Hello Fintech fanatics!

Before we dive into this week’s news overview, I would like to shine a light on the ‘Connecting the Dots in Payments’ newsletter that I launched together with my friend and fellow FinTech Geek Wouter de Vries.

Every Thursday we will summarize the latest Global Paytech News of that week for you to stay up to date on all things in digital payments. Sign up for this great newsletter and let me do the heavy lifting for you in sourcing and curating the news.

Many thanks for your support and enjoy this newsletter!

Cheers,

Marcel

REPORT

Andreessen Horowitz Crypto has published its annual report on the state of crypto👇

Key takeaways:

1. Web3 is more than a financial movement, it’s an evolution of the internet.

2. Blockchains are more than ledgers, they are computers.

3. Crypto isn’t just a new financial system, it’s a new computing platform.

REPORT

The demise of Silvergate, Signature, and Silicon Valley Bank rapidly followed by the implosion of Credit Suisse sent shockwaves through the financial world.

But even before the fall of the two juggernauts, crypto firms were having their own banking peril. For crypto firms, the question of banking isn’t an easy one.

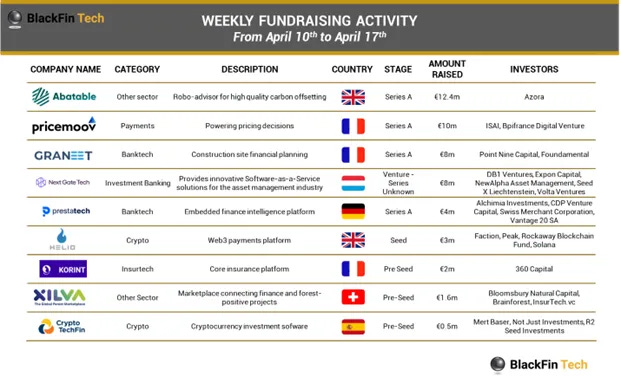

WEEKLY FUNDRAISING ACTIVITY

Last week we spotted only 9 European FinTech deals for a total amount of €49.6m raised;

👀 NEWS HIGHLIGHT

Yonder, a rewards credit card that partners with restaurants and bars, raised a £62.5m Series A round of funding, boosting its valuation nearly three times to £70m.

The cash, which is split between £12.5m of equity and £50m of debt.will be used for a growth push including scaling the company’s headcount by c.100% to 35 people and expanding into new UK cities.

📰 ARTICLE

Research from big four company EY, and Innovate Finance highlighted “barriers” in the FinTech sector with female leaders being overlooked for senior positions within the industry.

EY’s analysis indicated that the gender pay gap in the FinTech industry is as high as 22%, with 17% of respondents from the Powerlist calling for regulation of the gender pay gap to help close the difference.

