REPORT

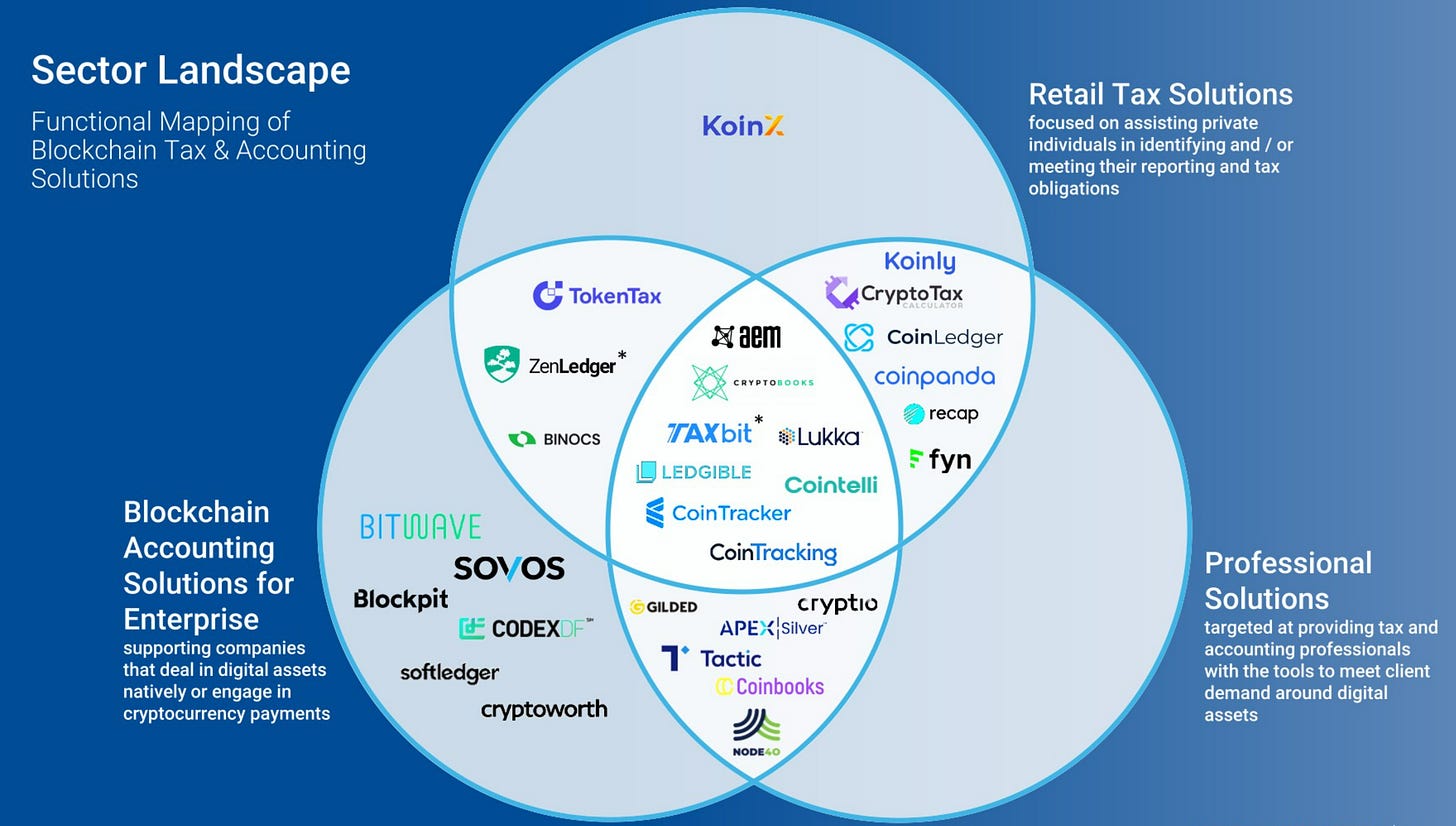

Following a long period in which cryptocurrency traders and participants in the broader ecosystem were largely left to their own devices, tax authorities now apply increasingly elevated levels of scrutiny and enforcement action.

