Finix Launches Advanced Fraud Monitoring in Partnership With Sift

Weekly news up to Tuesday, 26th of November 2024

😎 SPONSORED CONTENT

We've released a new (free!) guide for e-merchants, tackling the four major pain points: cart abandonment, facilitating global payments, decline rates, and chargebacks. Learn how to simplify your checkout process to capitalise on increased consumer purchasing levels.

👀 NEWS HIGHLIGHT

Intuit has added a generative artificial intelligence (AI)-powered financial assistant to QuickBooks.

The new Intuit Assist for QuickBooks is designed to help small and medium-sized businesses (SMBs) by generating estimates, invoices, bills and payment reminders and delivering personalized recommendations, the company said in a press release.

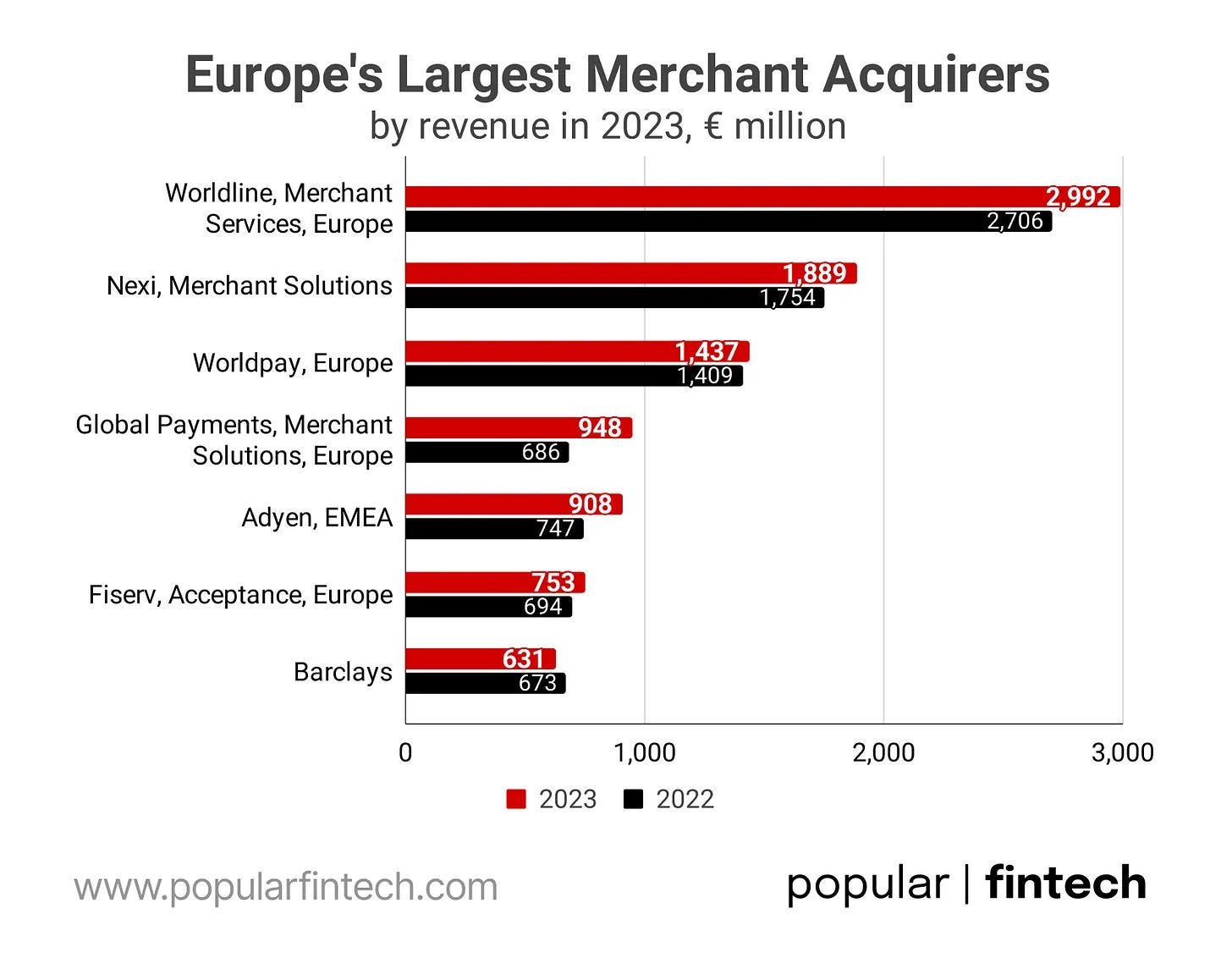

📊 INFOGRAPHIC

NOW, ON TO THE SUMMARY OF LAST WEEK'S NEWS

🌎 FINTECH HIGHLIGHTS

⭐️ Revolut Reveals 2025 Vision, With AI Assistant, Mortgages, and ATMs on the Horizon.

⭐️ Tide launches new carbon calculator to help SMEs reach Net Zero.

⭐️ Finix launches advanced fraud monitoring in partnership with Sift.

