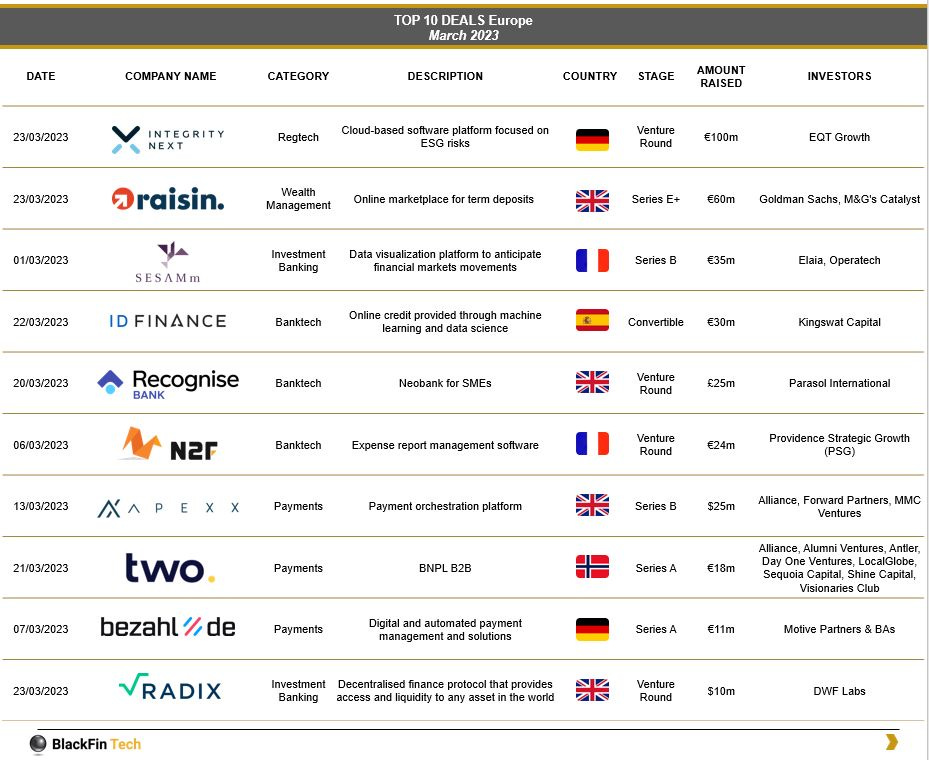

Here is a list of last month's top 10 European FinTech funding deals👇

REPORT

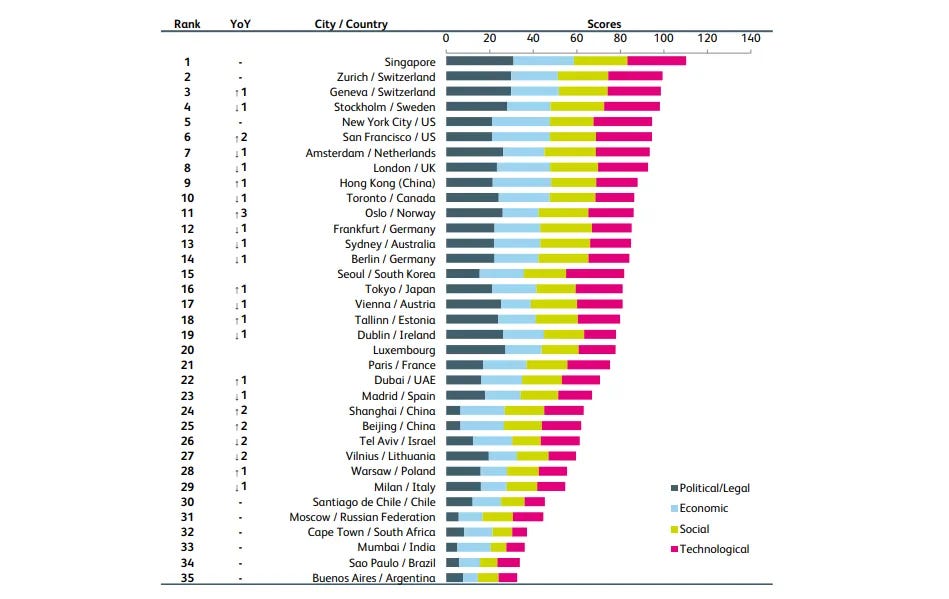

In order to evaluate the attractiveness of different locations for FinTech companies, the seventh edition of the FinTech hub ranking is presented in this #fintechreport by Thomas Ankenbrand & Denis Bieri, at the Institute of Financial Services Zug IFZ.