In response, consumers and enterprises seek the means to both reactively and proactively ensure compliance with tax regimes.

In many cases, tax reporting requirements coincide with the need for enterprise-scale accounting and reporting solutions.

👉 Download the full Financial Technology Partners research report here

REPORT

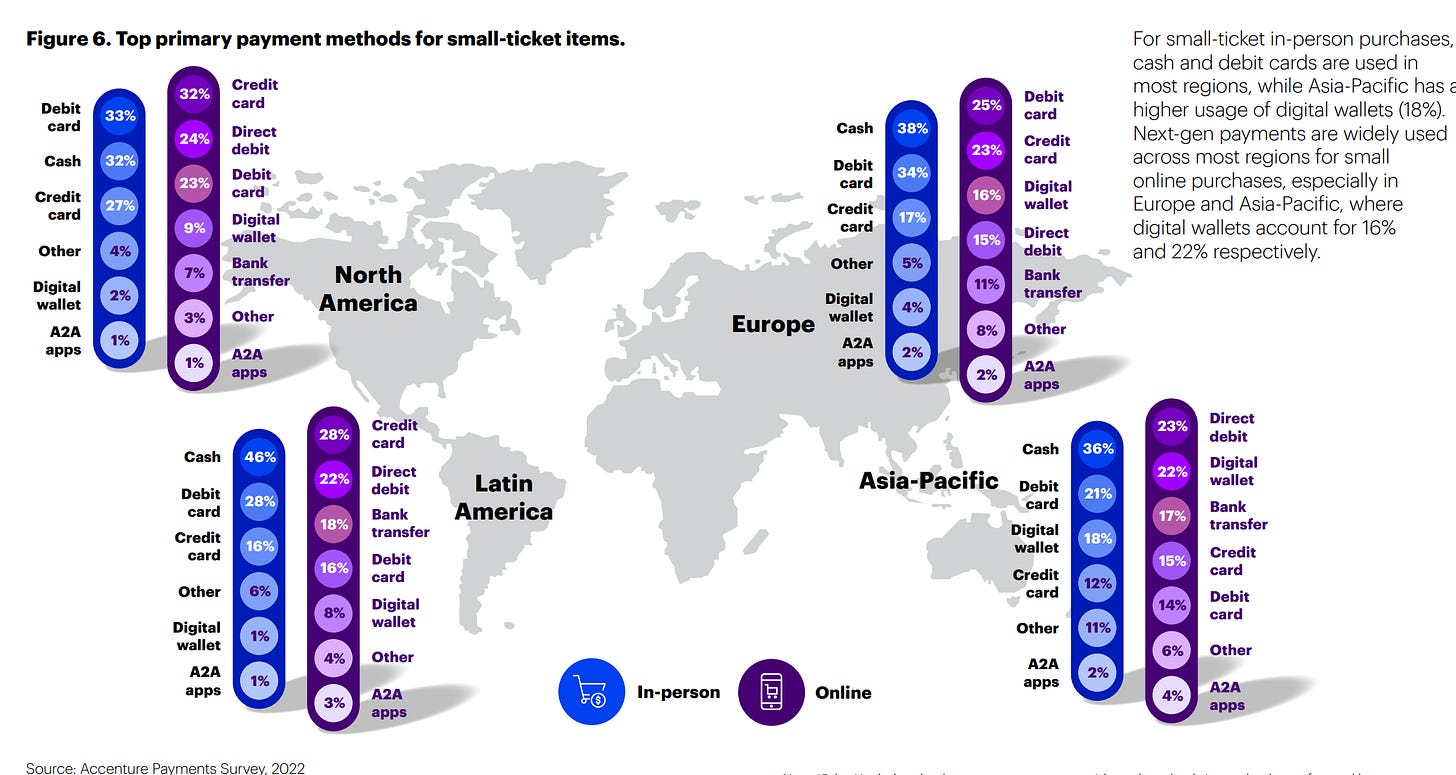

Next-generation consumer payments are growing rapidly due to changes in consumer behavior, advances in tech and innovative competition.