⭐️ FinTech Finastra Confirms Data Theft; Investigation Underway.

FINTECH

Stake implements AFTs to optimize costs and expands into new markets with Checkout.com. Stake, the first to implement Account Funding Transactions (AFTs) via Checkout.com in MENA, boosts payment efficiency and highlights Checkout. com’s leadership in enabling cross-border transactions to drive partner growth.

Payhawk partners with J.P. Morgan to drive payment innovations. “Our strategic focus on medium-sized and large companies in traditional industries requires the highest standards and trust in our banking partners,” Payhawk CEO and co-founder Hristo Borisov said. Read more

Zilch considers secondary share sale after first profitable quarter. According to CEO Philip Belamant, a secondary share sale would enable the company to clean up its cap table ahead of an IPO — and make a bunch of its employees happy.

ClearScore launches Credit Health, a revolutionary approach to accessing good credit. ClearScore's biggest update since 2015 enhances user access to financial data while expanding its online marketplace with over 160 financial partners. Building on a decade of innovation, it empowers users to make better credit and financial decisions.

LTIMindtree bags contract extension from Europe-based Nexi group. As part of this partnership, LTIMindtree will optimize Nexi's core platforms for better performance and scalability, while managing its hybrid infrastructure to seamlessly integrate on-premise and cloud solutions.

FinTech unicorns are watching Klarna’s debut for signs of when IPO window will reopen. Last week, Klarna filed confidentially to go public in the U.S., ending months of speculation. While FinTech circles are buzzing, founders are watching the market, focusing on pricing and stock performance. Explore more

Klarna’s Planned IPO Sets the Stage for More FinTech Listings. Klarna confidentially filed for an IPO with the US Securities and Exchange Commission. While the company provided no financial details, analysts last month put Klarna’s implied valuation at about $𝟭𝟰.𝟲 𝗯𝗶𝗹𝗹𝗶𝗼𝗻.

Worldline to raise new debt after tumultuous year hurts earnings. Worldline SA, the French payments firm formerly part of Atos SE, completed a refinancing effort to secure cash for upcoming debt maturities, despite raising its interest costs. The company issued a five-year bond at a 5.375% yield, according to a source.

Worldline to raise new debt after tumultuous year hurts earnings. Worldline SA, the French payments firm formerly part of Atos SE, completed a refinancing effort to secure cash for upcoming debt maturities, despite raising its interest costs. The company issued a five-year bond at a 5.375% yield, according to a source.

European climate tech poster child Northvolt is filing for Chapter 11 bankruptcy in the US after months of trying to secure fresh capital from investors. Northvolt will undergo a reconstruction process, set to conclude in Q1 2025. Read more

PAYMENTS

Airwallex partners with Moss to enhance and streamline global payments. Airwallex’s solutions enable Moss customers to top up their wallets, transfer funds, and use currency conversion for better exchange rates. This enhanced functionality helps Moss support businesses across nine European markets.

Solidgate AI Dispute Representment. The Solidgate AI Dispute Representment module connects to various acquiring banks and payment methods via its payment orchestration engine, streamlining the process. Click here to learn more

Buckaroo launches Hosted Fields for online card payments. With this new solution, consumers will be enabled to securely enter their card details directly within the webshop’s checkout without being redirected to an external payment page.

FINTRAC registers Navro to operate its payments curation platform in Canada. This will enable the company to provide money transfer services to businesses in the country while continuing to focus on meeting the needs, preferences, and demands of clients in an ever-evolving market.

Sweden's Riksbank presents case for modernisation of retail payments infrastructure. The Riksbank’s view is that the future infrastructure will have to comply with European standards, be ready to accept retail payments instantly or on schedule, and facilitate the entry of new actors using new technologies.

OPEN BANKING

tell.money selected as Open Banking Gateway Provider for Monese, expanding EU coverage and streamlining TPP integration. This strategic partnership arrives at a crucial time when embedded finance solutions are experiencing unprecedented growth in the UK and EU markets.

DIGITAL BANKING

Revolut celebrates: reached 50 million users globally. Revolut marks a major milestone, surpassing 50 million customers worldwide, including 2 million in Italy. The company now aims to establish itself as a leading global bank.

Starling Bank staff resign after new CEO calls for more time in-office. Staff have resigned at Starling Bank after its new chief executive demanded thousands of workers attend its offices more frequently, despite lacking enough space to host them.

Atom becomes first UK bank to commit to being carbon positive by 2035. The bank has made headlines by purchasing 25 acres of newly planted broadleaf woodland in Northumberland, becoming the first UK bank to commit to being carbon positive by 2035.

Wero launches in Belgium. The European Payment service Wero, through which some 16 European banks aim to compete with services such as PayPal, Mastercard and Visa, was officially launched in Belgium. Wero is now accessible through the applications of Belgium's four largest banks.

N26 reports first profitable quarter after customer limit lifted. The German neobank reported its first profitable quarter in Q3 after a 2021 customer cap was lifted. It forecasts €440m in 2024 revenue, with 50% from interest income, surpassing competitors like Monzo.