Download the full 191-page report below 👇

REPORT

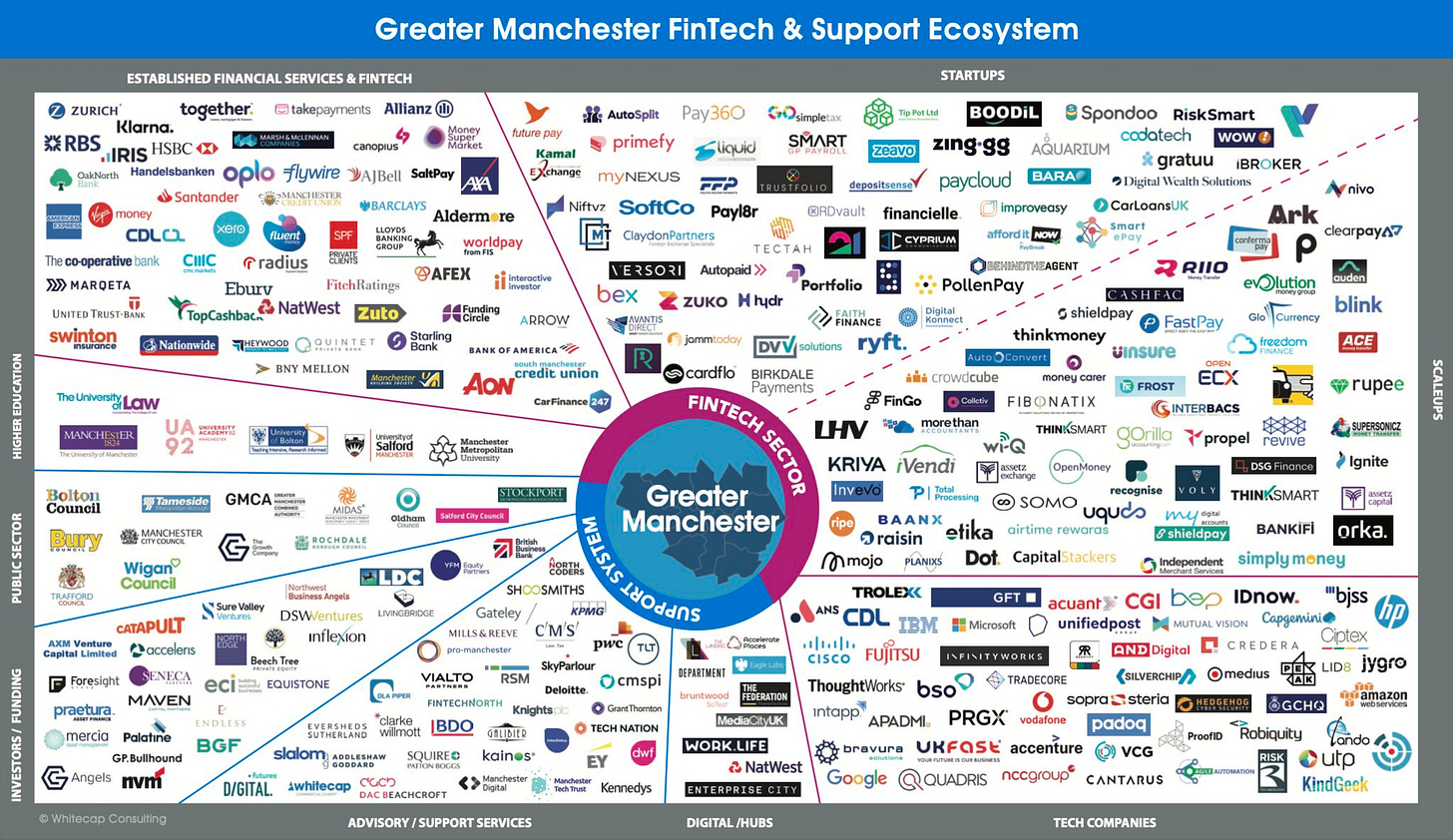

Check out & download the latest Whitecap Consulting Greater Manchester FinTech Report/Map👇

REPORT

Check out Finnovating's latest #fintechreport "FinTech Global Vision 2023". Download the full report through the link below👇

👀 NEWS HIGHLIGHT

Fourthline raises € 50 million. The platform provides banks and financial services providers with a complete suite of proprietary tech products that adhere to local KYC, AML and GDPR requirements in Europe and beyond.

📰 ARTICLE

FinTech investment hit the brakes in 2022; funding into the European sector dropped by a third to $19.2bn, down from $28.9bn in 2021, according to CB Insights.

Read the full article by Amy O'Brien, with a list of Europe’s most active Angel Investors in FinTech.

