Daily Fintech Newsletter | Mar. 7th

Hi!

In case you missed it, please see below today's most relevant fintech news.

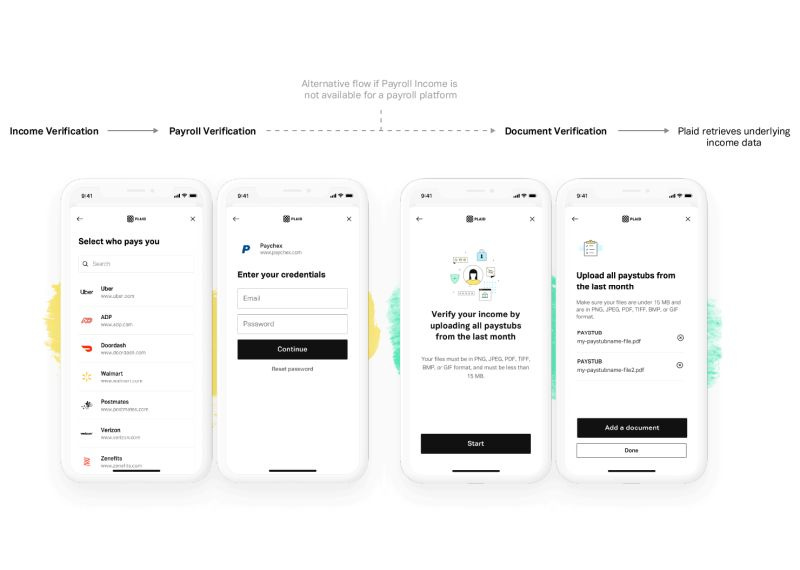

Fresh off the termination of its planned merger with Visa, Plaid announced Thursday a new income verification product, which it said is aimed at “improving the lending lifecycle” with payroll data. Dubbed simply Income, the new product — which is currently in beta — is designed to make it easier for people to verify their income in order to do things like secure loans, qualify for mortgages, rent apartments and lease cars, among other things. Plaid Income gives lenders — both at FinTech companies and financial institutions — verified and permission data on the income, employment status, and tax liabilities of individual users. Link here.

The covid pandemic has compressed years of online commerce progress into just several months. Some of the biggest winners of the shift are Buy Now Pay Later (BNPL) companies - Afterpay, Affirm, and Klarna all benefited from rising valuations and funding. Link here.

There are always startups waiting in the wings to be the next “insert company name here.” In the case of Robinhood, the stock-trading app valued at $20 billion, there is a growing list of retail-trading competitors who are raising significant venture funding and gaining traction. With Robinhood having a big share of the market, one of the lingering questions was if venture capitalists would be willing to fund competitors. The answer, as we especially learned this week, is “yes.” Link here.

Countingup, the U.K. FinTech offering a business current account with built-in accounting features, has closed £9.1 million in Series A investment. Link here.

Amazon has opened a cashier-less store in London that lets customers "just walk out" once they have collected their shopping, with payment automatically taken from their account. Link here.

Melbourne-born Airwallex has acquired Hong Kong's UniCard Solution Limited, joining the likes of PayPal, Alipay, and WeChat as a Stored Value Facilities (SVF) licensee under the territory's payment regulations. Link here.

Unslashed Finance, a company that provides insurance products for crypto assets, announced its $2M funding round. Link here.

Mexican salary advance startup minu has raised $14 million in Series A funding. Link here.

Monite launches a finance management platform that automates the admin and accounting processes for SMEs and announces it has raised €1.1M in pre-seed funding. Link here.

French alternative lender for the self-employed Mansa has raised €18m. Link here.

This ends my Daily Fintech Newsletter. Let me know if there are any questions or news/insights worth mentioning in the next newsletter. Until the next!

Regards,

Marcel van Oost

marcelvanoost.com

My weekly newsletter

Sign up for my Weekly Digital Banking newsletter on Substack here.

My free daily newsletters

Sign up for my Daily Digital Banking newsletter here.

Co-invest alongside me in the most promising FinTech startups

Join our Angel Investors Syndicate. Link here.

Looking for funding?

If you are a startup looking for funding, sign up here.

Join our group

Do you have and use Telegram? Join our group and get the latest changes to the Fintech industry as they are happening.

Sign up to get my updates first!