HSBC relaunches 'Premier' brand in UK in pursuit of wealthy clients. It targets so-called mass affluent customers with £100,000–£2 million ($2.5 million) to invest through its fee-free Premier product. Jose Carvalho, head of wealth and personal banking, said the offering includes 24/7 service, financial tools, and other benefits.

UK challenger bank Kroo considers offering investment products. The challenger bank has suggested that it could begin offering investment products, amid a further fall in interest rates and customers becoming less risk-averse. Read on

Banking-as-a-Service will provide plumbing for half of future banking activity, says NatWest Boxed boss. George Toumbev, chief commercial officer, NatWest Boxed, talks through its proposition and some of the challenges in the market. Listen here

CaixaBank sets business growth and transformation as the pillars of its new strategic plan. To achieve this goal, the Group is focusing on three strategic priorities: accelerating business growth, driving transformation and investment, and solidifying its position as a leader in sustainability.

CRYPTO

Gemini launches in France after VASP registration, expands crypto services. According to the firm, this move aligns with the its strategy to expand its presence in Europe, capitalizing on France's growing crypto and Web3 market. Read on

Yellow Card secures crypto licence in South Africa. The company has secured a Crypto Asset Service Provider (CASP) licence, a significant step in its regional expansion. Yellow Card entered South Africa in 2020 and operates in 20 African countries.

Universal Digital Payments Network and Forus Digital co-operate on CBDC testing environment. This partnership is set to empower African communities, governments, and businesses, and represents a significant step toward realising the shared goal of financial inclusion and economic advancement across Africa.

PARTNERSHIPS

Tarabut & Geidea sign MoU to explore game-changing SME financing solutions in Saudi Arabia. The partnership sets the stage for both companies to collaboratively explore and develop groundbreaking solutions that could create new, more efficient and accessible financing opportunities that empower SMEs.

Worldpay partners with Mastercard to introduce Virtual Card Programme for travel agents. Through the Mastercard Wholesale Programme, Worldpay provides virtual cards to travel agents, enhancing payment efficiency, flexibility, and benefits for agents and suppliers across the UK and Europe.

FOO partners with eNovate to further digital transformation in Egypt. This collaboration offers FinTechs in Egypt a scalable platform, empowering them to focus on innovation and growth in the dynamic financial sector. The ongoing FOO-eNovate partnership includes key projects, starting with an end-to-end digital solution for universities.

Guavapay partners with American Express to expand merchant payment acceptance options. MyGuava Business merchants can now accept AmEx via online gateways and POS terminals in the UK and Europe, expanding Guavapay’s reach and helping businesses access high-spending customers while improving payment experiences.

Senegal-based FinTech company New Africa Technology (NAT), joins forces with Mastercard to introduce a virtual and physical prepaid card for individuals through NAT’s existing digital wallet solution, ‘’Flash’’. This collaboration aims to transform the payment landscape in Senegal, Côte d’Ivoire, and Benin.

DONEDEAL

EdfaPay Raises USD 5M to Power FinTech Expansion Across MENA. The funding underscores rising demand for FinTech solutions in the region’s SME and startup ecosystem, while EdfaPay’s growth fosters competition, boosts FinTech adoption, and supports economic transformation efforts.

Stripe is once again buying back shares, valuing the company at approximately $𝟳𝟬 𝗯𝗶𝗹𝗹𝗶𝗼𝗻 According to documents seen by Bloomberg, the share price is set at $27.51, reflecting the same valuation Stripe reached in a previous share sale earlier this year.

M&As

Modulr acquires accounts payable automation disruptor Nook. The acquisition deepens Modulr’s focus on developing comprehensive solutions that address the evolving needs of businesses. Following a short period of integration Modulr AP, powered by Nook, will launch in the first quarter of 2025.

Paxos to Acquire Finnish E-Money Institution Membrane Finance. The platform announced it has agreed to acquire Membrane Finance (Membrane) in Finland. The acquisition is subject to regulatory approval. Upon completion of the acquisition, Paxos will be a fully licensed EMI in Finland and the EU.

MOVERS & SHAKERS

Russia's central banker in charge of digital payments system resigns. Olga Skorobogatova, Russia's First Deputy Governor and key figure behind the digital rouble and domestic payments system, has resigned. She joined the central bank in 2014 and played a pivotal role in the rapid digitalization of the Russian banking sector.

Emily Turner appointed CEO of HSBC Innovation Banking UK. Turner replaces former Silicon Valley Bank UK head Erin Platts, HSBC said, who will support the bank as a special adviser. More on that here

Qonto appoints Heidrun Luyt as Chief Growth Officer to accelerate European expansion and drive customer-centric growth, reaching 45% women in leadership team. As CGO, Luyt will oversee Qonto's 300-member growth team, covering sales, acquisition, client development, brand, communications, and growth operations.

Curve appoints Edoardo Volta as SVP, partner marketing and business development. Edoardo’s expertise in building multinational payment partnerships will be key to expanding Curve’s digital payment solution across Europe and driving its growth.