💡INSIGHTS

In 2019, e-wallets reportedly became the number one payment method in the world, after a two-decade history that has seen them build from a fringe financial product.

💡INSIGHTS

The Netherlands, with its vibrant startup scene, strong tech infrastructure, and supportive government policies, has become a hub for FinTech companies and startups.

NOW, ON TO THE SUMMARY OF LAST WEEK'S NEWS

🌎 FINTECH HIGHLIGHTS

⭐️ Enfuce was recognized by Celent as a winner of a Model Risk Manager award for embedded fraud prevention in its Card as a Service solution.

⭐️ Frost will offset its carbon emissions through a range of green initiatives.

⭐️ Toqio appointed Gabriel de Montessus as its new Board of Directors’ Chairman.

⭐️ CSI and Hawk AI partner to release AI-driven solutions for fraud prevention.

⭐️ Ingenico acquired smartphone payment acceptance company Phos.

⭐️ Acorns acquired GoHenry in an all-equity deal.

⭐️ Quantexa raised $129 million at a $1.8 billion valuation.

PAYMENTS

Inpay announced the firm’s record results and outlined plans for significant future growth within its UK office.

Paymentology joins forces with Wio Bank PJSC to power its banking model.

Open Payments closed a €3 million round led by Industrifonden.

Paytrix raised $18.3 million in a funding round which will drive product development and international expansion.

Equals Group acquired OONEX for £4.1 million as it looks to expand across Europe.

Checkout.com faces exec team exodus and makes layoffs ‘by stealth’.

Tranglo announced the launch of instant SEPA payments to Europe.

Yonder launches an app ‘Send Points’ feature to expand reward offerings for members.

Viva Wallet Marketplace Solution launches pan-European marketplace platform.

Amazon sellers are now able to integrate their stores with Juni’s platform.

Advanced Payment Solutions is set to enable merchants to receive money from clients of 700 EU banks via Open Banking.

APAS handed the Wirecard’s previous auditor a €500,000 fine.

TerraPay secures €91.7M to expand its payments infrastructure.

BNPL

Klarna relaunches ‘Money Talks’ game as Brits get more comfortable discussing finances.

DIGITAL BANKING

Bink raised £9 million in a fresh funding round. Lloyds Banking Group bought a minority stake in Bink in early 2022.

Tide hits 500,000 UK customer milestone after six years.

Tenity announced the first closing of its Tenity Incubation Fund I with investments from SIX Group, UBS’ strategic venture, and others.

ArK Kapital extends capital pool to €400 million and expands non-dilutive financing model to Germany.

Penny announced the launch of Penny Connect, designed to expand accelerated access to finance for small and owner-managed UK businesses.

Teya is launching, introducing itself as a provider of services to small businesses.

Finance Incorporated selected ThetaRay to further strengthen its AML framework.

ClearBank slashed its 2022 losses by 65% as income reached a record £58m.

Kashet came out of stealth mode after raising £5.4 million in an initial funding round.

Lunar Bank is to offload its P2P business to SaveLend Group.

INVESTMENT

Lightyear launches more than 100 UK stocks and ETFs on the London Stock Exchange.

ReAlpha acquires Columbus' Rhove, planning more acquisitions in the fragmented short-term rental market.

OPEN BANKING

According to Coadec’s analysis, UK's open banking sector is currently valued at £4.1bn.

ING partnered with Salt Edge, unlocking a new range of open banking use cases for small and medium-sized enterprises’ segments.

Finanzguru gets €13 million in funding from SCOR Ventures and PayPal Ventures.

CRYPTO

SwissBorg raises $23 million in a community funding round, which attracted a total of 16,660 investors.

BLOCKCHAIN / DEFI

LI.FI raises $17.5m to help traditional finance build on DeFi.

Acre secures £6.5m to simplify home-buying.

GREEN FINANCE

Clim8 is shutting down and searching for a potential buyer.

Agreena raises €46 million to scale the regenerative revolution.

REGTECH

Salv partnered with a global identity verification provider Veriff to strengthen the fight against financial crime.

MOVERS & SHAKERS

Torben Rabe joined Qonto’s central team as Global Partnerships Director.

Griffin appointed Chad Ryan as Chief Financial Officer and Dora Grant as Chief Risk Officer.

European Payments Council names Giorgio Andreoli its new Director General.

Checkout.com appointed Céline Dufétel as its new president.

Philippe Morel will take over as CEO of Railsr.

Paysafe hires Nicole Carroll as Chief Strategy and Innovation Officer.

PPRO appoints Motie Bring as its Chief Commercial Officer.