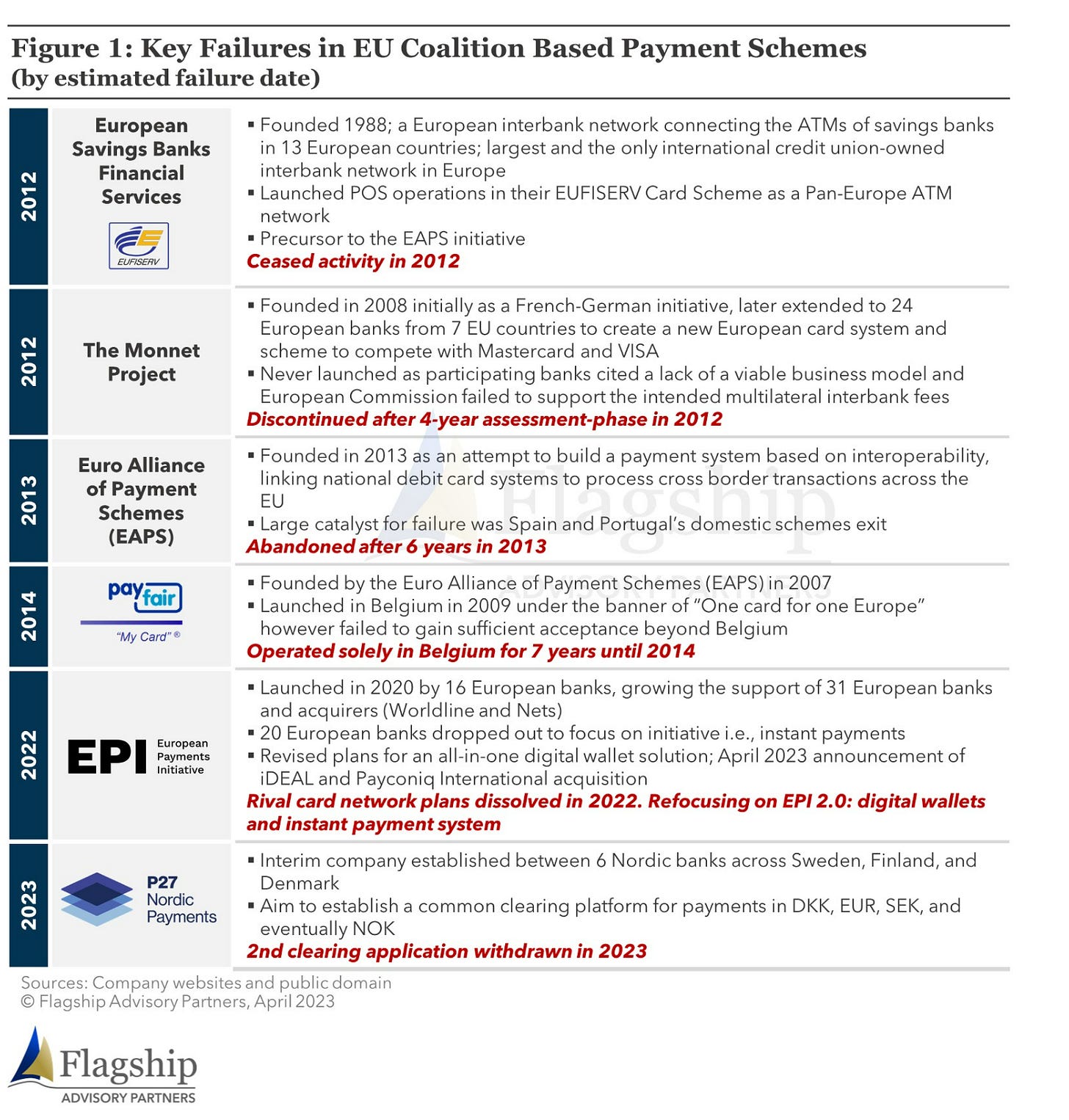

The Nordic P27 initiative is the latest pan-European payments collaboration to fail.

As illustrated below in figure 1, failures in pan-European payment collaborations are not new as there have been several such initiatives in the past.

NOW, ON TO THE SUMMARY OF LAST WEEK'S NEWS

🌎 FINTECH HIGHLIGHTS

⭐️ Bastion Cyber raised €2.5m in seed funding from Kima Ventures, Frst, Global Founders Capital and Motier Ventures.

⭐️ Vacuumlabs announced the launch of several new propositions to complement Thought Machine’s cloud-native core banking technology, Vault Core.

⭐️ Zodia Custody closed a $36m Series A funding round.

⭐️ Bits Technology raised €4 million in a seed funding round that will see the company further develop its API.

PAYMENTS

PingPong Payments received an Electronic Money Institution license from the United Kingdom’s Financial Conduct Authority.

PPRO signed a strategic agreement with NPCI International Payments Limited to offer global partners access to Unified Payments Interface.

TransferMate has been granted authorisation as an Electronic Money Institution by the Central Bank of Ireland, which allows TransferMate to offer an extended service.

Paysend announced the opening of a Dublin office in order to access the EU’s Single Market. The company recently received an Electronic Money Institution license from the Central Bank of Ireland.

Kani Payments was selected by UK climate-conscious neobank Frost as its preferred platform for settlement reconciliations and payment scheme reporting.

OPEN BANKING

Tink joined forces with instant credit provider Younited to create more accurate affordability assessments. Younited will be able to tap into Tink’s Open Banking capabilities to deploy its instant credit to more European consumers.

DIGITAL BANKING

S&P Global and Coinbase Ventures joined a $6 million funding round for Credora, a startup that has built privacy-preserving technology for real-time credit analytics.

Tide announced the launch of the MSME Exchange Programme – an initiative designed to glocalise entrepreneurship and foster bonds between small business owners from India and the UK.

Tembo raised £5 million from Lone Ventures and Starling Bank backer Harold McPike.

CRYPTO

Plug and Play’s Crypto and Digital Assets vertical is now coming to Paris, France. The program aims to help consumer businesses, retailers, and brands move from Web2 into Web3.

MOVERS & SHAKERS

Lanistar announced the appointment of Ed Blankson as its new Chief Financial Officer.

Shieldpay announced the appointment of Andrew Hawkins as Chief Executive Officer for the UK and Europe.

Griffin announced that Marina Gorey joined the company as Chief People Officer.

FINTECH MAPS

If you are a fintech startup and have over 100 questions send me an email, maybe I can answer a few.