💡INSIGHTS

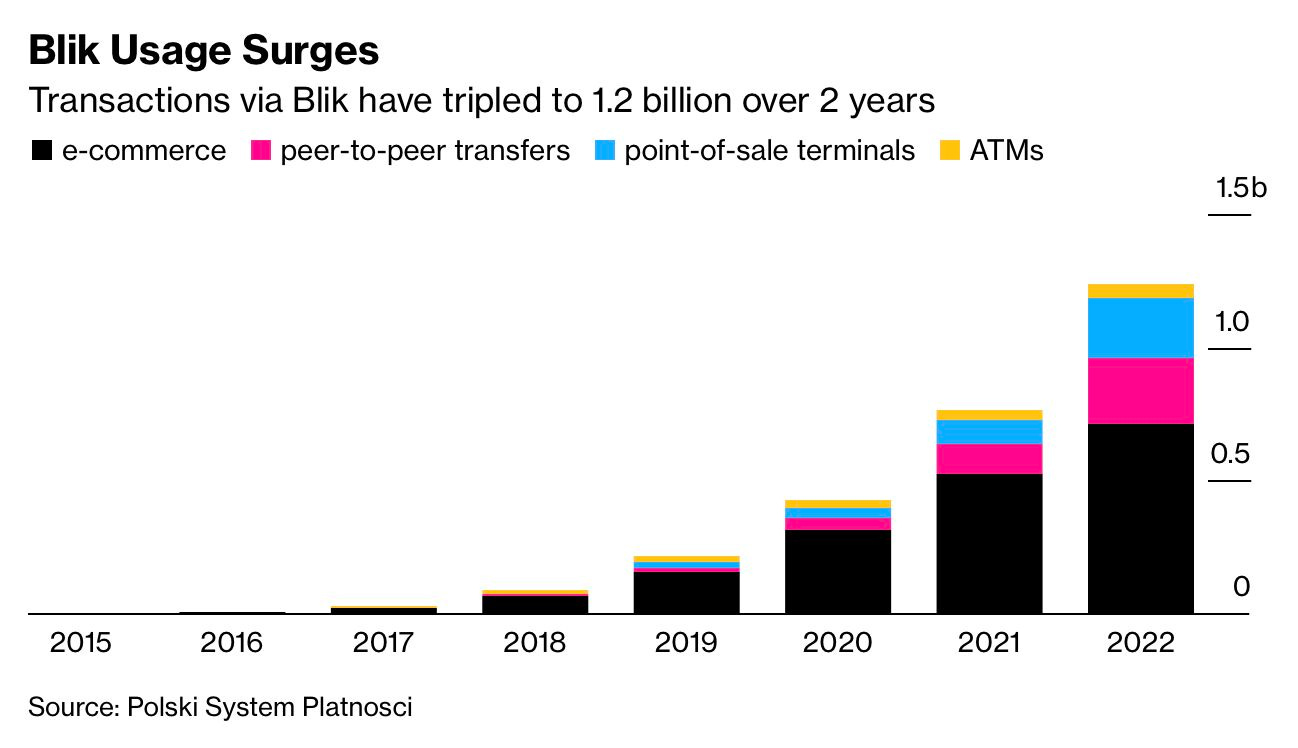

One of the European Union’s most successful mobile-payment companies is starting its international expansion with an ambitious goal to revolutionize cardless transactions across the bloc. A venture of six Polish banks and MasterCard Inc., BLIK boasts of 13 million monthly users — which it says is more than any European peer.