Accenture research finds that over half of consumers in major markets have used tools like digital wallets, which are more popular than credit cards.

👉 Check out the #fintechreport: “Payments gets personal—strategies to stay relevant” by Accenture here

👀 NEWS HIGHLIGHT

In 2022, G20 countries sent nearly $212 billion in remittances.

But nearly $11.6 billion was lost to fees along the way. The reason remittance prices remain high is the lack of transparency. Today, providers can tell consumers their transfers are “free”, include “0% commission” or cost just a low fixed fee of $5. In reality, however, the biggest cost is hidden in a terrible exchange rate.

👉 Read the full report by Wise here

📊 INFOGRAPHIC

2022 wasn’t 2021 — but it was still the second-biggest year on record for interest in European startups from outside the continent.

International funds poured $22.6bn into European startups in 2022, according to data from Dealroom.co (up until December 19), compared to $36.2bn in 2021 — and just $14.9bn in 2020.

👉 Read the full Sifted article by Tim Smith here

📰 ARTICLE

2022 was marred by mass fintech layoffs in the second half of the year.

Huge companies including Stripe, Plaid, Pleo and Klarna all made job cuts this year, and there were mass layoffs at Meta and Twitter in the tech space as well.

In the first half though we saw a host of top players make the leap from the traditional finance space into crypto and digital banking – including HSBC’s former group chief risk officer – and a number of big appointments from within the industry as well.

👉 Check the Altfi article by Amelia Isaacs here

📰 ARTICLE

After a record-breaking year of fundraising and growth in 2021, many European fintechs were forced to step on the brakes in 2022.

As the access to fresh investment dried up, the sector saw some of the biggest layoffs, the first down rounds and the first insolvencies in European tech.

Heading into 2023, industry watchers expect even more of the same. As the tech sector that’s closest to financial markets, a slowdown in economic growth will have a direct impact on fintech revenues. But some business models will be more at risk than others.

👉 Read the whole Sifted article by Amy O'Brien here

💡INSIGHTS

Despite one of the worst years for companies on a macroeconomic level and huge valuation drops for a number of big names, Checkout.com, Klarna, SumUp and Scalapay all had massive funding rounds in 2022.

FinTech lost its crown as the top industry for venture capital funding globally in Q3 of 2022, according to Dealroom, but it wasn’t all doom and gloom.

👉 Check the whole Altfi article by Amelia Isaacs here

NOW, ON TO THE SUMMARY OF LAST WEEK'S NEWS

🌎 FINTECH HIGHLIGHTS

⭐️ FinTech investment in the Czech Republic is expected to reach $22.8m in 2022 based on the first three months of 2022, a 71% drop from 2021. Link here

⭐️ Check out this amazing FinTech report: “The UX Playbook for Finance” with some great case studies. Link here

⭐️ Amsterdam-headquartered Bynder has been acquired by Boston-based private equity firm Thomas H. Lee Partners. Link here

PAYMENTS

Nova banka a.d. Banja Luka partnered with UnionPay to roll out UnionPay’s virtual card solution in Bosnia and Herzegovina via TIZI wallet. Link here

CRYPTO

FTX founder Sam Bankman-Fried is reportedly cashing out large amounts of cryptocurrency soon after being released on bail. Link here

MOVERS & SHAKERS

Backbase announced the appointment of Mark Appel as Chief Marketing Officer. Link here

FINTECH MAPS

If you are a fintech startup and have over 100 questions send me an email, maybe I can answer a few.