Online shopping changed our way to shop, especially in 2020 with the corona pandemic. What also changed in the latest years is our way to pay for online purchases. The Buy Now Pay Later (BNPL) concept became an almost ubiquitous form of payment like credit cards.

Other driving factors making consumers choose BNPL over credit cards are to avoid paying credit card interest, making high value purchases and skipping credit checks (for those with lower than average credit scores), according to a study by The Ascent.

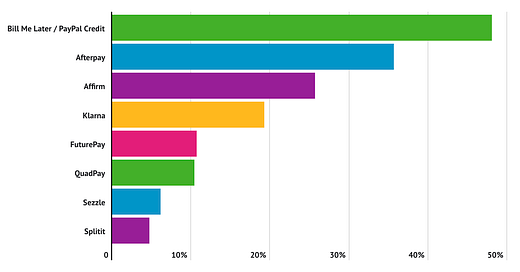

The same study also shows most popular BNPL services for Americans in 2020 were Bill Me Later/Paypal, followed by Afterpay, Affirm and Klarna.

BNPL has become so popular headed by FinTechs like Affirm, Afterpay and Klarna that Paypal was the latest player to launch a BNPL service to go head-to-head with them in the US.

American Affirm added more fuel to the BNPL fire last September, with a series G round that brought in USD $500 million, bringing the company’s total raised to USD $1.3 billion. Last week Affirm went public raising USD $1.2 billion with an initial public offering that went over all expectations and now, the company’s valuation is about USD $23 billion. The Affirm IPO jumped by double digits on its first day of trading.

In Europe and the rest of the world, the BNPL also attracted a lot of attention and massive funding rounds and valuations.

Australia’s Afterpay is worth USD $20B+, after going for their IPO at a valuation of only around USD $100m in 2016. In 2020, Afterpay’s share price has shot up since mid-March from USD $8.90 per share on 23 March, stock soared to a high of USD $75.05 on 21 July.

The largest BNPL service provider in Europe is Swedish unicorn Klarna, present in 17 countries including the UK, Germany, and other European countries. It has over 70 million customers, 190,000 retail partners, and 2,500 employees. The company also said it added 200 retailers a day during the first part of 2020, mainly due to the pandemic and increase of online sales.

Just last November, Klarna brought in USD $650 million in equity funding from a group of investors led by Silver Lake. The funding round gives Klarna a valuation of USD $10.65 billion, it said.

Klarna also hinted that they might have their IPO in the coming year or so, sooner than planned because of the pandemic online shopping boom.

A BNPL newcomer making waves in the UK is Tymit - launched in December 2019, Tymit offers a credit card that lets customers pay in installments allowing them to avoid paying unnecessary interest by spreading their cost over 3, 6, 12 or 24 months. Tymit users can also simulate purchases before they buy and, with true costs made available up front, see how they will affect their bill.

Tymit is also on the spot for investments. Just last November, Tymit received £4m from VentureFriends, an early stage VC as reported by FinExtra.

What’s making Tymit so interesting is their straightforward approach to innovation offering a totally new lending concept.

In an interview for Startup.info, CEO Martin Magnone said :

“We are guided by two principles: First, always start with real customer problems in the market. Second, reinvention over repetition: we like to break things apart and start fresh rather than skirting around the edges making incremental changes. So, if you look at what we’ve done, we’ve totally recreated the credit card experience around a new lending model. That’s all been driven by a mission to give the customer more transparency and control over their borrowing.”

When asked what Tymit offers that the BNPL giants don’t, Magnone explained: “We offer the kind of flexibility, transparency, and control they can’t match. Tymit customers can see upfront costs for every purchase and spread the payment over 3 to 36 months.”

According to Magnone, BNPL gets a lot right, like flexible payment planning and upfront costs, but the lack of transparency, like offering a consolidated view of their spending is still lacking. Tymit picks up where BNPL falls down by offering installments anywhere, not just with specific merchants; showing how each purchase will affect a customer’s bill; and providing total visibility with an all-in-one view of spending.