🧐 ANALYSIS

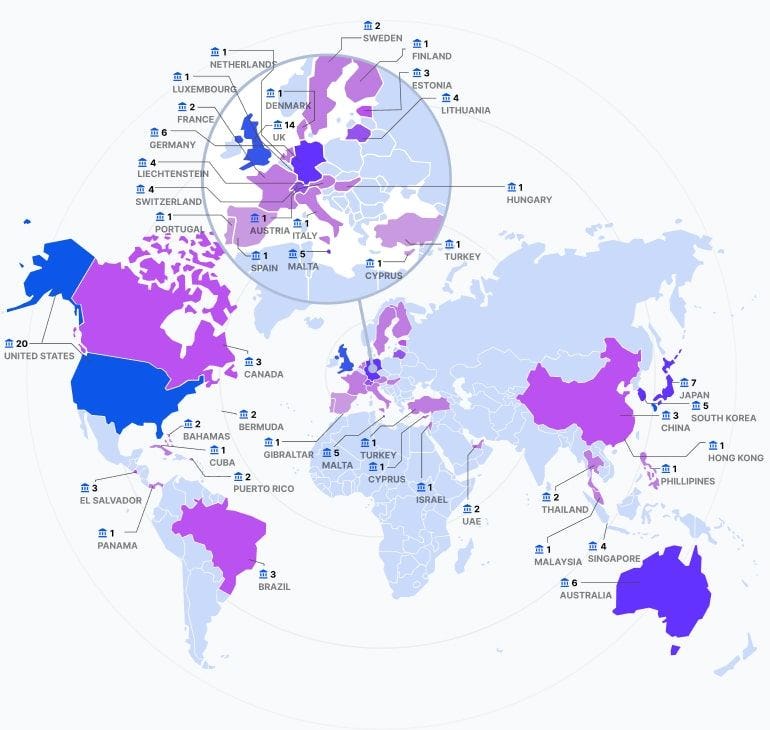

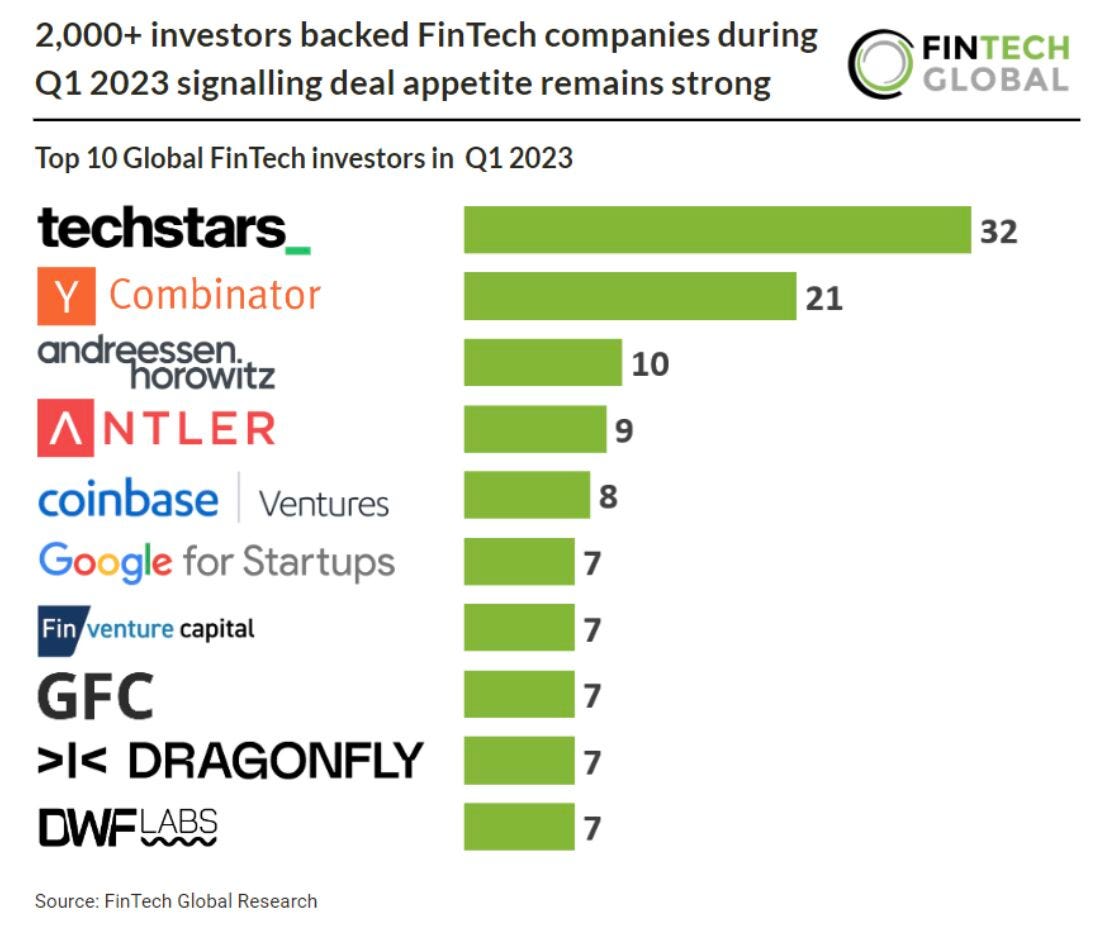

Key Highlights from Global FinTech investor activity during Q1 2023:

👉 2432 investors invested in FinTech companies during the first quarter

👉 A combined $22bn was raised by FinTech companies in Q1 2023

👉 Overall, 1,366 FinTech deals were announced globally in Q1

NOW, ON TO THE SUMMARY OF LAST WEEK'S NEWS

🌎 FINTECH HIGHLIGHTS

⭐️ Twitter will give users the option to buy and sell stocks and other assets from eToro.

⭐️ Wise announced two partnerships aimed at improving diversity and social mobility in the next generation of workers.

⭐️ PensionBee slashed its median hourly gender pay gap to 0% across the company.

⭐️ Factris scored €50m in global funding from global investment business Aegon Asset Mangement.

PAYMENTS

Square announced a new integration across the UK with OpenTable to serve better personalized service based on diners’ unique preferences to create exceptional experiences.

Puulse launched in the UK and Europe, providing free advance payments for gig workers experiencing a productivity lull.

TerraPay raised $100m in equity and debt financing in its Series B round and will use the funds to continue its plans for global expansion, particularly across the LATAM and MENA regions.

Thunes secured a new Payments Institution licence from the Autorité de Contrôle Prudentiel et de Résolution in France.

Floodlight raised a $6.4M seed funding round. The round was led by Aleph, and 83 North.

Visa announced the launch of its Eco Benefits solution in UAE in partnership with the Berlin-based fintech and Visa partner ecolytiq and its Sustainability-as-a-Service solution.

Caxton acquired the entire operating business and share capital of Nimbl, the pocket money app from ParentPay, expanding Caxton's offering into the fast-growing market of youth money apps and cards.

DIGITAL BANKING

FIS.solutions received €250K from Expansion Capital to scale its operations by adding new members to the team.

Ripplewood Advisors LLC is considering a bid for the digital banking arm of Orange SA as the French telecom carrier’s search for a partner reaches its final stage.

SME Finance agreed on a new €100m credit facility with Fasanara Capital to extend an existing funding facility to €240m, helping expand its SME lending in the Baltic region and Finland.

Virgin Money launched a digital wealth management platform for retail investors through a joint venture partnership with abrdn.

The Banque de France published a detailed discussion paper on DeFi, exploring the dangers concerned within the space and potential regulatory adjustments that would mitigate them.

Saxo introduced a new, innovative interest rate model that allows clients to earn interest income on their uninvested cash with no lock-in period or upper limit on amount paid.

SOFTWARE SOLUTION

Finastra launched a partnership with sustainability technology platform Alygne to help asset managers make informed ESG investments.

MOVERS & SHAKERS

Monument appointed Craig Blackburn as its new chief of staff.

WealthKernel appointed Brian Schwiegernew as its new Chair.